Union Budget 2026 Marketing Opportunities: CFO Playbook for Post‑Budget Customer Acquisition Campaigns

Estimated reading time: 9 minutes

Key Takeaways

- Win the first 72 hours after the Budget by launching real-time, policy-aligned journeys across your owned channels.

- Scale budget impact video personalization and policy change marketing automation to convert fiscal shifts into acquisition.

- Track CFO-grade KPIs like Conversion Rate Delta, Calculator Completion Rate, and Time-to-Market to prove ROI.

- Deploy sector-specific playbooks (BFSI, Manufacturing, D2C, EV/Green) tied to incentives, subsidies, and tax outcomes.

- Plan campaigns for the full fiscal year with quarterly sequencing and budget-driven offer orchestration.

Union Budget 2026 marketing opportunities go live the moment the Finance Minister speaks on Feb 1; the first 72 hours decide who leads customer acquisition for the year. For Strategic Planning Teams and CFOs, this is not just a policy event but a high-velocity race to convert legislative shifts into immediate, policy-aligned revenue streams. Platforms like TrueFan AI enable enterprises to bridge the gap between complex policy text and personalized consumer action in under 30 seconds.

The stakes for 2026 are unprecedented. With India’s digital advertising market projected to grow by 8.6% in 2026 and global ad spend set to surpass $1 trillion for the first time, the competition for consumer attention during the budget window will be fierce. Success requires a transition from static “Budget Update” emails to real-time budget response marketing that speaks directly to a customer's wallet.

This playbook provides the operational framework to deploy budget impact video personalization and policy change marketing automation with CFO-grade ROI. By the end of this guide, your team will be equipped to turn fiscal incentives into a competitive advantage for the entire 2026-27 fiscal year.

