Union Budget 2026 marketing strategies: A real-time, sector-specific playbook for enterprise teams

Estimated reading time: 8 minutes

Key Takeaways

- Real-time activation is critical, with the 0-48 hour window being the most impactful for budget-driven marketing.

- Sector-specific personalization using tools like TrueFan AI allows enterprises to translate complex policy changes into high-converting customer touchpoints.

- Video content, particularly impact assessments and tax calculators, drives significantly higher engagement than static communication.

- Automation and governance are essential for scaling personalized outreach while maintaining regulatory compliance.

Union Budget 2026 marketing strategies aren’t just about reacting to headlines—they’re about turning policy signals into sector-specific, personalized campaigns within 48 hours. As India moves toward its "Viksit Bharat" goals, the Union Budget remains the single most significant economic catalyst for enterprise growth. For strategic planning teams and industry marketing leaders, the ability to activate data-driven, policy-triggered campaigns in real-time is no longer a luxury; it is a competitive necessity.

In 2026, the marketing landscape is defined by budget opportunity real-time marketing, where the window for maximum impact closes within the first 48 hours of the Finance Minister’s speech. With India’s GDP growth projected to maintain a robust 6.5-7% trajectory and digital ad spend expected to cross the $10 billion mark by 2026, the stakes for budget-driven customer acquisition have never been higher.

Platforms like TrueFan AI enable enterprise teams to bridge the gap between complex policy announcements and personalized customer outreach, ensuring that every tax tweak or subsidy allocation becomes a high-converting touchpoint. This playbook provides the structural framework to navigate the Union Budget 2026 with precision, from 0-hour listening stacks to full-funnel government scheme enrollment campaigns.

The 0–48 hour budget opportunity real-time marketing playbook

The concept of budget opportunity real-time marketing refers to the event-driven activation of content and offers within 0–48 hours of official policy announcements. This requires a "listening stack" that prioritizes truth sources like the Official Union Budget Portal and PIB Press Releases.

The Listening Stack and Truth Sources

To execute at speed, your team must track:

- The Budget Speech PDF: For the exact phrasing of new policy measures.

- Key Features (Budget Highlights): For rapid summarization of sector-specific outlays.

- PIB Fact Sheets: For granular details on scheme eligibility and implementation timelines.

