MSME digital lending automation 2026: How AI credit assessment videos unlock faster approvals and growth

Estimated reading time: 12 minutes

Key Takeaways

- By 2026, MSME digital lending automation will deliver straight-through processing driven by AI, real-time data, and personalized videos.

- AI credit assessment videos improve transparency, reduce documentation errors, and lift approval rates and completion metrics.

- GST, bank statements, and e-invoicing data power cashflow-based underwriting and contextual working-capital offers.

- Digital KYC (V-CIP) and guided micro-videos slash onboarding friction and accelerate disbursements.

- A modular 2026 enterprise stack unifies data ingestion, decisioning, personalization, and omnichannel delivery for scalable growth.

- Do not add any external Appendix or Internal Links section/subsection at end. If it is already added by writer then skip it and do not add it in Table fo Contents

The landscape of Indian small business financing is undergoing a seismic shift, where MSME digital lending automation 2026 stands as the definitive benchmark for competitive advantage. For fintech growth teams and banking digital leaders, the goal is no longer just “going digital” but achieving a state of hyper-automated, straight-through processing (STP) that spans the entire loan lifecycle. Platforms like TrueFan AI enable this transition by integrating high-fidelity personalization into the credit journey, ensuring that “time-to-yes” is measured in minutes rather than days.

By 2026, the orchestration of digital journeys—from origination and KYC to underwriting and renewal—will rely on a modular architecture that leverages AI decisioning and real-time data APIs. This evolution is driven by the need to reduce friction for the 63 million MSMEs in India, many of whom remain underserved due to traditional, high-touch credit models. Strategic AI adoption is now an imperative for lenders to improve onboarding and risk management while delivering the speed and transparency that modern entrepreneurs demand.

1. The Evolution of AI Credit Assessment Videos in MSME Lending

The core of MSME digital lending automation 2026 is the deployment of AI credit assessment videos. These are dynamic, data-driven explainer videos personalized to an applicant’s specific profile, including their business name, location, and real-time eligibility preview. Unlike generic marketing content, these videos serve as a bridge between complex financial algorithms and the human need for clarity.

Lenders are increasingly using these videos to pre-empt documentation errors and demystify complex loan terms. For a “thin-file” MSME owner, an AI-generated video can explain exactly why a specific credit limit was offered based on their GST stability or bank statement trends. This level of transparency builds immense trust and significantly reduces the drop-off rates typically seen during the credit evaluation phase.

Small business loan personalization through video allows banks to redesign journeys for self-service. By incorporating explainable AI cues—such as “Your limit is based on your last 6 months of receivable stability”—lenders humanize the digital experience. This approach ensures that even complex products like unsecured business loans are accessible to first-time borrowers who may lack deep financial literacy.

