Tax Saving Panic Marketing March 2026: BFSI Enterprise Guide to 80C ELSS Personalized Video Calculators and Deadline Automation

Estimated reading time: 12 minutes

Key Takeaways

- Leverage the March 31 deadline with ethical urgency architecture and countdown automation across WhatsApp, apps, and email.

- Use 80C ELSS personalized video calculators and salary-specific videos to convert high-intent users at peak urgency.

- Anchor creatives to regulatory facts across 80C, 80CCD(1B) for NPS, and 80D health insurance slabs.

- Deploy TrueFan AI’s enterprise stack to scale compliant, multi-language personalized videos with real-time data.

- Execute a 4-week sprint plan from education to final 48-hour pushes, then recycle insights for April retention.

The final quarter of the Indian financial year is traditionally defined by a singular, high-velocity phenomenon: the March 31 investment rush. As the deadline looms, millions of taxpayers scramble to optimize their liabilities, creating a unique window for BFSI leaders to deploy tax saving panic marketing March 2026 strategies that drive immediate action. This period is not merely about volume; it is about capturing intent at the exact moment of peak urgency through hyper-personalized digital experiences.

In 2026, the landscape of financial year-end investment urgency has shifted from generic reminders to sophisticated, data-driven interventions. Enterprises are no longer just sending emails; they are deploying compliance deadline marketing frameworks that combine real-time tax calculators with automated urgency triggers. By leveraging advanced AI, banks and insurers can transform the traditional “panic” into a structured, ethical journey that helps users secure their financial future while meeting regulatory deadlines.

The goal for BFSI enterprises this season is clear: turn the March 31 investment rush marketing into measurable inflows for ELSS, NPS, and insurance products. This is achieved through salary-specific tax planning videos, 80C ELSS personalized video calculators, and tax deadline countdown automation that provides clarity amidst the chaos. Platforms like TrueFan AI enable these organizations to scale these personalized experiences to millions of users simultaneously, ensuring that every nudge is relevant, compliant, and high-converting.

