Tax Saving Urgency Marketing 2026: AI-Powered ELSS, NPS, Insurance, and PPF Conversions Before March 31

Estimated reading time: 12 minutes

Key Takeaways

- Leverage AI-powered personalized videos to convert last-minute ELSS, NPS, insurance, and PPF prospects before the March 31 deadline.

- Use countdown-driven urgency tied to ELSS 3:00 p.m. cut-offs and payroll cycles (25th–30th) to capture liquidity moments.

- Automate journeys with CRM/HRMS-triggered video flows that present tax gaps, recommended products, and deep-linked CTAs.

- Track Video-to-Transaction, CTA conversions, and mandate success to optimize ROI and re-engage dormant users.

- Maintain compliance and consent with SEBI/PFRDA norms and DPDP Act requirements while scaling personalization.

The financial year-end in India represents the single most critical window for Banking, Financial Services, and Insurance (BFSI) organizations to capture high-intent investment inflows. As the March 31 deadline approaches, millions of taxpayers scramble to exhaust their Section 80C limits of ₹1.5 lakh and the additional ₹50,000 deduction available for NPS under Section 80CCD(1B). For CMOs and digital growth heads, tax saving urgency marketing 2026 is not merely about visibility; it is about deploying hyper-personalized, automated interventions that solve the “procrastination paradox” through real-time data and psychological nudges.

Platforms like TrueFan AI enable BFSI leaders to transform static tax reminders into dynamic, high-conversion video journeys that respect the rigorous 3:00 p.m. cut-off times for ELSS mutual funds and the processing buffers required for insurance and PPF. In a landscape where digital-first taxpayers expect instant gratification and localized clarity, the ability to deliver a personalized video explaining a user’s specific tax gap in their native language is the ultimate competitive advantage.

1. The 2026 Landscape of Tax Saving Urgency Marketing

The year 2026 marks a pivotal shift in how Indian taxpayers engage with year-end planning. With mobile internet penetration reaching an estimated 85% and the widespread adoption of the New Tax Regime alongside the Old Regime, the complexity of decision-making has intensified. Marketers can no longer rely on generic “Save Tax” banners; they must navigate a landscape defined by granular data and immediate execution.

