Union Budget 2026 marketing strategies: Real-time, sector-specific playbooks for post-budget growth in India

Key Takeaways

- Capitalize on the 48–72 hour post-budget newsjacking window with policy-aligned activations.

- Build a sector-specific readiness stack: hypotheses, templates, compliance checklists, and multilingual assets.

- Use an economic policy personalization engine to tailor messages by user profile, sector, and geography.

- Prioritize conversion assets like budget impact videos, calculators, and subsidy checkers with embedded CTAs.

- Sustain results with automation and governance: trigger-based updates, audit trails, and validated sources.

Union Budget 2026 marketing strategies represent the most critical window for Indian brands to align their value propositions with national economic shifts. As the Finance Minister presents the budget on February 1, 2026, the subsequent 48 to 72 hours create a high-intent “newsjacking” window where consumer and enterprise attention is at its peak. Strategic Planning Teams and CMOs must move beyond generic summaries to deliver hyper-personalized, policy-aligned activations that convert awareness into a pipeline.

With India’s growth outlook projected at 7–7.5% and a continued thrust on capital expenditure, the 2026 budget is expected to prioritize AI, EV infrastructure, and MSME support. Platforms like TrueFan AI enable brands to bridge the gap between complex policy announcements and personalized customer outreach within minutes of the speech. By translating macro-economic shifts into micro-level benefits, organizations can achieve outsized budget-driven customer acquisition during this volatile yet rewarding period.

Source: KPMG: India Union Budget 2026–27

Source: TrueFan AI blog on Union Budget 2026 marketing strategies

Source: Economic Times: Budget 2026 Live Updates

Pre-Budget Readiness: Executing Fiscal Year Planning Campaigns

Effective fiscal year planning campaigns begin at least 14 days before the budget announcement. This phase is dedicated to building a robust “budget allocation industry insights” dataset that maps ministry-level schemes to specific customer segments. Marketing leaders must define target outcomes—such as test drives for EVs or deposit sign-ups for BFSI—and align them with anticipated policy levers like Production Linked Incentive (PLI) tweaks or MSME credit guarantees.

Preparation involves creating a sector-specific watchlist with clear hypotheses. For instance, the agriculture sector expects a push toward climate-resilient farming and PM-KUSUM expansion, while the pharma sector anticipates increased R&D outlays. Pre-loading historical data from the last three years allows brands to anticipate recurring themes and prepare dynamic content templates that can be populated in real-time.

Regulatory change marketing adaptation is equally vital during this period. Brands must draft a multi-language disclaimer library and a claims substantiation checklist to ensure compliance with evolving tax and trade policies. This readiness ensures that when the speech begins, the production team is not starting from scratch but is instead executing a pre-validated versioning plan across Hindi, English, and regional languages (regional language video SEO).

Source: Deloitte: Budget Expectations 2026

Source: Grant Thornton: Union Budget 2026 Insights

Source: India Budget (Official)