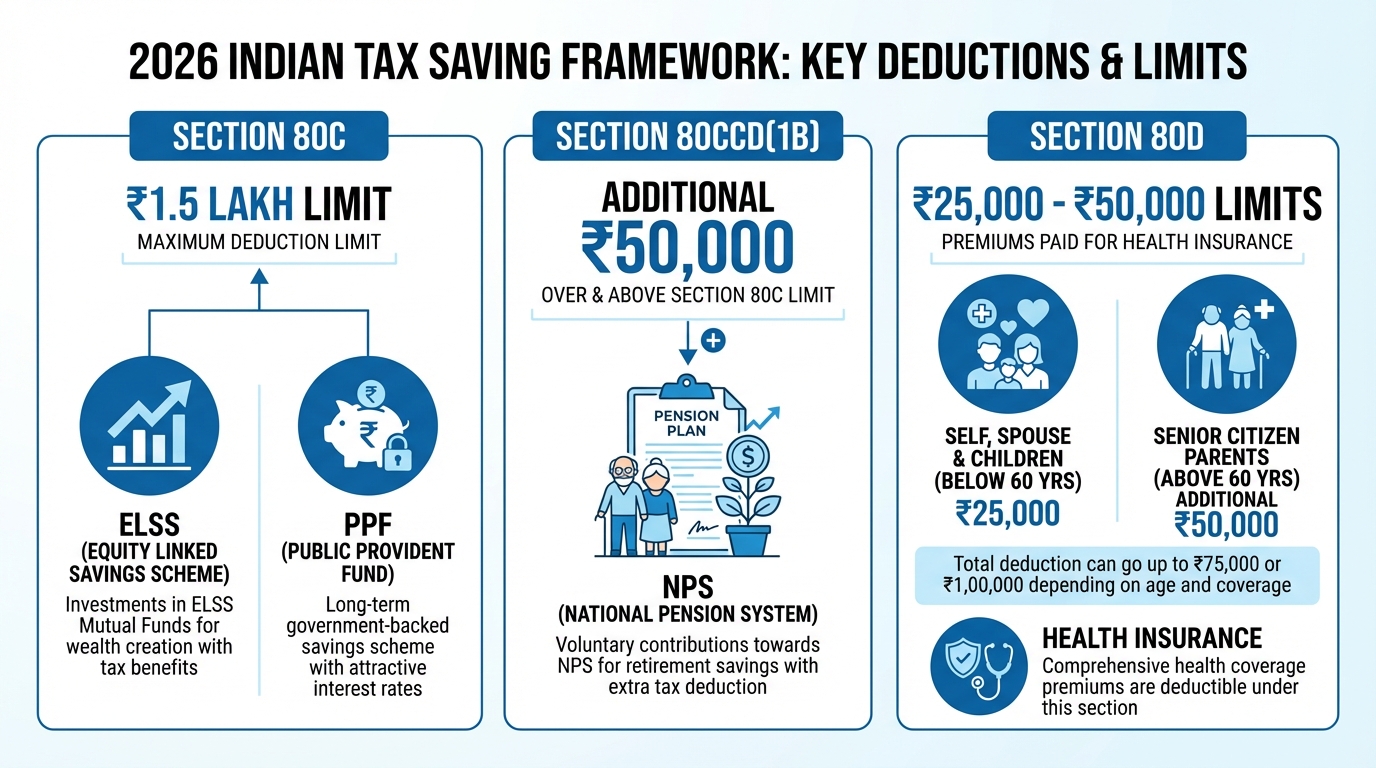

The Regulatory Anchors: ELSS, NPS, and 80D Frameworks

To execute an effective campaign, marketing teams must ground their creative assets in the hard facts of the Indian tax code. The primary driver for the March rush remains Section 80C, which allows for a maximum deduction of Rs 1.5 lakh under Chapter VI-A. This limit includes popular instruments like the Equity Linked Savings Scheme (ELSS), which offers the shortest lock-in period of three years among 80C options.

Beyond the standard 80C limit, the National Pension System (NPS) offers a critical secondary lever for tax optimization. Under Section 80CCD(1B), taxpayers can claim an additional deduction of up to Rs 50,000 over and above the Rs 1.5 lakh limit. This makes last-minute NPS enrollment campaigns particularly effective for high-income earners who have already exhausted their 80C quota but seek further relief.

Health insurance remains the third pillar of the tax-saving trifecta under Section 80D. Current regulations allow for deductions of up to Rs 25,000 for self and family, with an increased limit of Rs 50,000 if the policy covers senior citizens. In 2026, insurance tax benefit videos have become the preferred medium for explaining these slabs, as they can dynamically adjust the messaging based on the user’s family composition and age.

It is also vital to address the ongoing transition between the Old and New tax regimes. While the New regime has become the default for many, the Old regime still offers significant benefits for those with high home loan interest or specific deductions. Marketing collateral must include clear disclaimers and “Old vs New” comparison tools to ensure compliance and maintain trust.

Sources:

- Income Tax Department: Section 80C Limit (Rs 1.5 Lakh) - https://www.incometax.gov.in/iec/foportal/sites/default/files/2020-02/Calendar_web_version_31st_December.pdf

- NPS Trust: Tax Benefits under NPS (80CCD(1B)) - https://npstrust.org.in/benefits-of-nps

- Income Tax Department: Section 80D Limits - http://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

- NPS Trust: All Citizen Model FAQ - https://npstrust.org.in/sites/default/files/faq_document/05-All-Citz-Mdl-Faq.pdf

- Income Tax Department: New vs Old Regime FAQ - https://www.incometax.gov.in/iec/foportal/sites/default/files/2024-07/New%20vs.%20Old%20Regime%20FAQs%20approved%20final.pdf

Audience Segmentation: From Salaried Employees to HNIs

A one-size-fits-all approach fails during the high-stakes March window. Successful BFSI enterprises segment their audience into three distinct tiers, each requiring a tailored messaging framework. For corporate employees, the focus is on salary-specific tax planning videos that align with their specific payroll bands and employer-provided benefits.

Corporate employee tax saving drives are often executed in partnership with HR departments. By integrating with payroll data, banks can send personalized nudges like: “You have utilized Rs 1.1 lakh of your 80C limit; invest the remaining Rs 40,000 in ELSS today to save Rs 12,480 in taxes.” This level of precision removes the cognitive load from the employee and provides a clear path to action.

For High Net Worth Individuals (HNIs), the strategy shifts toward HNI wealth management urgency. These individuals often have complex portfolios and require bespoke advisory. Instead of generic countdowns, they respond to “portfolio gap” messaging that highlights missed opportunities in NPS Tier I or high-value life insurance riders. Personalized video clips from their dedicated Relationship Managers (RMs) can bridge the gap between digital speed and human trust.

The third segment consists of lapsed investors and existing policyholders. This is where the BFSI retention tax season play comes into effect. The goal here is to move one-time, “panic” buyers into recurring SIPs or NPS auto-debits. By showing them how their last-minute investment in 2025 grew over the year, you can encourage a more disciplined approach for the 2026-27 financial year while they are already in an “investment mindset.”