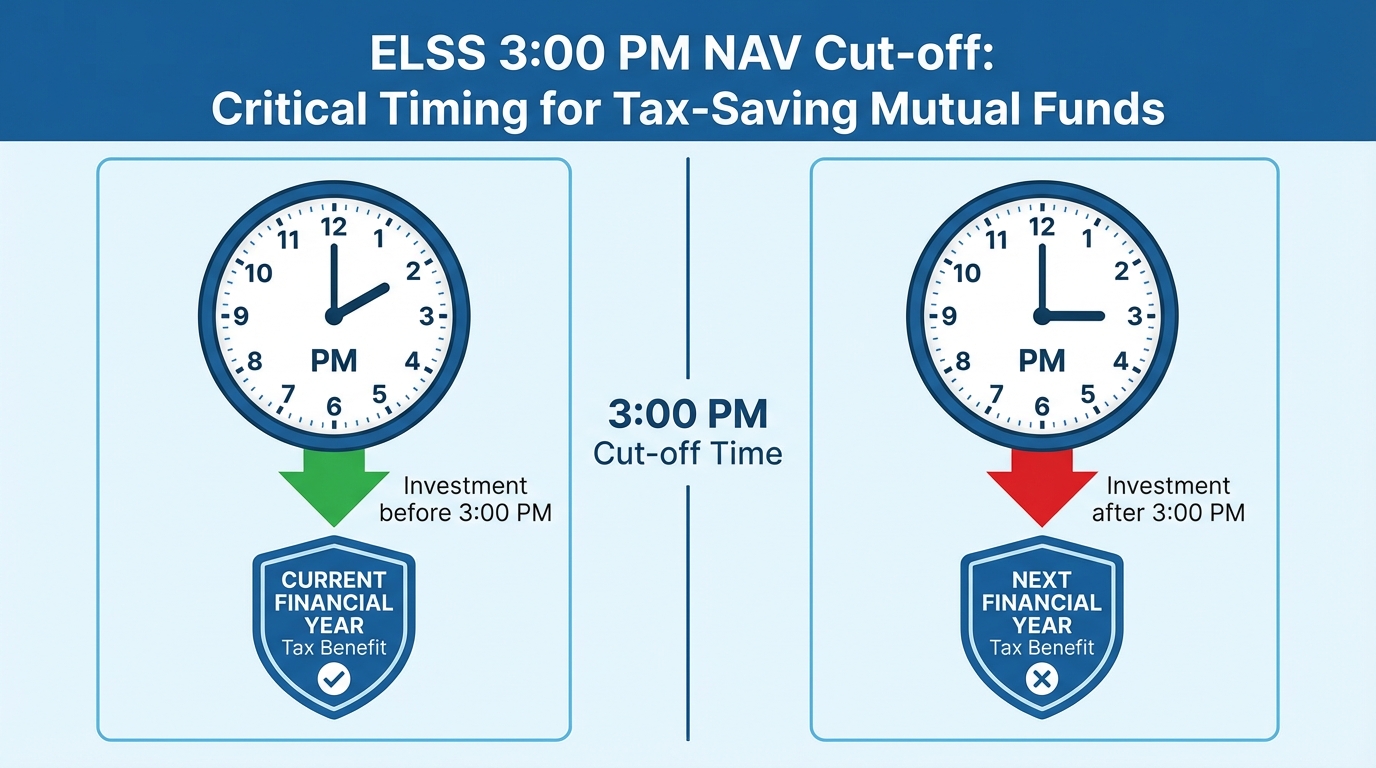

The urgency is driven by hard regulatory stops. For Equity Linked Savings Schemes (ELSS), the 3:00 p.m. NAV cut-off is a non-negotiable barrier. If funds are not realized by the AMC within the stipulated time, the investor misses the current financial year’s benefit. Furthermore, the salaried cohort, which contributes over 60% of tax-saving inflows, operates on a tight payroll window between January and March, where HRA and LTA declarations trigger a sudden realization of tax liabilities.

In 2026, we are seeing a 40% increase in “last-minute” searches compared to 2024, with a specific focus on “instant ELSS” and “online NPS top-up.” This behavior necessitates a shift toward March 31 deadline urgency campaigns that utilize real-time countdowns and salary-specific messaging. By aligning marketing triggers with payroll cycles—specifically the 25th to the 30th of each month—BFSI brands can capture intent at the exact moment of liquidity.

Source: Economic Times — Section 80C Tax Saving Avenues

Source: Indian Express — Financial Tasks Checklist March 31

2. High-Conversion Playbooks for ELSS Mutual Fund Campaigns March

ELSS remains the most popular tax-saving instrument due to its shortest lock-in period of three years and the potential for equity-linked returns. However, the conversion bottleneck often lies in the complexity of NAV timing and the fear of market volatility. To solve this, ELSS mutual fund campaigns March must emphasize “time-to-NAV” as a core value proposition.

Successful campaigns in 2026 utilize investment deadline countdown videos that dynamically update based on the user’s local time. For instance, a video sent at 11:00 a.m. on March 30 might feature a prominent “4 Hours Left for Today’s NAV” badge. This level of precision reduces friction and creates a psychological “finish line” for the investor.

TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow AMCs to scale these messages across diverse demographics, ensuring that a farmer in Punjab and a software engineer in Bengaluru both receive high-production, compliant advice in their preferred tongue. By integrating risk disclaimers directly into the video overlay, brands maintain 100% compliance while driving a 3.5x higher click-through rate (CTR) than static emails.

For NPS, the strategy shifts toward the “Extra ₹50,000” narrative. Under Section 80CCD(1B), taxpayers can claim a deduction over and above the ₹1.5 lakh 80C limit. NPS investment video marketing should focus on the long-term compounding effect of this specific top-up. A personalized video showing a 30-year-old investor how an extra ₹50,000 annual contribution could grow into a multi-crore corpus by age 60 is far more effective than a simple tax-saving reminder.