Source: EY: Climate-Resilient Agriculture Expectations

Budget Day Live Activation: Mastering Budget Opportunity Real-Time Marketing

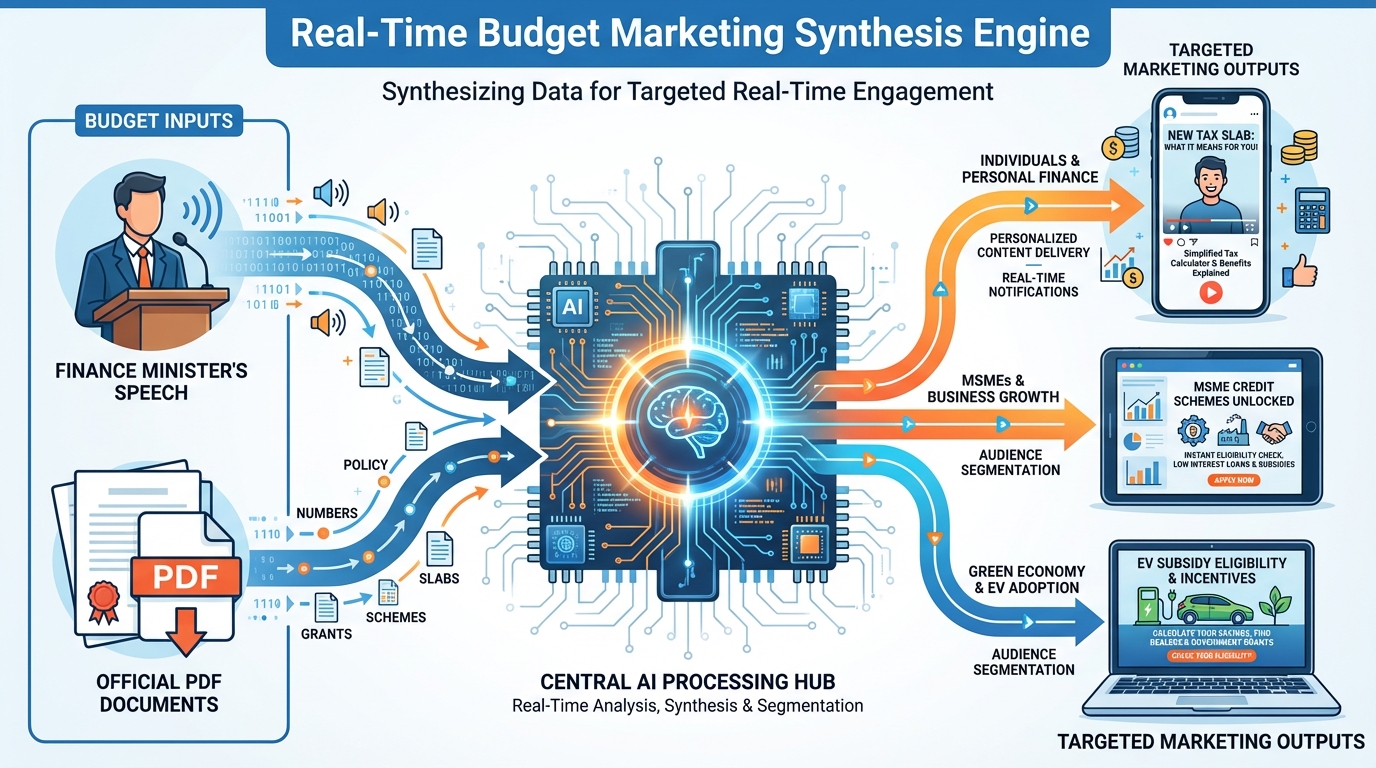

Budget opportunity real-time marketing requires a rapid synthesis engine capable of processing the Finance Minister’s speech and official documents within a three-hour window. As the Expenditure Profile and Taxation documents are released, marketing teams must extract sector-specific budget benefits. This includes identifying changes in tax slabs, new eligibility criteria for subsidies, and specific allocation increases that impact consumer purchasing power.

The core of this activation is the economic policy personalization engine. This programmatic approach tailors policy narratives to a user’s specific identity, such as their GST status, income slab, or industry sector. For a salaried professional, the messaging focuses on the delta between the old and new tax regimes; for an EV fleet operator, it highlights import duty changes and FAME-III eligibility.

Launching assets fast is non-negotiable. Within hours, brands should deploy 60–90 second budget impact assessment videos that visualize these allocations. These videos serve to translate abstract numbers into tangible business or personal outcomes, rendered by state or city to ensure maximum relevance. By validating key figures against reputable summaries from firms like KPMG or EY, brands maintain the high E-E-A-T standards required for financial and policy-related content and deliver via WhatsApp (voice commerce personalization in India).

Source: PIB (Press Information Bureau)

Source: Moneycontrol: Budget 2026 Live Updates

Source: EY India: Budget 2026 Priorities

Sector Playbooks: Capitalizing on Post-Budget Sector Opportunities

To maximize post-budget sector opportunities, brands must deploy tailored playbooks that address the unique incentives provided to different industries. Each sector requires a specific mix of messaging angles, interactive tools, and clear calls to action (CTAs).

BFSI and Fintech

In the BFSI sector, the primary focus is on tax regime clarity and financial inclusion levers. Marketing assets should include tax reform calculator videos that allow users to input their income and see the immediate impact of the 2026 tax slabs. The CTA should drive users toward portfolio reviews or tax-saver products like NPS and ELSS, leveraging the immediate post-budget urgency (80C investment personalized videos).

MSME and Manufacturing

For MSMEs, the narrative centers on PLI expansion and working capital support. Brands can deploy subsidy eligibility checker videos that guide business owners through the new credit guarantee schemes. These fiscal incentive communication videos should simplify complex eligibility criteria into a three-step process, encouraging owners to schedule a consultation or check their PLI fit.

Auto, EV, and Energy

The green energy push is expected to be a highlight of the 2026 budget. Marketing strategies should focus on FAME-III updates and battery manufacturing incentives. Subsidy eligibility checker videos for EV buyers can significantly reduce the friction in the sales funnel by showing the exact subsidy amount available at the point of purchase.

Agriculture and AgriTech

Agri-brands should focus on climate-resilient agriculture programs and irrigation outlays. Government scheme enrollment campaigns can be powered by vernacular videos that guide farmers through the documentation required for PM-KUSUM or agri-finance access. This localized approach is essential for building trust in rural markets.

Infrastructure and Real Estate

With a sustained capex thrust, infrastructure brands should highlight project pipeline developments. Budget impact assessment videos can visualize how new logistics corridors or housing support schemes will drive property value or supply chain efficiency. CTAs should focus on downloading project briefs or booking infrastructure finance consultations.