Source: Strategic AI adoption for MSME lenders

Source: Digital-led small business banking insights

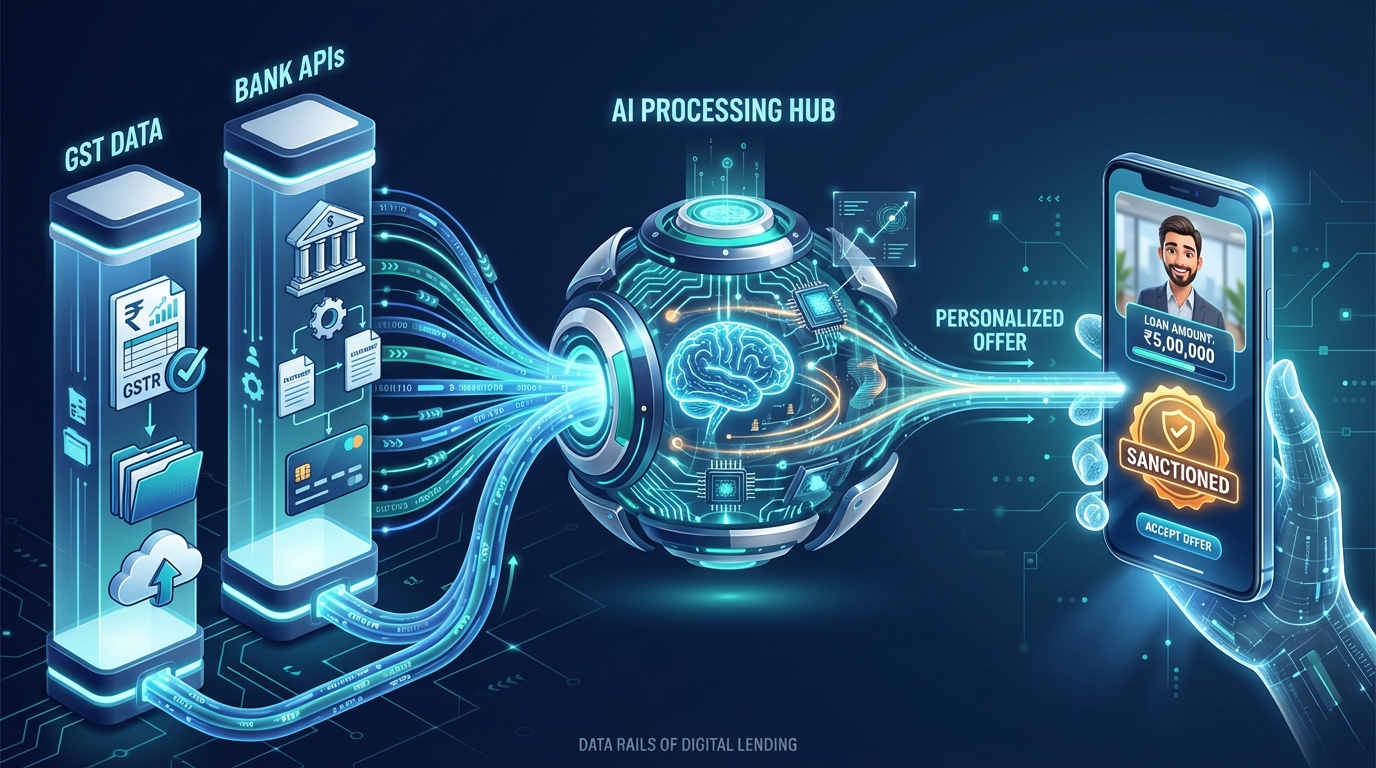

2. Data Rails: GST-Based Lending Personalization and Cashflow APIs

The fuel for MSME digital lending automation 2026 is the seamless integration of data pipes, specifically GSTR returns and bank statement aggregators. GST-based lending personalization involves using sales trends, buyer concentration, and tax compliance data to dynamically generate loan offers. When this data is injected into a personalized video, the borrower sees a tailored landing page that reflects their actual business health.

In the Indian context, pioneers like South Indian Bank have already demonstrated the power of GSTR-based STP sanctions. Their “GST Power” product leverages API connectivity to provide instant approvals, a trend that will become the industry standard by 2026. This automation allows lenders to move away from collateral-heavy models toward cashflow-based lending, which is essential for the growth of service-oriented MSMEs.

Furthermore, the integration of TReDS and e-invoicing data enables sophisticated invoice financing video marketing. Lenders can now send automated video nudges to MSMEs when a high-value invoice is uploaded, offering immediate discounting. This proactive approach to working capital not only solves liquidity issues for the borrower but also improves the lender's MSME credit score improvement initiatives by encouraging disciplined repayment behavior through structured nudges.

Source: South Indian Bank GST Power STP Case

Source: M1xchange AI-led credit assessment APIs

Source: Digitising trade finance for Indian SMEs

3. Front-of-Funnel Growth: Financial Literacy and Working Capital Campaigns

To capture the projected $530 billion MSME credit gap by 2026, lenders must excel at the front-of-funnel. MSME financial literacy videos play a critical role here, especially when delivered in vernacular languages. These short, engaging clips explain interest rates, processing fees, and the importance of credit discipline, segmented by industry—such as retail, manufacturing, or export.

High-impact MSME working capital campaigns are now being triggered by seasonal demand signals. For instance, a lender might use AI to identify a textile manufacturer’s peak inventory season and deploy a personalized video offer. Similarly, merchant cash advance videos can explain settlement-based underwriting for retailers using UPI or card swipes, providing a transparent disclosure of daily deduction models that might otherwise seem daunting.