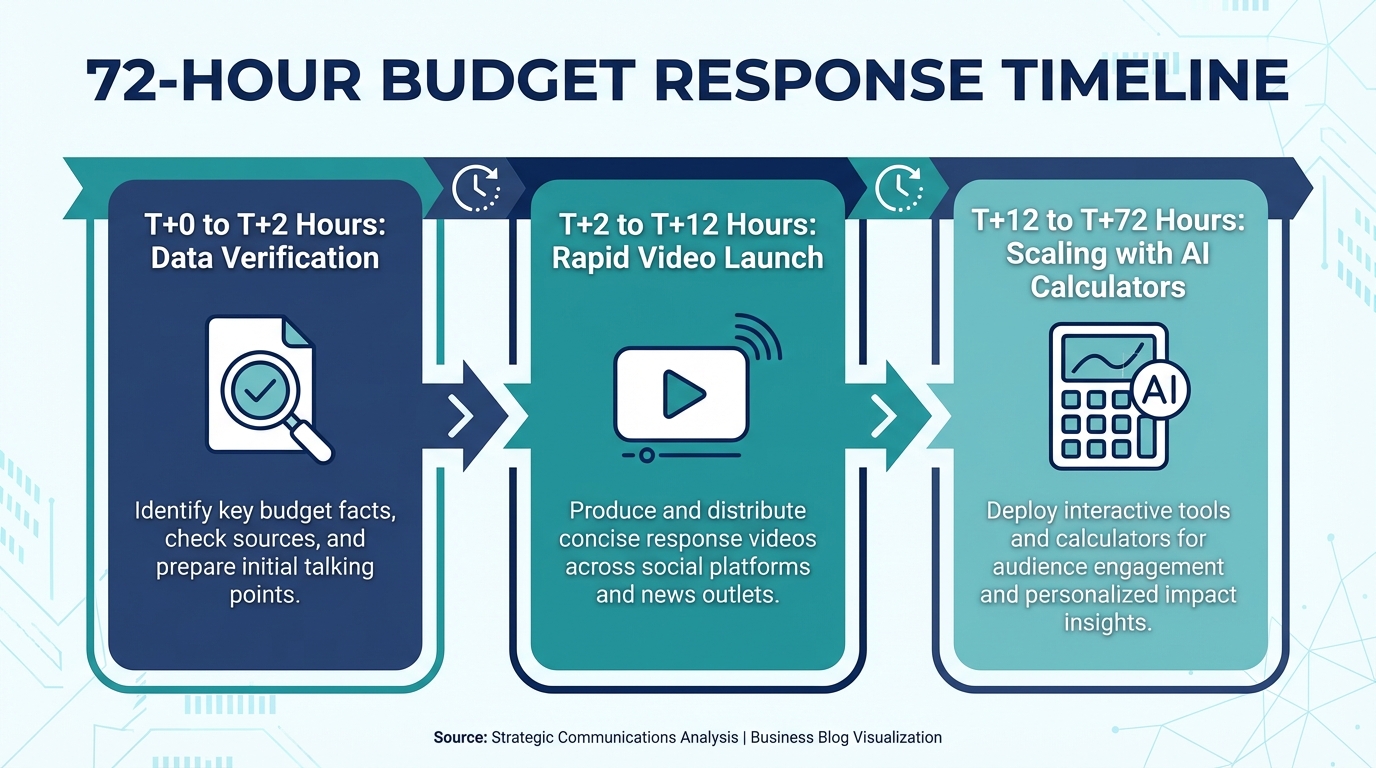

1. The 72-Hour Playbook: Operationalizing Real-Time Budget Response Marketing

The first three days following the Union Budget announcement are critical for post-budget customer acquisition campaigns. During this window, consumer intent is at its peak as individuals and businesses scramble to understand how new tax slabs, subsidies, and sector outlays affect their financial health.

T+0 to T+2 Hours: Verification and Trigger Setup

The moment the speech concludes, your policy SMEs must freeze a “truth set” for all calculators and narratives. This involves extracting specific tax slabs, exemption limits, and sector-specific outlays from the official documents. Once verified, these parameters are fed into your policy change marketing automation engine to update all dynamic creative assets simultaneously.

T+2 to T+12 Hours: Launching Real-Time Response

Speed is the primary differentiator. Brands should immediately ship rapid explainer videos per persona, such as “What Budget 2026 means for your MSME” or “Your new tax savings under the 2026 regime.” These videos should be deployed across owned channels like WhatsApp Business API and in-app inboxes to capture immediate interest.

T+12 to T+72 Hours: Scaling Acquisition

As the initial noise settles, the focus shifts to tax reform calculator videos. These interactive assets allow users to input their specific data and receive a personalized output, such as “You save ₹45,000 this year; invest it now.” This period also marks the start of budget-driven offer orchestration, where product incentives are mapped to the newly created policy deltas.

Source: https://inthemoneybyzerodha.substack.com/p/budget-2026-trading-strategies-what

2. Sector-Specific Playbooks: Navigating Fiscal Incentive Communication Strategies

Every sector faces a unique set of Union Budget 2026 marketing opportunities. To win, brands must move beyond generic messaging and adopt sector-specific budget benefits that align with the government's 2026 economic targets.

Manufacturing and Electronics

With India targeting $300 billion in electronics production by 2026, the manufacturing sector will see significant PLI (Production Linked Incentive) extensions. Marketing teams should deploy government scheme enrollment videos that guide MSME vendors through the eligibility and application process for these incentives. This builds deep B2B trust and secures long-term supply chain partnerships.

Financial Services and Insurance (BFSI)

Tax reforms are the primary driver for BFSI acquisition. By using tax reform calculator videos, banks can show customers exactly how much disposable income they gain from new slabs. This data then triggers a personalized CTA for ELSS, ULIPs, or SIPs, effectively turning a policy change into a direct deposit growth strategy. Financial Year-End Marketing 2026

Consumer Retail and D2C

If the budget provides middle-class tax relief, discretionary spending will surge. Brands must use budget-driven offer orchestration to target these “newly wealthy” cohorts. For example, a retail brand could send a video saying, “Your tax savings just covered your next vacation; here is a 20% discount to celebrate.”

Green Energy and EV

As India pushes for green finance, subsidy eligibility automation becomes vital. For EV manufacturers, this means providing real-time eligibility checks for state and central subsidies within the customer journey. A personalized video explaining the “Total Cost of Ownership” (TCO) reduction based on new 2026 subsidies can significantly shorten the sales cycle.

Source: https://www.ibef.org/research/case-study/india-s-electronics-manufacturing-and-export-market

