Voice commerce vernacular India 2026: A CTO’s blueprint for Hindi, Tamil, and Bengali shopping at scale

Estimated reading time: ~12 minutes

Key Takeaways

- The shift to voice-native commerce is accelerating in India, with 2026 marking mainstream adoption across Hindi, Tamil, and Bengali users.

- NLP and ASR stacks must handle code-mixing, dialect variance, and noisy environments to drive reliable transactions.

- Voice-triggered video offers and WhatsApp handoffs materially improve trust, conversion, and LTV in Tier-2/3 markets.

- A disciplined 90-day rollout—from Hindi pilots to dialect variants—de-risks scale and proves incrementality.

- Privacy and consent are foundational; govern voice data collection and telemetry for enterprise-grade deployments.

Voice commerce vernacular India 2026 is the tipping point for monetizing India’s regional internet, as voice becomes the default interface for shopping beyond metros. For CTOs and Digital Innovation Leads, the shift from “text-first” to “voice-native” is no longer a speculative trend but a core infrastructure requirement. As we enter 2026, the convergence of high-speed 5G, affordable AI compute, and a massive influx of regional language users is rewriting the rules of e-commerce.

The upside for Indian enterprises is unprecedented. Vernacular voice commerce is projected to be the default interface for over 650 million regional users by 2026, according to recent industry analysis. Rural vernacular voice search is already rising at a staggering 150% year-on-year, signaling a fundamental shift in how the “Next Billion Users” interact with digital storefronts.

Furthermore, data from Financial Express indicates that 73% of Indian internet subscribers now prefer consuming content and transacting in Indian languages. This demand is driving faster adoption in Tier-2 and Tier-3 cities, where low-friction flows, UPI-native offers, and personalized video confirmations are becoming the standard for building trust. Platforms like TrueFan AI enable brands to bridge this gap by delivering hyper-personalized, voice-triggered video content that resonates with regional sensibilities.

Section 1 — 2026 market unlock and sizing: Why the window is closing

The momentum behind voice commerce in India is backed by massive capital and user adoption. The India voice commerce market is expected to grow from $1.57 billion in 2024 to a projected $7.47 billion by 2030. This represents a massive opportunity for early movers to capture a significant share of the 540 million user targeting segment that is now coming online with high intent.

The broader voice assistant market in India is also on a steep trajectory, moving from $153 million in 2024 to an estimated $958 million by 2030, growing at a 35.7% CAGR. This growth is fueled by the fact that India’s total advertising market is set to hit ₹2 lakh crore in 2026. A significant portion of this budget is being reallocated toward AI-led commerce and multilingual voice marketing to reach users who were previously digitally excluded.

In 2024, a landmark 98% of Indian internet users accessed local-language content, proving that the English-speaking metro market is now a saturated minority. Users are no longer just researching; they are purchasing across multi-platform journeys that involve social discovery, voice search, and WhatsApp handoffs. To stay competitive, enterprises must allocate 2026 budgets to regional voice use-cases that link discovery directly to transaction with measurable uplift. Voice Commerce India 2026 overview

Sources:

- Grand View Research: India Voice Commerce Outlook

- Fortune India: India's Ad Market to hit ₹2 lakh crore in 2026

- TrueFan AI: Voice Commerce India 2026 Guide

Section 2 — Regional shopping behavior analysis: Decoding trust and intent

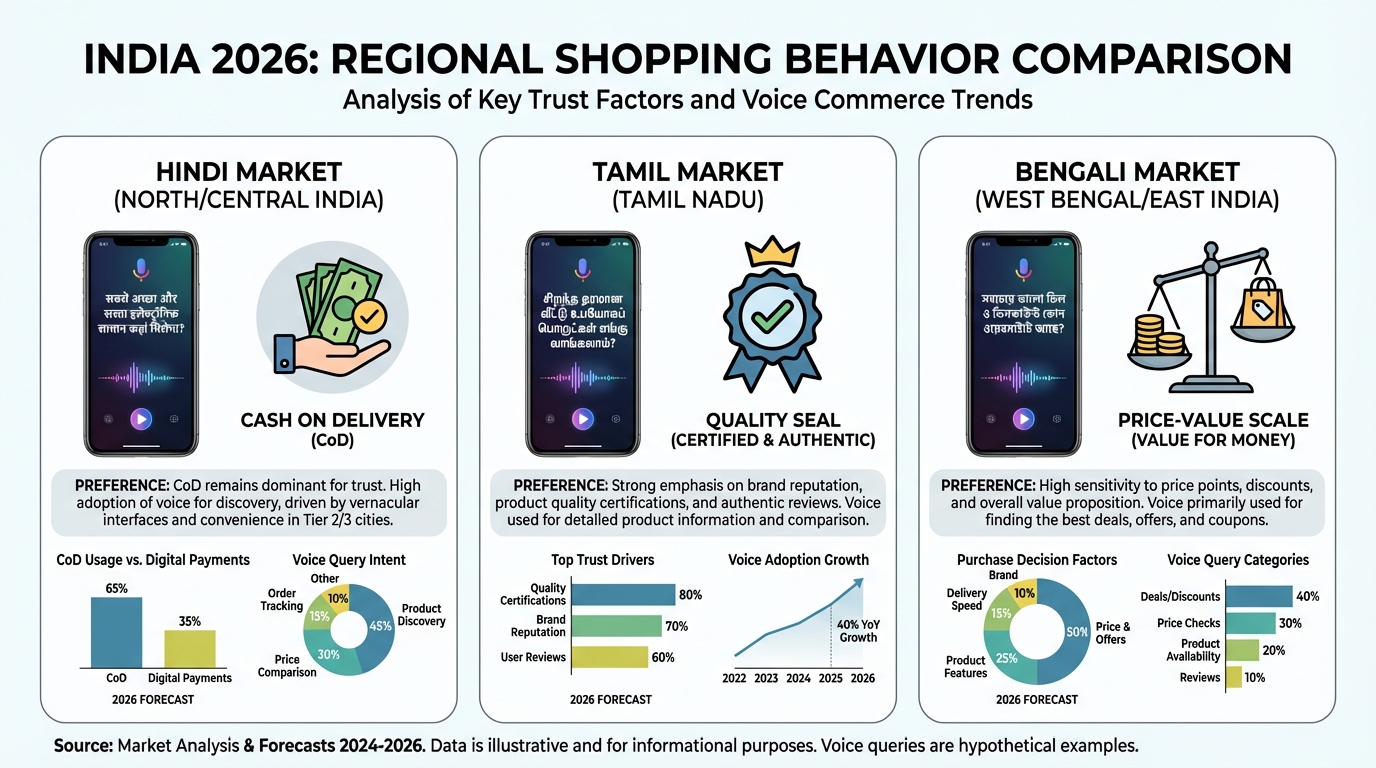

Understanding regional shopping behavior analysis is critical for building a voice interface that doesn't just “translate” but “resonates.” According to Bain’s “How India Shops Online 2025” report, value orientation and trust levers vary significantly across the Hindi belt, Tamil Nadu, and Bengal. Voice SEO for regional languages

In the Hindi belt, behaviors are characterized by “Hinglish” long-tail queries. Users often ask for products using a mix of languages, such as “₹10 hazaar ke andar mobile dikhao” or “mere paas kitna balance hai?” There is a strong reliance on Cash on Delivery (CoD) and a high sensitivity to festival timing, particularly during Diwali and Navratri.

Tamil Nadu shoppers, by contrast, place a higher emphasis on quality and durability terms. Their queries often include honorifics and show strong brand recall tied to cinema and sports icons. For this region, voice commerce must be optimized for Onam and Pongal seasons, using localized trust markers like store proximity and UPI-native payment prompts.

In Bengal, the focus shifts to price-value combinations and romanized Bangla queries. During the Pujo season, there is a massive spike in voice-activated discovery. Building local brand trust here requires native-language customer support and voice prompts that understand the specific phonetic nuances of the region. CTOs must implement geo-language cohorts to ensure that conversational commerce ROI is maximized through culturally aligned interactions.

