Financial Year-End Marketing 2026: AI Urgency Playbook to Drive ELSS, NPS, Insurance Conversions Before March 31

Key Takeaways

- March 31 is the absolute deadline for ELSS, NPS, and Insurance tax-saving investments in the Indian financial year.

- AI-driven personalized countdown videos create high-impact urgency by visualizing specific tax gaps and time remaining.

- Leveraging vernacular content in 175+ languages builds essential trust and clarity for diverse investor segments.

- Automation must intelligently distinguish between Old and New Tax Regimes to ensure compliant and relevant messaging.

The Indian financial landscape in 2026 is defined by a singular, high-stakes deadline: March 31. For BFSI CMOs and Digital Heads, financial year-end marketing 2026 represents the most critical window to drive massive volumes in ELSS, NPS, and insurance products. As salaried professionals scramble to optimize their tax liabilities, the difference between a missed target and a record-breaking quarter lies in the precision of your urgency-driven automation.

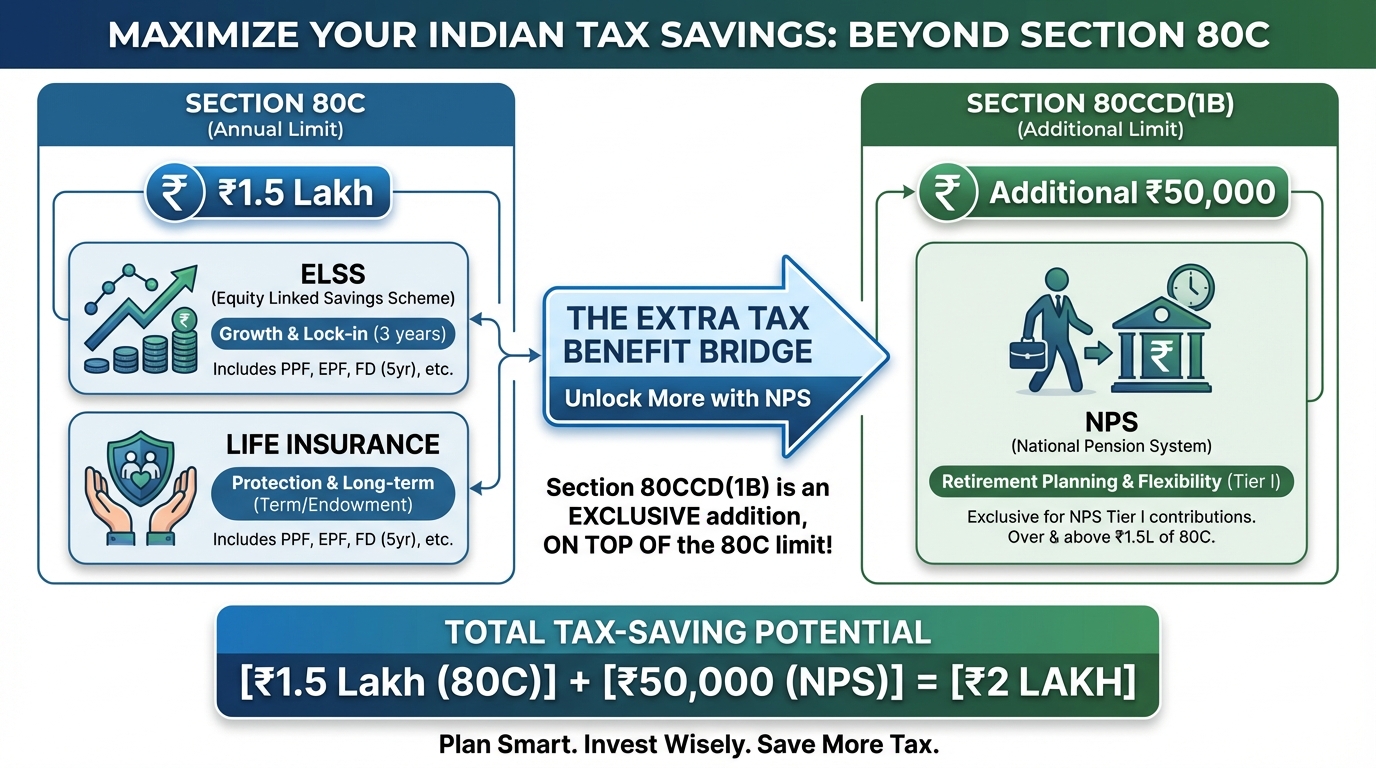

India’s financial year, running from April 1 to March 31, dictates that all tax-saving investments must be finalized before the clock strikes midnight on the final day. Specifically, Section 80C offers a deduction cap of up to INR 1.5 lakh, covering instruments like ELSS, life insurance premiums, and PPF. Furthermore, Section 80CCD(1B) provides an additional INR 50,000 deduction specifically for NPS contributions, a crucial lever for high-income earners.

However, the technical nuances of these deadlines often catch investors off guard. For instance, the deadline for ELSS investments is effectively the last working day before March 31 due to bank cut-offs and NAV allotment requirements. If March 31 falls on a weekend or holiday, investments must be processed by March 28 to qualify for the FY25–26 tax claim. Platforms like TrueFan AI enable financial institutions to communicate these critical nuances through hyper-personalized, real-time video nudges that eliminate investor confusion.

Investment Deadline Countdown Videos

In 2026, the shift toward "fewer ideas, better execution" has forced BFSI brands to move away from generic email blasts toward high-impact, precision-targeted content. Investment deadline countdown videos have emerged as the gold standard for driving last-minute conversions. These are not static advertisements; they are dynamic, data-driven assets that show a viewer’s specific Section 80C gap and the exact time remaining to fill it.