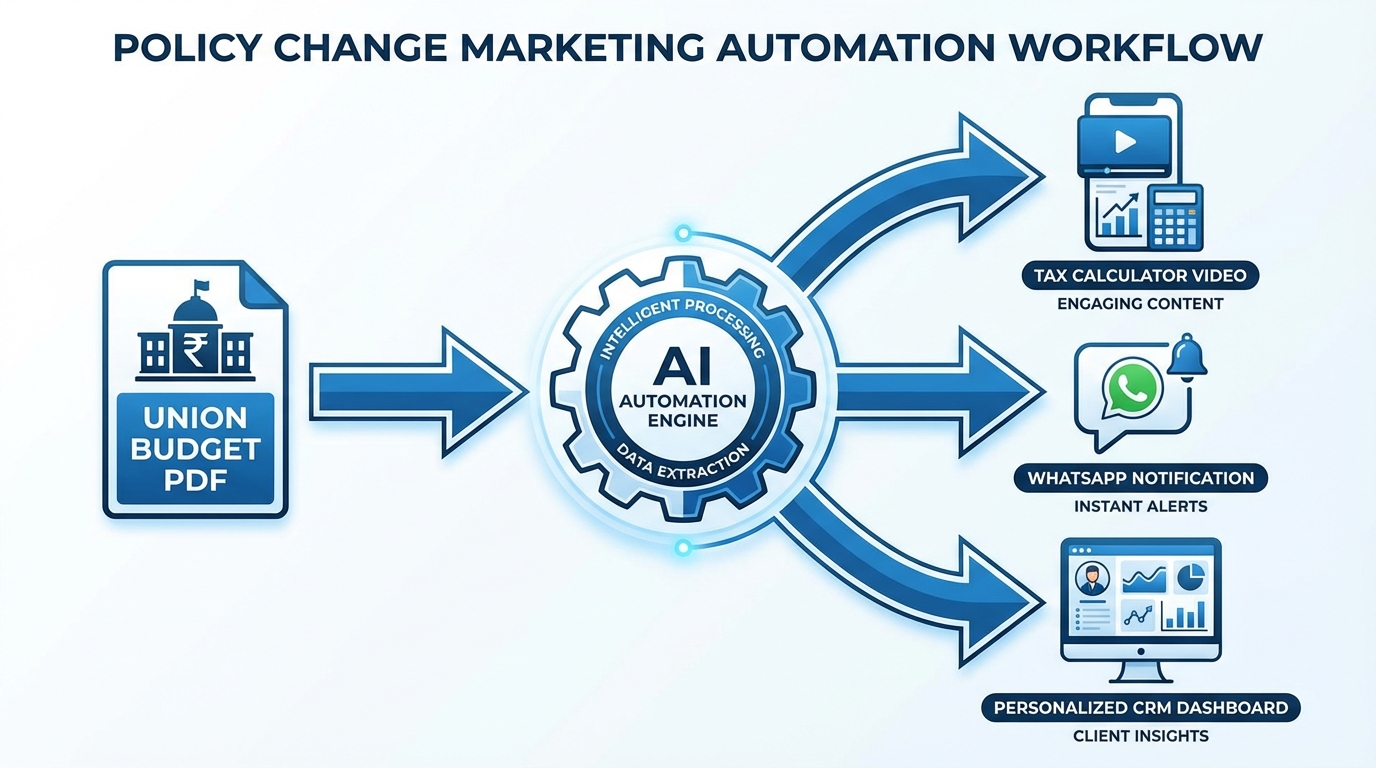

Trigger Taxonomy for Policy Change Marketing Automation

Effective policy change marketing automation relies on a predefined trigger taxonomy. When a policy change is detected, it should automatically trigger specific content workflows:

- Tax Reforms: Slab changes or surcharge updates trigger tax reform calculator videos.

- Incentives/Subsidies: PLI extensions or green energy support trigger fiscal incentive communication videos.

- Allocations: Infrastructure or healthcare outlays trigger sector-specific landing pages and enrollment flows.

Low-Latency Execution via TrueFan Enterprise API

For enterprises, the bottleneck is often creative production. By integrating the TrueFan New Request API (POST https://newvideorequest.truefans.in/api/post_new_request), teams can generate personalized videos at scale. Using text_data arrays, you can overlay dynamic fields such as a user’s name, city, and specific budget benefit (e.g., "Arjun, your tax savings this year is ₹45,000").

With a Status Check API and Webhook integration, these videos are rendered in under 30 seconds and delivered via WhatsApp or CRM, ensuring your brand is the first to provide a budget impact assessment video to your high-value cohorts.

Source: Economic Times: Budget 2026 Date and Presentation Nuance

Source: Outlook Business: How the Union Budget is Prepared

Mapping post-budget sector opportunities into campaigns

Identifying post-budget sector opportunities requires translating raw allocations into messaging pillars. According to Deloitte India’s 2026 expectations, the focus will likely remain on manufacturing, energy transition, and digital infrastructure.

Sector-Specific Budget Benefits: A Mini-Brief

- BFSI & Fintech: Focus on tax regime clarifications and UPI-linked credit. Use tax reform calculator videos personalized by income bracket to drive investment product upsells.

- Manufacturing & MSME: Leverage PLI tweaks and credit guarantees. Deploy fiscal incentive communication videos that detail state-specific benefits and customs duty rationalization.

- Energy & EV: Capitalize on battery/solar subsidies. Create subsidy eligibility checker videos for fleet buyers to calculate ROI based on new fiscal support.

- Healthcare & MedTech: Focus on R&D outlays and medical tourism. Use budget impact assessment videos to explain how new allocations lower the cost of specialized equipment.

Deriving Budget Allocation Industry Insights

To establish authority, enterprises must convert line items into "visual cards" showing YoY percentage changes. Annotating "who benefits" by firm size or region allows for economic policy personalization that resonates with specific B2B and B2C segments.