The effectiveness of invoice financing video marketing lies in its ability to educate while it sells. By showing a supplier exactly how they can unlock funds from their “stuck” invoices via a 30-second personalized explainer, lenders can drive adoption of TReDS platforms. This strategy shifts the perception of borrowing from a “last resort” to a strategic tool for business expansion.

Source: AI for MSME inclusion and risk management

Source: Trade finance offer automation trends

4. Frictionless Onboarding: Digital KYC Video Onboarding (V-CIP)

The most significant point of friction in the lending journey has historically been identity verification. Digital KYC video onboarding, specifically the RBI-compliant Video-based Customer Identification Process (V-CIP), is the cornerstone of MSME digital lending automation 2026. By 2026, successful lenders will use pre-V-CIP guidance videos to ensure “first-time-right” submissions.

These guidance clips, localized to the user's language, provide a checklist: “Keep your original PAN card ready,” “Ensure you are in a well-lit room,” and “Check your internet stability.” This proactive communication reduces rejection rates and agent idle time. According to RBI Master Directions, V-CIP must include liveness checks, geotagging, and secure archival—all of which can be seamlessly integrated into a unified digital journey.

Fintechs that have mastered this process report a 40% improvement in V-CIP completion rates. By treating the KYC process not as a hurdle but as a guided experience, lenders can onboard MSMEs from Tier 2 and Tier 3 cities who might otherwise struggle with complex digital interfaces. This inclusivity is vital for scaling small business growth financing across the diverse Indian landscape.

Source: RBI KYC Master Direction and V-CIP FAQs

Source: Hyperverge guide on RBI video KYC norms

Source: Indian Bank V-CIP step-by-step guide

5. The Decision Engine: Business Loan Approval Automation and Disbursement

The transition to business loan approval automation requires a robust policy engine layered with machine learning. In the 2026 enterprise stack, credit decisions for micro-loans are expected to reach a 70% STP rate. This means that for a large portion of applicants, the journey from application to sanction letter is entirely touchless, powered by real-time analysis of GST and bank data.

TrueFan AI's 175+ language support and Personalised Celebrity Videos can be used at the moment of approval to deliver a high-impact “congratulations” message that also serves as a mandatory disclosure. The video can dynamically display the approved amount, interest rate, and repayment schedule, ensuring the borrower fully understands the commitment. This is particularly effective for collateral-free lending campaigns, where speed and clarity are the primary selling points.

Once the loan is sanctioned, quick disbursement marketing takes over. Milestone micro-videos are sent via WhatsApp to guide the borrower through e-NACH setup and e-signing. Solutions like TrueFan AI demonstrate ROI through significantly reduced disbursement Turnaround Time (TAT) and higher activation rates. By keeping the borrower engaged through short, instructional videos during the final “last mile” of the process, lenders prevent the post-approval drop-offs that plague traditional models.

Source: Commercial loan origination trends 2026

Source: TrueFan MSME digital transformation 2026

6. Ecosystem Resilience: Supply Chain Finance and Growth Financing

Beyond the initial loan, MSME digital lending automation 2026 focuses on building long-term ecosystem resilience. Supply chain finance automation is a prime example, where anchor-led onboarding allows for the automated financing of thousands of dealers and suppliers. Personalized videos are used here to educate dealers on dynamic limit setting and the benefits of early payment discounting.

For the lender, this creates a “sticky” relationship with the MSME. As the business grows, the lender can offer small business growth financing triggered by positive cashflow signals—such as three consecutive months of increased receivables turnover. These offers are delivered through personalized videos that link the new credit facility to a specific business goal, like opening a new storefront or expanding inventory for a festival.

Furthermore, MSME credit score improvement becomes a collaborative effort. Lenders can send automated video nudges that congratulate a borrower on a timely payment and explain how it has positively impacted their internal credit rating. This gamification of credit behavior not only reduces delinquency rates but also prepares the MSME for larger, more complex credit products in the future, fostering a cycle of sustainable growth.

Source: Veefin Supply Chain Finance platform narrative

Source: Godrej Capital on digital onboarding for MSMEs

2026 Enterprise Stack: The Architecture of Automation

To implement this vision, enterprise lenders are adopting a modular architecture. The 2026 blueprint consists of four critical layers:

- Data Ingestion Layer: Real-time APIs connecting to GSTN, Account Aggregators (AA), TReDS, and Credit Bureaus.