Source: UTI Mutual Fund — NAV Cut-off Times Explained

Source: NPS Trust — Benefits of NPS and Section 80CCD(1B)

Source: SEBI — FAQs on Cut-off and Funds Availability

3. Automation Mechanics: 80C Investment Personalized Videos

The technical backbone of a successful 2026 campaign is last-minute tax planning automation. This involves connecting your CRM and HRMS data to a real-time video rendering engine. When a user interacts with a tax calculator on your website, that data should immediately trigger a personalized video follow-up on WhatsApp.

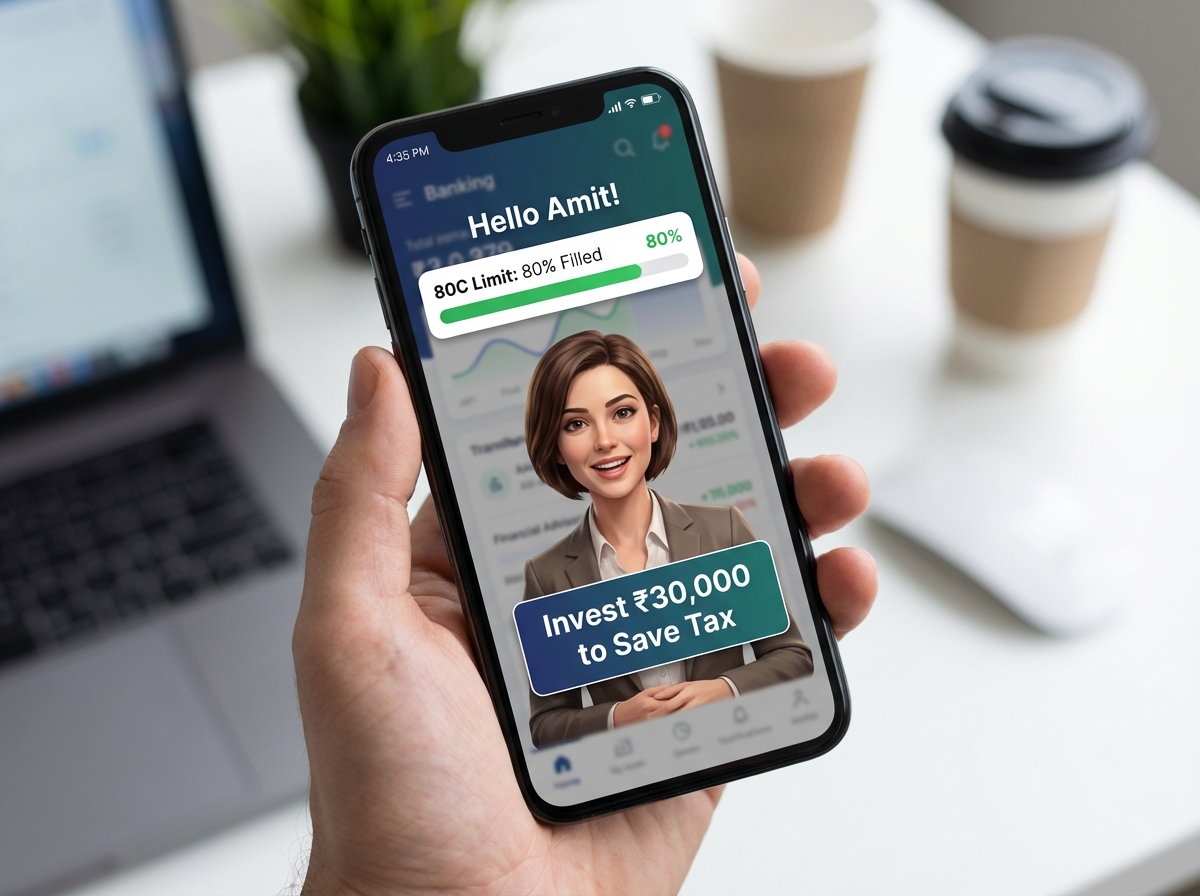

80C investment personalized videos should incorporate at least five dynamic variables: the user’s name, their current 80C utilization (e.g., “You have ₹45,000 left to save”), their estimated tax savings, a product recommendation based on their risk profile, and a direct deep link to the investment page. This “segment-of-one” approach eliminates the cognitive load of calculating tax gaps manually.