Sources:

Section 3 — Building the language and NLP stack for transactions

To achieve scale, enterprises need a robust natural language processing commerce pipeline. This starts with Automatic Speech Recognition (ASR) that is tuned for local dialects and noisy environments. In India, this means handling the “scramble for data” to train models on specific regional variations as highlighted by Outlook Business.

The stack must include a Natural Language Understanding (NLU) layer for intent classification. It needs to extract slots like SKUs, variants, and delivery preferences from messy, code-mixed speech. A Dialog Management system then scaffolds the conversation, using micro-prompts to clarify ambiguity without frustrating the user.

Hindi voice shopping optimization

Hindi optimization requires handling Hinglish and colloquial synonyms like “chhota size” or “jaldi delivery.” The entity schema must disambiguate between Hindi digits and Latin numerals. A successful prompt ladder might look like: “Aap kaun sa brand chahte hain—BoAt ya Noise?” followed by “Budget batayein—₹1500–₹2000?” Conversational shopping AI for Hindi

Tamil conversational AI commerce

Tamil systems must address Dravidian morphology and normalize formal versus informal variants. ASR tuning is vital here to handle higher Word Error Rates (WER) in mixed-noise conditions typical of Tier-2 markets. Intent disambiguation should focus on distinguishing between a “reorder” and a “new purchase” based on phonetic brand variations. Voice Commerce India 2026 — Ultimate Guide

Bengali voice-activated offers

For Bengal, the system must handle romanized Bangla and frequent code-switching to English. Synonym tables are essential for common product descriptors. When confidence levels fall below a certain threshold, the system should fallback to curated offers to maintain the transaction flow.

Dialect-specific shopping experiences

True scale comes from dialect-specific shopping experiences. This involves using city-cluster acoustic models—for example, distinguishing between Lucknow and Jaipur Hindi. Progressive disclosure techniques can be used to reduce errors, switching to a visual UI or chat when voice confidence is low.

Sources:

Section 4 — Platforms and channels that convert: Smart speakers and in-app assistants

While smart speaker integration in India is growing, the primary driver for voice commerce remains the smartphone. In-app mic SDKs allow brands to own the entire user journey. However, Google Assistant and Gemini usage in Indian languages cannot be ignored, as one-third of Assistant users in India now interact in their native tongue.

Distribution surfaces must be stitched together to create a seamless journey. This includes in-app voice entry points, Android Assistant intents, and WhatsApp handoffs with deep links. For discovery, YouTube Shorts in regional languages are becoming a powerful top-of-funnel tool. WhatsApp catalog video marketing handoffs with deep links are especially effective for voice-to-purchase continuity.

To drive repeat purchases, voice assistant personalization is key. Systems should retain session memory, including the last-seen product, preferred language, and payment defaults. This personalization must be balanced with strict consent management to maintain user trust in Tier-2 and Tier-3 markets. Multilingual voice marketing strategies should leverage these platforms to ensure the brand is present wherever the user chooses to speak.

Sources:

Section 5 — Experience and monetization: The rise of voice-triggered video offers

The most significant innovation in 2026 is the “voice-triggered video offer.” This involves generating a shoppable, personalized video immediately after a user expresses intent via voice. For example, if a user asks about a festival discount, they instantly receive a video of a brand ambassador addressing them by name and offering a specific coupon. Voice Commerce India 2026 — Ultimate Guide

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow brands to automate this at scale. These videos can be delivered via WhatsApp or SMS within 30 seconds of the voice trigger. Use cases include first-purchase nudges, reorder reminders, and store pickup confirmations that feel personal rather than transactional. Voice commerce personalization in India 2026

Measuring conversational commerce ROI requires looking beyond simple click-through rates. CTOs should track Average Order Value (AOV) uplift compared to traditional tap-based flows, watch-to-buy ratios on personalized videos, and regional LTV cohort splits. With ad budgets expanding to ₹2 lakh crore, the ability to prove incrementality through these AI-driven experiences is a major competitive advantage.

Sources:

Section 6 — Tier-2 voice adoption strategies that actually work

Success in Tier-2 and Tier-3 markets requires a “low-data, low-latency” UX. On-device wake words and partial streaming ASR are essential for areas with intermittent connectivity. Minimizing round-trips to the server ensures that the voice interface feels responsive and reliable.