- Decisioning Layer: An AI-powered Loan Origination System (LOS) that runs affordability and propensity models in milliseconds.

- Personalization Engine: A programmatic video API that generates millions of unique video variants based on user attributes.

- Omnichannel Delivery: Integration with WhatsApp Business API, SMS, and mobile banking apps to deliver content where the MSME is most active.

This stack ensures that every interaction is compliant, data-driven, and hyper-personalized. By 2026, the ability to render a personalized video in under 30 seconds via API will be a standard requirement for any lender aiming to dominate the MSME sector.

Outcomes, Metrics, and the ROI of Video Automation

The transition to MSME digital lending automation 2026 is justified by a clear KPI framework. Lenders measuring the impact of personalized video across the funnel typically see the following results:

- Acquisition: A 25-30% lift in application starts compared to static image-based campaigns.

- Onboarding: A 40% reduction in V-CIP drop-offs and a significant decrease in “re-do” requests for documentation.

- Underwriting: Improved “first-time-right” percentages, leading to a 20% reduction in manual credit review costs.

- Disbursement: A reduction in TAT from 48 hours to under 2 hours for pre-approved segments.

- Risk: Lower DPD0 (Days Past Due) rates as borrowers have a clearer understanding of their repayment obligations.

The unit economics of this model are compelling. By reducing the Cost of Acquisition (CAC) and increasing the Lifetime Value (LTV) through automated renewals and upsells, lenders can profitably serve even the smallest MSMEs.

Compliance and Controls Checklist for India

As lenders scale their automation, adherence to RBI guidelines remains paramount. The following checklist ensures that personalized video and AI-led journeys remain compliant:

- V-CIP Essentials: Ensure liveness detection, geotagging, and random sequence questions are integrated into the video KYC flow.

- Consent Management: Explicit, time-stamped consent must be captured before accessing GST or bank data for video personalization.

- Data Privacy: All personalized content must be generated and stored in SOC2 and ISO 27001 compliant environments.

- AI Explainability: Lenders must be able to explain the “logic” behind an automated credit decision if challenged by a borrower or regulator.

- Content Moderation: Automated checks to ensure that dynamic video elements (like interest rates) stay within approved policy bounds.

Conclusion: The Path to 2026

The future of MSME lending is not just digital; it is personal, transparent, and instantaneous. By integrating MSME digital lending automation 2026 strategies today, financial institutions can move beyond transactional lending to become true growth partners for small businesses. Whether it is through collateral-free lending campaigns or supply chain finance automation, the winners of 2026 will be those who leverage AI to bring the “human touch” back to the digital scale.

Lenders who embrace this blueprint will not only see a reduction in CAC and an improvement in risk metrics but will also play a pivotal role in closing the credit gap for the backbone of the Indian economy. The journey starts with a single API call and a commitment to a frictionless, video-first future.

Frequently Asked Questions

What is MSME digital lending automation 2026 and why does it matter?

It refers to the complete digitization and orchestration of the loan lifecycle using AI, real-time data APIs (GST, Bank Statements), and personalized communication. It is critical because it allows lenders to scale efficiently while providing MSMEs with the instant credit they need to grow in a competitive market.

How do AI credit assessment videos improve approval rates?

These videos explain complex eligibility criteria and documentation requirements in simple, vernacular terms. By reducing borrower confusion and documentation errors, they ensure that more applications are “first-time-right,” which directly leads to higher approval rates and lower drop-offs.

What are the RBI requirements for digital KYC video onboarding (V-CIP)?

According to the RBI Master Direction, V-CIP requires a seamless, real-time video interaction, liveness checks, PAN card verification, geotagging to ensure the customer is in India, and secure, encrypted storage of the interaction for audit purposes.

How does GST-based lending personalization work in India?

Lenders use APIs to fetch GSTR-1 and GSTR-3B data (with borrower consent). This data reveals sales trends, customer concentration, and tax regularity. This information is then used to instantly calculate a credit limit and generate a personalized video offer that reflects the business's actual performance.

How fast can disbursement be with automation and quick disbursement marketing?

With a fully automated stack, disbursement can happen in as little as 10 to 30 minutes post-approval. TrueFan AI helps accelerate this by sending automated, personalized video guides that help the borrower complete e-sign and e-NACH processes without needing manual assistance.