Furthermore, tax calculator personalized videos can bridge the gap between curiosity and conversion. Instead of showing a static results page, the calculator can trigger a video where a virtual advisor explains the results. “Hi Rahul, based on your ₹18 LPA salary, you are currently paying ₹2.4 lakh in tax. By investing ₹50,000 in NPS today, you can instantly reduce this by ₹15,600.” This level of clarity is what drives the 2026 BFSI growth engine.

For high-net-worth individuals (HNIs), the automation should include financial advisor video consultations. If a user’s tax gap exceeds ₹1 lakh, the automated video should offer a one-click “Book a Video Call” CTA, connecting them with a wealth manager who has already been briefed on the user’s specific tax profile via the CRM.

Source: TrueFan AI — Enterprise Gen-AI Capabilities

Source: TrueFan AI — BFSI Gen-AI Journeys

4. Implementation Sprint: From T-21 to the March 31 Deadline

Executing a high-impact tax season requires a disciplined 3-week sprint. The window between March 10 and March 31 is where 70% of the quarter's revenue is often generated.

T-21 to T-15 (The Education Phase): Focus on salary-specific tax saving videos. Use payroll data to segment users into tax slabs. Send educational content that explains the difference between the Old and New regimes for their specific bracket. This is the time to capture consent and clear any KYC hurdles.

T-14 to T-7 (The Consideration Phase): Launch corporate employee tax campaigns in partnership with HR departments. Provide “Tax Clinics” via personalized video links. This is where you push ELSS and NPS as the primary vehicles, highlighting the 3-year lock-in and the ₹50,000 extra benefit respectively.

T-6 to T-1 (The Urgency Phase): This is the time for March 31 deadline urgency campaigns. Deploy daily countdowns. Use WhatsApp as the primary channel for PPF investment reminders and insurance premium alerts. Ensure that your “Invest Now” buttons lead to pre-filled forms to minimize drop-offs.

T-0 (The Execution Day): On March 31, move to hourly updates. Between 9:00 a.m. and 3:00 p.m., the focus is entirely on ELSS NAV cut-offs. Post-3:00 p.m., pivot the messaging to NPS and Insurance, which often have slightly later processing windows depending on the aggregator.

Source: Kotak Life — March 31 Tax Saving Checklist

Source: TrueFan AI — FY-End 2026 Marketing Ideas

5. Measurement and ROI: Tracking Success in BFSI Tax Campaigns

In the high-stakes environment of Q4, every marketing rupee must be accounted for. Tax saving ROI calculators are essential for both the investor and the marketer. For the marketer, ROI is measured by the reduction in Customer Acquisition Cost (CAC) and the increase in Average Revenue Per User (ARPU) through cross-selling.

Solutions like TrueFan AI demonstrate ROI through significantly higher engagement metrics—often seeing a 300% increase in video completion rates compared to standard marketing clips. By tracking “Video-to-Transaction” as a primary KPI, BFSI brands can optimize their creative spend in real-time. If a specific celebrity variant is outperforming a generic brand variant in the “Salary ₹10-15L” segment, the automation engine can reallocate the budget instantly.

BFSI retention during tax season is another critical metric. Tax season is the best time to re-engage dormant users. A personalized “Welcome Back” video that acknowledges their previous year's investment and suggests a “Top-up” based on their current age and income can revive accounts that have been inactive for months.

Key metrics to monitor include:

- Video Retention Rate: At what second do users drop off? (Target: >70% for the first 10 seconds).

- CTA Conversion Rate: Percentage of video viewers who click the “Invest” or “Book Advisor” button.

- Mandate Success Rate: For ELSS and NPS, how many clicked users actually completed the payment before the cut-off?