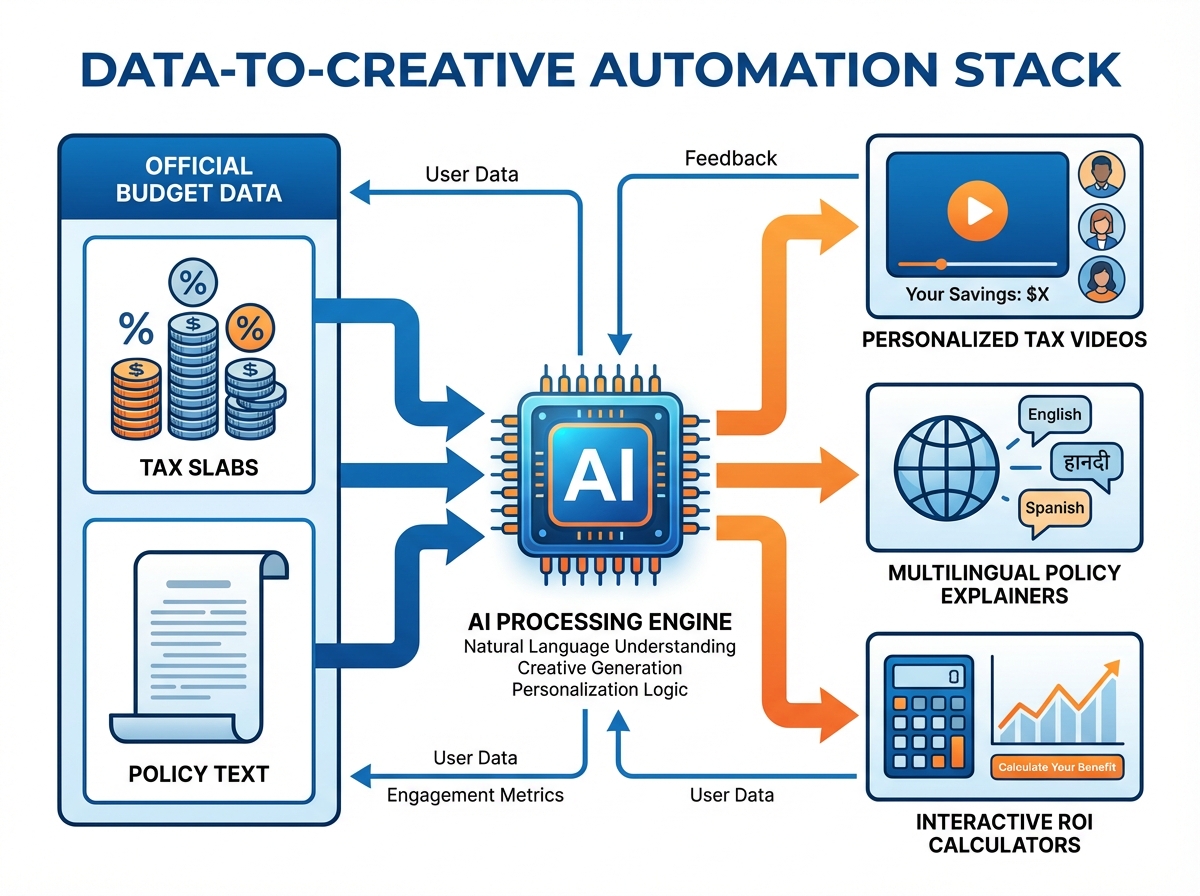

3. Data-to-Creative Automation: Scaling Budget Impact Video Personalization

To execute at the scale required for national impact, manual creative production is no longer viable. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow enterprises to generate millions of unique, policy-aligned videos in the time it traditionally takes to edit a single clip.

Defining the Automation Stack

- Budget Impact Video Personalization: Generating one-to-one videos that reflect each customer’s personalized impact from Union Budget rules (e.g., tax slab change, scheme eligibility, sector incentive), using CRM/CDP data and official policy parameters to compute outcomes showcased inside the video.

- Policy Change Marketing Automation: An event-driven rules engine that listens for policy announcements, thresholds, and scheme rollouts, then automatically updates copy, creatives, and offers, triggering journeys across channels without manual redeployment.

- Tax Reform Calculator Videos: Dynamic videos that compute tax liability/savings in real time from user inputs (income, regime selection, deductions) and render the personalized outcome (“You save ₹X under the new regime”) with a direct CTA to relevant products.

The Multilingual Edge

In 2026, reaching the “Next Billion Users” requires vernacular depth. Automation allows for the simultaneous release of government scheme enrollment videos in 175+ languages. This ensures that a farmer in Punjab and a small business owner in Tamil Nadu receive the same high-quality, personalized guidance in their native tongue, dramatically increasing enrollment completion rates.

Subsidy Eligibility Automation

Backend rules must be established to pre-screen users for benefit eligibility based on geography, income, and sector codes. When a user matches a new 2026 subsidy criteria, the system automatically triggers a guided video explaining the steps to claim the benefit, linked to a pre-filled application form.

Source: https://www.truefan.ai/blogs/union-budget-2026-marketing-impact

4. Compliance and ROI: Measuring Budget Allocation ROI Strategies

For CFOs, the primary concern is not just engagement, but the efficiency of the capital deployed. Solutions like TrueFan AI demonstrate ROI through significant CAC reduction and LTV uplift by ensuring that every marketing rupee is tied to a verifiable policy benefit.

Regulatory Compliance Updates

Marketing during the budget involves navigating complex legal landscapes. Brands must maintain a single “source of truth” for all policy claims. Any update to the official budget text must trigger an immediate refresh of the creative assets via virtual reshoots. This ensures that no non-compliant or outdated financial advice is ever delivered to the consumer, protecting the brand from regulatory scrutiny.