The psychological impact of a personalized countdown cannot be overstated. By integrating real-time timers that reflect the actual working hours remaining before NAV cut-offs, banks can trigger a "fear of missing out" (FOMO) that is grounded in utility rather than hype. These videos should explicitly state, "Your Section 80C headroom is ₹60,000," and "Invest by 2:00 PM on March 28 for FY25–26 tax benefits."

Beyond the timer, the 2026 trend landscape emphasizes multi-language video personalization as a core trust-builder. Indian investors are increasingly seeking financial guidance in their native tongues. TrueFan AI's 175+ language support and Personalised Celebrity Videos ensure that complex tax concepts—like the three-year lock-in period of ELSS—are explained clearly and authoritatively in the customer’s preferred language, whether it is Hindi, Marathi, Tamil, or Bengali.

Source: ClearTax

Source: Economic Times

Source: exchange4media

March 31 Tax Saving Campaigns

A successful March 31 tax saving campaigns strategy requires a multi-pronged approach that maps specific AI-driven urgency formats to different financial instruments. Each product—ELSS, NPS, or Insurance—requires a unique narrative that addresses the specific pain points of the investor during the final fiscal weeks.

For ELSS, the focus must be on the "last working day" nuance. Campaigns should utilize personalized short videos that visualize the growth potential of the investment while emphasizing the 3-year lock-in period as a tool to reduce short-term volatility. Data fields such as the user's name, masked PAN, and existing 80C usage should be injected into the video to create a 1:1 advisory experience.

NPS enrollment deadline marketing requires a different psychological trigger: the "extra" benefit. Since the INR 50,000 deduction under Section 80CCD(1B) is over and above the 80C limit, the messaging should focus on the net tax savings. A personalized video might show a 80C tax benefit calculator videos visual: "Save up to ₹15,600 in taxes (for the 30% slab) by contributing ₹50,000 before March 31." This tangible ROI makes the decision-making process frictionless for the investor.

Insurance products, both life and health, demand a focus on "payslip-ready" receipts. Last-minute insurance purchase automation should trigger videos that show the premium due, provide a direct payment link, and guarantee that the receipt will be generated in time for the employer's submission deadline. This addresses the primary anxiety of the year-end investor: will this investment actually count toward my tax savings this year?