Data Points for 2026:

- Digital-first tax planning adoption has reached 65% among urban millennials in FY 2025-26.

- Video-based financial advisory is seeing a 40% higher conversion rate than static ads this season.

- 15% YoY growth in ELSS inflows is projected for the final week of March 2026.

Urgency Architecture: Countdown Automation and Ethical FOMO

The core of “panic marketing” is the strategic use of time-bound triggers. However, in the BFSI sector, this must be balanced with ethical standards to avoid fearmongering. Urgency architecture in 2026 involves using tax deadline countdown automation across all digital touchpoints—WhatsApp, mobile apps, and email.

A progressive urgency ladder is essential. At T-21 days, the tone should be educational, focusing on “80C ELSS personalized video calculators” to help users identify their gaps. By T-7, the messaging shifts to last-minute NPS enrollment campaigns, highlighting the processing time required for KYC. In the final 72 hours, the focus moves to “instant” products with T+0 or T+1 NAV cutoffs.

Investment deadline FOMO triggers can be enhanced by social proof. For example, showing a “peer progress meter” within a corporate dashboard can nudge employees: “78% of your colleagues at [Company Name] have completed their tax-saving investments.” This leverages the psychological drive to keep pace with one’s social or professional circle without resorting to high-pressure sales tactics.

To maintain trust, all urgency-driven copy must be backed by compliance-first controls. This includes clear statements that ELSS is subject to market risks and that insurance policy terms apply. Transparency regarding “last processing windows” is also crucial; if a bank knows that an NPS contribution takes 48 hours to reflect, they must communicate this clearly at T-3 to manage expectations and avoid regulatory friction.

Sources:

- TrueFan AI Case Study: 3.2x higher participation rates in contests using personalized celebrity videos.

- Industry Trend: Real-time API integration for video rendering now supports under-30-second delivery for high-volume campaigns.

The TrueFan AI Enterprise Stack: Scaling Personalization

Executing thousands of unique, data-driven video campaigns manually is impossible. This is where the TrueFan AI enterprise stack becomes a force multiplier for BFSI marketing teams. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow a bank to have a top-tier brand ambassador address a customer by name, in their mother tongue, while citing their exact tax-saving gap.

The platform’s real-time APIs ingest data from CRMs and CDPs to generate salary-specific tax planning videos on the fly. When a user interacts with an 80C ELSS personalized video calculator on a bank's microsite, the system can instantly render a video where a celebrity explains the results. This creates a “VIP experience” at a scale that was previously reserved for only the highest-tier HNI clients.

Furthermore, TrueFan’s “virtual reshoot” capability allows marketing teams to be incredibly agile. If a regulatory change occurs on March 15, or if a specific product reaches its cap, the AI can alter the speech and lip movements in existing footage to deliver updated lines without needing a new shoot. This ensures that compliance deadline marketing remains accurate up to the very last minute of the financial year.

Solutions like TrueFan AI demonstrate ROI through significantly improved engagement metrics. For instance, personalized travel nudges have shown a 17% higher read rate on WhatsApp compared to text. In the BFSI context, this translates to higher click-through rates on “Invest Now” buttons and a reduction in the cost per completed transaction during the expensive March advertising window.

Sources:

- TrueFan AI: Enterprise Generative AI Solutions - https://www.truefan.ai/

- TrueFan AI: Case Study on Zomato Mother's Day (354,000 videos in one day) - https://www.truefan.ai/case-study

Execution Roadmap: The 4-Week Sprint to March 31

A successful tax saving panic marketing March 2026 campaign requires a disciplined, week-by-week execution plan. This roadmap ensures that the creative, data, and distribution channels are perfectly aligned as the deadline approaches.

Week 1: The Educational Foundation (March 1 - March 7)

The focus this week is on awareness and discovery. Launch the “80C ELSS personalized video calculators” and drive traffic through educational blog posts and social media. The tone should be helpful, encouraging users to “check their tax health” before the rush begins. This is also the time to finalize API integrations for salary-specific tax planning videos.

Week 2: The Corporate Push (March 8 - March 14)

Activate corporate employee tax saving drives. Deploy co-branded videos in partnership with HR departments. Use WhatsApp to send video nudges to users who used the calculator in Week 1 but haven't yet transacted. For HNIs, start the outreach with bespoke RM-led video messages focusing on portfolio optimization.

Week 3: The Urgency Escalation (March 15 - March 21)

Intensify tax deadline countdown automation. Roll out last-minute NPS enrollment campaigns, emphasizing that the window for KYC and fund realization is closing. Introduce insurance tax benefit videos that simplify complex 80D slabs for families. At this stage, FOMO triggers like “Limited processing slots remaining” can be introduced ethically.