Source: Economic Times: Green Energy Expectations

Source: Economic Times: Trade Policy in Flux

Source: India Today: What Consumers Can Expect

The Conversion Asset Kit: Deploying Budget Impact Assessment Videos

A high-converting asset kit is the backbone of any Union Budget 2026 marketing strategy. These assets must be designed for low-latency delivery and high engagement. Budget impact assessment videos are the flagship of this kit, typically running 60–90 seconds and featuring animated infographics that translate policy into profit. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow for hyper-local targeting that resonates with India's diverse demographic (AI celebrity video marketing in India).

Tax reform calculator videos provide a high level of interactivity. By allowing users to branch the video based on their specific financial profile, brands can provide a personalized “break-even” analysis between different tax regimes. This level of utility ensures that the video is not just watched but used as a decision-making tool.

Subsidy eligibility checker videos and fiscal incentive communication videos serve a similar purpose for B2B audiences. These tools guide users through turnover requirements, geography-based incentives, and sector-specific rebates. By integrating a “Start Application” CTA directly within the video interface, brands can drastically shorten the path from policy awareness to lead generation.

Source: TrueFan AI: AI Product Demo Video Creator

Source: TrueFan AI: Voice Commerce Personalization in India

Source: Swastika: Union Budget 2026 Explained

Automation and Orchestration: Implementing Policy Change Marketing Automation

Policy change marketing automation ensures that your brand remains relevant as the budget details evolve from the initial speech to official gazette notifications. Triggers should be set for new PIB releases, CBDT circulars, and ministry-specific clarifications. When a trigger is activated, the automation system should automatically refresh video scenes or dynamic text via API to reflect the most accurate data (cultural celebration marketing automation).

Government scheme enrollment campaigns benefit immensely from this automation. As deadlines for specific schemes are announced, automated workflows can send reminders via WhatsApp or Email, complete with personalized document checklists. This proactive approach positions the brand as a partner in the customer’s growth, rather than just a service provider.

Regulatory change marketing adaptation must be baked into these automated workflows. This includes automated moderation to ensure that all generated content adheres to the latest compliance standards and data privacy laws. By maintaining a versioned audit trail—from the initial speech-day assets to the final clarified notifications—brands can ensure transparency and trust throughout the campaign lifecycle. See empathetic collections and automation examples here (BNPL default prevention campaigns).

Source: PIB (Press Information Bureau)

Source: India Budget (Official)

Measurement and Governance: Optimizing Budget-Driven Customer acquisition

To truly master budget-driven customer acquisition, brands must implement a rigorous measurement and optimization framework. KPIs should go beyond simple views to include video completion rates, calculator interactions, and scheme enrollment initiations. By comparing the uplift of budget-specific campaigns against business-as-usual (BAU) benchmarks, CMOs can isolate the exact ROI of their budget strategies.

Solutions like TrueFan AI demonstrate ROI through significantly higher engagement rates compared to generic post-budget static ads, often seeing a 3x to 5x increase in CTR. Attribution models should be refined to account for sector-specific budget benefits, allowing teams to adjust audience weights in real-time based on which sectors are responding most favorably to the new policy environment.

Risk and compliance remain the foundation of these strategies. A source-of-truth registry must be maintained, documenting every figure used in marketing assets with direct links to official Budget documents or Big4 summaries. This level of governance is essential for maintaining brand authority and avoiding the pitfalls of misinformation during a high-stakes economic event.

Conclusion

The Union Budget 2026 marketing strategies outlined here provide a comprehensive roadmap for navigating one of the most significant economic events of the year. By combining real-time synthesis, economic policy personalization, and automated orchestration, brands can transform a complex policy announcement into a powerful engine for growth. The key to success lies in the ability to move fast without sacrificing accuracy, ensuring that every piece of content delivers genuine value to the end-user. As the Indian economy continues its upward trajectory, those who can effectively translate national policy into personal opportunity will lead the market in 2026 and beyond.

Frequently Asked Questions

1. How quickly can budget impact assessment videos be deployed after the speech?

Using automated rendering engines and pre-built templates, flagship videos can be deployed within 3 to 6 hours of the Finance Minister concluding the speech. This allows brands to capture the peak search interest window.

2. Can these marketing strategies be localized for regional languages?

Yes, high-impact strategies utilize AI-driven localization to render assets in over 175 languages. This ensures that sector-specific budget benefits are communicated effectively to diverse audiences across India (voice commerce and vernacular India 2026).

3. How does TrueFan AI handle high-volume rendering for personalized budget videos?

TrueFan AI utilizes a low-latency API-driven infrastructure that can render millions of personalized video variants in under 30 seconds, ensuring that every customer receives a unique, policy-aligned message almost instantly.

4. What are the most important KPIs for budget-driven customer acquisition?

The most critical KPIs include the conversion rate from video view to calculator completion, the number of eligibility checks initiated, and the overall lift in high-intent lead volume compared to the pre-budget period.

5. How do you ensure the accuracy of tax and subsidy data in real-time assets?

Accuracy is maintained through a “validation-first” workflow where all data points are cross-referenced with PIB releases and official Budget documents before being pushed to the dynamic content engine.