Source: The Indian Express

Source: Times of India

Corporate Employee Tax Saving Drives

The corporate sector remains the largest pool for year-end investment volume. Corporate employee tax saving drives must be executed in coordination with HR and payroll departments to align with internal proof-of-investment (POI) submission windows. In 2026, the most effective corporate campaigns use co-branded explainer shorts delivered via company intranets or official WhatsApp channels.

By utilizing employee payroll data, BFSI providers can send personalized videos that state: "Based on your current salary structure, you still have ₹45,000 of unclaimed tax benefits." These videos can include one-click links that pre-fill the investment form, reducing the time-to-completion to under 60 seconds. On-site activations, such as QR codes in corporate cafeterias, can lead employees directly to personalized video calculators that simulate their take-home pay increase after the investment.

For High-Net-Worth Individuals (HNIs), the strategy shifts toward HNI wealth management campaigns. This segment requires a "white-glove" approach where personalized videos are introduced by their dedicated Relationship Manager (RM). These videos should go beyond simple tax saving and offer a fiscal year-end portfolio review videos experience, summarizing asset allocation and suggesting capital gains set-offs before the year closes.

To further convert fence-sitters in the HNI segment, institutions should enable financial advisory video consultations. These allow HNIs to book a direct slot with a tax expert or wealth advisor through a link embedded in the personalized video. Additionally, tax consultant referral programs can be integrated into the workflow, allowing HNIs to refer their personal accountants to the bank’s specialized tax-saving desk, ensuring a seamless, compliant transition of funds.

Source: Tantrash

Source: Social Samosa

Year-End Compliance Marketing

In the BFSI sector, speed must never come at the expense of security. Year-end compliance marketing is the backbone of any AI-driven campaign. In 2026, enterprise-grade marketing requires systematized controls for tax messaging, ensuring that disclosures are prominent and that every video generated is logged for audit purposes.

One of the most significant compliance challenges in 2026 is the coexistence of the "Old" and "New" tax regimes. Marketing automation must be intelligent enough to distinguish between these cohorts. A user on the New Tax Regime should not receive a nudge for 80C benefits, as those deductions are generally not applicable. Instead, their personalized video should focus on NPS (under employer contribution) or health insurance benefits that still offer value.

Data protection is equally paramount. Enterprise solutions must adhere to ISO 27001 and SOC 2 standards, ensuring that sensitive financial data used to personalize videos—such as PAN details or salary brackets—is handled with the highest level of encryption. Consent-first marketing, where users opt-in to receive personalized financial insights, ensures that the brand remains compliant with evolving Indian data privacy laws.

Furthermore, every piece of AI-generated content must undergo rigorous moderation. This includes filtering for unapproved financial claims or political content. By maintaining a strict audit trail of scripts and approvals, BFSI brands can confidently scale their financial year-end marketing 2026 efforts without risking regulatory friction from the RBI or IRDAI.

Tax Planning Reminder Automation

The final 45 days of the financial year require a sophisticated tax planning reminder automation cadence. An omni-channel approach—spanning WhatsApp, SMS, Email, and In-App notifications—ensures that the message reaches the investor wherever they are most active. The key is escalating urgency: a T–21 reminder might be educational, while a T–3 reminder must be action-oriented with a prominent countdown timer.

WhatsApp Business API has become the primary channel for these interactions due to its high open rates and deep-linking capabilities. A typical flow involves sending a personalized video that ends with a "Pay Now via UPI" button. This removes the friction of logging into a separate banking portal, which is often the point where last-minute investors drop off. Solutions like TrueFan AI demonstrate ROI through these seamless integrations, significantly lifting the view-to-click rates compared to static images.