Tier-2 voice adoption strategies should also include guided prompts. Instead of open-ended questions, use constrained choices to reduce ambiguity. For example, “Kya aap detergent ya sabun dhoond rahe hain?” is more effective than “Aapko kya chahiye?” Pairing these with festival-aligned intents ensures the commerce experience feels relevant to the user's current context. Tier-2 festival commerce automation

Another effective strategy is the IVR-to-voice-app migration. Many regional users are already comfortable with IVR systems. By reusing these call-tree intents as jump-off prompts for a voice-enabled app, brands can transition users to a more interactive commerce environment. This should be reinforced with visual confirmations via WhatsApp to bridge the gap between voice intent and transaction security.

Sources:

Section 7 — CTO execution playbook: Risk controls and rollout

Implementing a vernacular voice strategy requires a disciplined engineering approach. The foundation is language-specific ASR fine-tuning. CTOs must implement active learning loops that capture misrecognitions and use them to retrain models for specific retail lexicons.

Privacy and governance are non-negotiable. Explicit voice-capture consent must be integrated into the UI, and PII (Personally Identifiable Information) should be minimized in logs. Solutions like TrueFan AI demonstrate ROI through secure, consent-first frameworks that protect both the brand and the consumer.

90-Day Rollout Plan:

- 0–30 Days: Instrument voice telemetry and launch a Hindi pilot for the top 50 intents. Integrate WhatsApp handoffs and baseline your metrics.

- 31–60 Days: Expand to Tamil and Bengali. Introduce voice-triggered video offers and begin regional offer-rule experiments.

- 61–90 Days: Deploy dialect model variants for city clusters. Launch festival-specific campaigns and perform incrementality testing to calculate CAC payback.

Voice SEO regional optimization should be run in parallel. This involves building speakable content in native scripts and using language-specific schema markup for products and offers. By targeting long-tail, code-mixed queries, brands can capture high-intent voice traffic before it even reaches their app. Vernacular voice SEO strategies

Conclusion: The Future is Spoken

Voice commerce vernacular India 2026 is not just a technological upgrade; it is a cultural alignment. For the 540 million users entering the digital economy, voice is the most natural way to interact. By building a stack that understands Hindi, Tamil, and Bengali nuances, and augmenting it with hyper-personalized video experiences, enterprises can unlock a market worth billions.

The window for early-mover advantage is narrowing. As ad budgets shift toward AI-led commerce, the brands that win will be those that speak the language of their customers—literally. Whether through smart speaker integration India or in-app assistants, the goal is the same: to make shopping as simple as a conversation.

Final Strategic Takeaway: Invest in the NLP stack today, prioritize regional behavior analysis, and leverage tools that turn voice intent into personalized visual engagement. The future of Indian e-commerce is spoken, regional, and hyper-personalized.

Frequently Asked Questions

How does voice commerce improve conversion in Tier-2 cities?

Voice removes literacy and UI complexity barriers, allowing users to transact in their native dialect. Combined with voice-triggered video offers and WhatsApp confirmations, it boosts trust, reduces friction, and lifts conversion rates versus tap-only flows.

What are the biggest technical challenges in vernacular ASR?

Key challenges include background noise, code-mixing (e.g., Hinglish), and dialectal variation. Address them with locally trained acoustic models, confidence thresholds, and clarification prompts to maintain accuracy and flow.

Can TrueFan AI integrate with our existing CRM?

Yes. TrueFan AI supports enterprise integrations across CRMs, mobile apps, and WhatsApp Business APIs to trigger personalized video content in real time based on voice intent and purchase history.

Is voice SEO different for regional languages?

Absolutely. It requires speakable schemas, content in native scripts (Devanagari, Tamil, Bangla), and optimization for colloquialisms and question-style queries. See Voice SEO for regional languages for guidance.

How should we measure the ROI of conversational commerce?

Track AOV uplift, IVR deflection, first-purchase and reorder rates, and watch-to-buy on personalized videos. Run controlled experiments against tap-only journeys to quantify incrementality and CAC payback.