Week 4: The Final Rush (March 22 - March 31)

This is the peak of the March 31 investment rush marketing. Deploy daily countdown bursts across all channels. Ensure that tax consultant video consultations are available for high-value leads who need a final nudge. The final 48 hours should focus on “instant” digital products and clear “2-step finish” CTAs to minimize friction.

Data Points for 2026:

- NPS Tier I accounts are expected to cross 25 million by early 2026, driven by increased awareness of the 80CCD(1B) benefit.

- BFSI enterprises using automated video rendering have reported a 50% reduction in creative production time compared to traditional methods.

FAQs and Compliance Guide

Q1: What is the Section 80C limit for ELSS investments in 2026?

The maximum deduction that can be claimed under Section 80C remains Rs 1.5 lakh for the current financial year. This includes ELSS, PPF, and other eligible instruments. You can verify this on the official Income Tax Department calendar. Platforms like TrueFan AI can help you visualize how much of this limit you have already utilized through personalized video tools.

Q2: Can I get an additional tax benefit for NPS beyond the 80C limit?

Yes, under Section 80CCD(1B), you are eligible for an additional deduction of up to Rs 50,000 for contributions to NPS Tier I. This is over and above the Rs 1.5 lakh limit of Section 80C. This makes NPS a powerful tool for those in the higher tax brackets.

Q3: What are the Section 80D limits for health insurance in 2026?

For individuals, the deduction is up to Rs 25,000 for self, spouse, and dependent children. If you are paying premiums for parents who are senior citizens, you can claim an additional Rs 50,000. The total potential deduction under 80D can go up to Rs 75,000 or Rs 1,00,000 depending on the age of the insured members.

Q4: Do these tax-saving deductions apply to the New Tax Regime?

Under the New Tax Regime (as per the latest AY 2025-26 and 2026-27 rules), most Chapter VI-A deductions, including 80C and 80D, are not available. However, the employer's contribution to NPS under Section 80CCD(2) is still deductible. Always check the “New vs Old Regime FAQ” on the Income Tax portal before making your final investment.

Q5: Is ELSS better than NPS for last-minute tax saving?

ELSS has a shorter lock-in period (3 years) compared to NPS (until age 60), making it more liquid. However, NPS provides an additional Rs 50,000 deduction that ELSS does not. Many taxpayers choose to maximize both to achieve the highest possible tax efficiency.

Sources:

- Income Tax Department: Senior Citizen 80D Limits - http://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

- NPS Trust: Benefits of NPS - https://npstrust.org.in/benefits-of-nps

- TrueFan AI: Product Offerings and Enterprise Solutions - https://www.truefan.ai/

Conclusion: Turning Panic into Performance

The March 31 deadline will always create a sense of urgency, but for the modern BFSI enterprise, this is an opportunity to demonstrate value through technology. By moving away from generic “panic marketing” and toward a model of “urgency architecture,” brands can provide the clarity and personalization that taxpayers crave during this stressful period.

Whether it is through 80C ELSS personalized video calculators that simplify complex math or tax deadline countdown automation that ensures no one misses a window, the focus must remain on the customer's needs. By integrating these tools into a cohesive, week-by-week strategy, financial institutions can maximize their inflows while helping their customers build a more secure future.

As we look toward the BFSI retention tax season in April, the data gathered during the March rush will be invaluable. The journey doesn't end on March 31; it merely transitions from tax-saving to wealth-building. By leveraging the power of hyper-personalization today, you are setting the stage for a deeper, more profitable relationship with your customers for years to come.

Frequently Asked Questions

How do 80C ELSS personalized video calculators improve March conversions?

They translate tax gaps into actionable next steps with personalized numbers, lowering cognitive load and driving higher click-through and completion rates in the final weeks of March.

When should I push NPS vs ELSS in the countdown ladder?

At T-7 days, emphasize NPS (80CCD(1B)) for additional Rs 50,000 deduction; in the last 72 hours, prioritize ELSS and instant products with faster cutoffs to minimize processing risk.

How can BFSI brands maintain ethical FOMO?

Back every urgency claim with clear processing timelines, product risk disclosures, and compliant language while using social proof and countdowns transparently.

What role does TrueFan AI play in enterprise-scale personalization?

TrueFan AI connects CRM/CDP data to real-time video rendering, enabling multi-language, compliance-safe, and celebrity-led personalization at massive scale.

What should a 4-week March plan include?

Week 1 education and calculators, Week 2 corporate pushes, Week 3 NPS and 80D simplification with escalated urgency, and Week 4 high-frequency countdowns and instant products.