The technical execution of these campaigns is powered by robust APIs. For instance, a BFSI brand can send a POST request to a video generation API with a JSON payload containing dynamic fields like {first_name}, {80C_headroom}, and {deadline_date_time}. The system then renders a high-definition, personalized video in sub-30 seconds. Once the video is ready, a webhook notifies the CRM, which then triggers the WhatsApp message to the customer.

Measurement and optimization are the final pieces of the puzzle. In 2026, CMOs are moving beyond simple "open rates" to track "time-to-completion pre-deadline" and "cost per completed investment." By A/B testing different video thumbnails—such as a celebrity expert versus a brand mascot—and analyzing which regional languages drive the highest engagement, marketers can refine their BFSI March retention strategies in real-time during the critical March 20–31 window.

BFSI March Retention Strategies

While acquiring new tax-saving investments is vital, BFSI March retention strategies are equally important for long-term portfolio health. March is a high-risk month for policy lapses and SIP cancellations as investors prioritize immediate tax-saving outflows. Retention campaigns should use personalized videos to remind customers of the long-term value-at-risk if they allow a life insurance policy to lapse or stop a long-term wealth-building SIP.

Anti-redemption nudges can be highly effective when they are goal-based. A video might show: "You are only 12 months away from your 'Child's Education' goal. Don't let a temporary tax crunch derail your progress." Offering small loyalty rewards for rolling over maturing FDs into new tax-saving instruments can also help keep capital within the institution’s ecosystem.

As we approach the 2026 deadline, the integration of AI video, real-time data, and compliant automation will be the deciding factor for BFSI success. The ability to deliver a personalized, high-authority message to millions of investors simultaneously is no longer a luxury—it is a requirement for any institution looking to dominate the March 31 peak.

Compliance Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or investment advice. Tax provisions are subject to change. Customers should evaluate options based on their individual circumstances and consult a qualified tax professional before making decisions.

Summary: March 31 is the hard stop for Indian tax planning. By deploying financial year-end marketing 2026 strategies that combine AI-powered investment deadline countdown videos, vernacular localization, and compliant automation, BFSI brands can unlock disproportionate conversions in the final weeks of the year. To see how these tools can transform your March results, book an enterprise demo and launch a February pilot today.

Frequently Asked Questions

1. What makes March 31 decisive for ELSS, NPS, and insurance tax benefits in India?

March 31 marks the end of the Indian financial year. To claim deductions under Section 80C (up to ₹1.5 lakh) and Section 80CCD(1B) (up to ₹50,000 for NPS) for the FY25–26 period, the investment must be completed and the funds must be deployed by this date. Missing this deadline means you cannot reduce your tax liability for the preceding year.

2. When should ELSS orders be placed considering bank/NAV cut-offs?

While the official deadline is March 31, investors should aim to complete ELSS transactions by the last working day (e.g., March 28 if the 31st is a holiday). This is because the tax benefit is tied to the date of NAV allotment, which requires the funds to be realized by the Mutual Fund house. Delays in banking transfers can result in the investment being dated April 1, losing the tax benefit for the current year.

3. How do investment deadline countdown videos lift conversions?

Personalized countdown videos create a psychological trigger known as "Urgency." By showing the investor exactly how much tax they stand to lose and the specific number of hours remaining to act, you reduce procrastination. When these videos are personalized with the user's name and specific 80C gap, the relevance increases, leading to higher click-through and completion rates.

4. How does TrueFan AI ensure year-end compliance marketing at enterprise scale?

TrueFan AI employs a multi-layered security and compliance framework, including ISO 27001 and SOC 2 certifications. The platform features automated content moderation to ensure all scripts meet regulatory standards, consent-management workflows to protect user data, and detailed audit logs for every personalized video generated, making it safe for highly regulated BFSI environments.

5. Can these AI campaigns handle multiple tax regimes?

Yes. Modern tax planning reminder automation systems can segment users based on whether they have opted for the Old or New Tax Regime. This ensures that the messaging remains relevant—focusing on 80C/80D for the Old Regime and specific NPS or employer-led benefits for the New Regime—thereby maintaining trust and authority.