- Incremental Lift: Comparing the performance of personalized video cohorts against a control group receiving standard SMS/Email.

Source: TrueFan AI — Union Budget 2026 Marketing Impact

6. Compliance and Trust: Navigating Regulatory Guardrails

Trust is the currency of BFSI. In the rush of March 31 deadline urgency campaigns, compliance cannot be sacrificed for speed. Every insurance tax benefit video must clearly state that tax benefits are subject to changes in tax laws and that the 10(10D) exemption has specific conditions regarding premium-to-sum-assured ratios.

For ELSS, SEBI mandates clear risk disclosures. These should not be hidden in fine print; in a personalized video, they can be presented as a clear, legible overlay during the final 5 seconds of the content. Similarly, NPS communications must adhere to PFRDA guidelines regarding Tier I and Tier II account distinctions and withdrawal restrictions.

Data privacy is equally paramount. In 2026, with the Digital Personal Data Protection (DPDP) Act in full effect, marketers must ensure that all personalization is based on explicit consent. TrueFan AI’s enterprise-grade security (ISO 27001 and SOC 2) ensures that PII (Personally Identifiable Information) is handled with the highest level of encryption, providing peace of mind to both the brand and the end consumer.

Compliance Checklist for 2026:

- ELSS: Include “Market linked” and “3-year lock-in” disclaimers.

- NPS: Highlight the retirement nature and lock-in until age 60.

- Insurance: Clarify that “Tax saving is an added benefit, not the primary purpose of life insurance.”

- PPF: Mention the 15-year tenure and the ₹1.5 lakh annual limit.

Source: SEBI — Regulatory Guidelines for MF Advertisements

Source: NPS Trust — NPS Subscriber Rights and Benefits

Conclusion

The Jan–Mar 2026 quarter is a high-velocity period that demands a sophisticated blend of data, creativity, and timing. By moving beyond generic outreach and embracing tax saving urgency marketing 2026, BFSI leaders can provide genuine value to their customers while hitting aggressive year-end targets. Whether it is through 80C investment personalized videos, investment deadline countdown videos, or financial advisor video consultations, the goal remains the same: to make tax saving as frictionless and personalized as possible.

As the March 31 deadline looms, the organizations that win will be those that respect the investor's time, speak their language, and provide the automated tools necessary to make confident, last-minute financial decisions. The future of tax marketing is not just digital—it is personal, real-time, and powered by Gen-AI.

Frequently Asked Questions

1. What is the exact deadline for tax-saving investments in 2026?

The deadline for all investments qualifying under Section 80C and 80CCD(1B) for the Financial Year 2025-26 is March 31, 2026. However, for ELSS mutual funds, you must ensure your payment is completed and funds are realized by the AMC before the 3:00 p.m. cut-off on the last working day to get that day's NAV.

2. How can I claim the extra ₹50,000 deduction for NPS?

Under Section 80CCD(1B), any individual taxpayer can claim an additional deduction of up to ₹50,000 for investments made in the NPS Tier I account. This is over and above the ₹1.5 lakh limit of Section 80C. Many NPS investment video marketing campaigns focus specifically on this “extra” benefit to drive late-season adoption.

3. Why is personalized video more effective for tax marketing?

Taxation is deeply personal and often confusing. A personalized video addresses the user by name, calculates their specific tax gap, and provides a tailored solution. This reduces the “analysis paralysis” that often leads to missed deadlines. TrueFan AI mentions that such hyper-personalization can lead to a significant uplift in conversion rates for BFSI products.

4. Can I save tax through insurance premiums paid on March 31?

Yes, life insurance premiums paid on or before March 31 qualify for Section 80C benefits for that financial year. However, it is advisable to complete the transaction at least 48 hours in advance to account for any bank processing delays or technical glitches on the insurer's portal.

5. What are the risks of last-minute ELSS investing?

The primary risk is missing the NAV cut-off. If your payment is processed after 3:00 p.m. on March 31, or if the funds do not reach the AMC's account the same day, your investment will be counted for the next financial year (2026-27), and you will lose the tax benefit for 2025-26.