The CFO Dashboard: Key Metrics

To measure the success of Union Budget 2026 marketing opportunities, teams should track:

- Conversion Rate Delta: The lift in conversion for users who engaged with a personalized budget video versus a control group.

- Calculator Completion Rate: A high completion rate indicates that the tool is providing genuine value and capturing high-intent data.

- Time-to-Market (TTM): The number of hours between the FM’s speech and the first live personalized journey.

- Assisted Revenue: Revenue directly attributed to users who interacted with a budget-driven automation.

Budget Allocation ROI Strategies

By analyzing which cohorts show the highest “eligibility-to-conversion” ratio, CFOs can reallocate marketing spend in real-time. If MSMEs in the electronics sector are responding 3x faster to PLI-themed videos, the budget should shift from broad awareness to deep-funnel acquisition for that specific segment.

Source: https://www.pwc.in/budget/union-budget-2026.html

5. Fiscal Year Planning: Sequencing Campaigns for Long-Term Growth

The Union Budget is the starting gun, but the race lasts the entire fiscal year. Strategic teams must sequence their fiscal year planning campaigns to maintain momentum long after the initial 72-hour blitz.

Quarterly Sequencing

- Q1 (April-June): The Post-Budget Blitz. Focus on tax saving, immediate subsidy claims, and new scheme enrollments. This is the peak period for post-budget customer acquisition campaigns. Financial Year-End Marketing 2026

- Q2 (July-September): Segment Expansion. Use the data gathered in Q1 to refine lookalike audiences and expand into secondary markets.

- Q3 (October-December): Festival Leverage. Align budget-driven savings with festive spending. Use “Budget Bonus” narratives to drive high-ticket purchases.

- Q4 (January-March): Retention and Renewal. Focus on tax-filing assistance and year-end investment deadlines, setting the stage for the 2027 budget cycle.

Budget-Driven Offer Orchestration

Throughout the year, the orchestration engine should map policy deltas to product incentives. For example, if a mid-year notification updates the GST threshold for a specific sector, the system should automatically trigger a “Compliance Upgrade” offer to the affected MSME segment. This continuous economic policy marketing adaptation ensures the brand remains relevant to the customer's changing financial reality.

Source: https://www.deloitte.com/us/en/insights/topics/economy/asia-pacific/india-economic-outlook.html

Conclusion: Leading the 2026 Fiscal Race

The Union Budget 2026 marketing opportunities represent the single largest window for customer acquisition in the Indian market. For CFOs and Strategic Planning Teams, the choice is clear: remain a spectator to the policy shifts or become an active orchestrator of consumer action.

By integrating real-time budget response marketing with advanced tools like budget impact video personalization and subsidy eligibility automation, brands can provide genuine value to their customers while driving unprecedented ROI. The future of marketing is not just being fast; it is being personalized, compliant, and policy-aligned at scale.

As you prepare for Feb 1, 2026, ensure your technical stack is ready to ingest data, generate creative, and orchestrate offers within the first 72 hours. The brands that speak to the individual's wallet in their own language will be the ones that own the fiscal year.

Frequently Asked Questions

6. FAQ: Navigating Union Budget 2026 Marketing Opportunities

How can we ensure our budget marketing is compliant with the latest regulations?

Compliance is managed through regulatory compliance updates and a centralized “source of truth” sheet. By using platforms like TrueFan AI, brands can implement built-in moderation that blocks any non-compliant claims and allows for rapid virtual reshoots if policy details change mid-campaign.

What is the most effective channel for post-budget customer acquisition campaigns?

While multi-channel is best, WhatsApp Business API consistently shows the highest engagement for personalized content. Delivering a budget impact video personalization via WhatsApp allows for a 17% higher read rate compared to standard text, as seen in previous high-scale campaigns.

How do tax reform calculator videos drive actual revenue?

These videos move the user from “passive observer” to “active participant.” By showing a personalized savings figure, the video creates an immediate “found money” effect, which the brand can then capture through a direct CTA to an investment or savings product.

Can policy change marketing automation handle sudden changes in the Finance Minister’s speech?

Yes. An event-driven rules engine is designed for this exact scenario. Once the official documents are released, the parameters are updated in the backend, and the API-triggered video generation refreshes all live assets in under 30 seconds.

What are the target benchmarks for budget allocation ROI strategies?

Enterprises should aim for a 10–20% reduction in CAC and a 15–30% uplift in LTV among eligible cohorts. Additionally, the time-to-value (TTV) from the announcement to the first live journey should ideally be less than 24 hours.