Source: KPMG India: Union Budget 2025-26 Sector Lenses

Source: EY India: Union Budget Highlights and Precedents

Video formats that convert in a budget cycle

In a high-noise environment like Budget Day, video is the superior medium. Statistics show that video content will account for 82% of all internet traffic by 2026, and personalized video campaigns see up to 3.5x higher engagement than static ads.

1. Budget Impact Assessment Videos

These are concise, C-suite-ready explanations (45–90 seconds) of how specific budget changes alter cost structures or compliance. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow these messages to be delivered by a trusted face in the recipient's native tongue, significantly increasing trust and watch-through rates.

2. Fiscal Incentive Communication Videos

These videos summarize new subsidies with dynamic overlays showing the specific benefit quantum. For example, a manufacturing firm can send a video to its distributors explaining the exact credit limit increase they are eligible for under the new MSME norms.

3. Tax Reform Calculator Videos

By embedding dynamic tax slab outputs into a video, you can guide a user through their "Old vs. New" regime comparison. Implementation involves populating text_data arrays with calculated slab lines and delivering them via WhatsApp with a deep link to a full calculator page.

4. Subsidy Eligibility Checker Videos

These act as personalized "Are you eligible?" flows. Based on a user's turnover and sector, the video outputs their likely eligibility tier. This format is essential for government scheme enrollment campaigns, moving users from curiosity to verified action.

Source: Union Budget 2026 Marketing Impact

Source: Video Personalization ROI Metrics

Government scheme enrollment campaigns: A full-funnel design

A successful government scheme enrollment campaign moves an eligible audience from awareness to verified enrollment. This is particularly critical when the Budget introduces new schemes like "PM Surya Ghar" or updates to "Lakhpati Didi."

The Enrollment Funnel

- Awareness: Use sector explainer shorts in regional languages to reach rural and semi-urban audiences.

- Pre-qualification: A 5-question eligibility checker leads to an auto-personalized video summary of the user's potential benefits.

- Documentation: Provide a personalized checklist video and assisted upload links.

- Enrollment: Direct users to official portals (e.g., PIB Hub) for final submission.

Compliance is non-negotiable here. All content must include disclaimers that the information is not legal advice and that final eligibility is determined by the relevant Ministry.

Economic policy personalization and segments to prioritize

Economic policy personalization involves tailoring content based on a user’s exposure to budget measures—such as their income slab, NIC/SIC sector code, or geographic proximity to a new infrastructure project.

Priority Segments for 2026

- Salaried Taxpayers: Segment by tax regime and income bracket to offer relevant financial planning tools.

- MSMEs: Segment by GST turnover and state to communicate specific credit and subsidy benefits.

- Enterprise Buyers: Focus on those impacted by PLI extensions or changes in corporate tax surcharges.

- Rural Audiences: Prioritize segments benefiting from increased agri-infra outlays or BharatNet expansions.

By syncing CRM attributes with budget triggers, enterprises can achieve budget-driven customer acquisition that feels helpful rather than intrusive.

Policy change marketing automation: Reference architecture and governance

To achieve the required speed, enterprises must adopt a robust policy change marketing automation architecture. This involves an event-driven orchestration where Budget PDFs are parsed, rules are applied, and content is generated via API.

Governance and Regulatory Change Marketing Adaptation

Regulatory change marketing adaptation requires strict governance:

- Approval Workflows: Ensure all dynamic templates are pre-approved by legal.

- Auto-Expiry: Set claims to expire automatically when new CBDT or Ministry circulars are issued.

- AI Moderation: Use guardrails to prevent the generation of politically sensitive or offensive content. TrueFan AI’s ISO 27001/SOC 2 certification and built-in moderation filters ensure that celebrity likenesses and brand assets are used ethically and safely.

Source: Enterprise Video Security Standards

Source: AI Video Moderation Tools Guide

Fiscal year planning campaigns and calendars (Q4 FY25 – Q1 FY26)

The Union Budget isn't just a one-day event; it dictates the rhythm of fiscal year planning campaigns. The cycle typically spans from the announcement in February (Q4 FY25) through the implementation in April (Q1 FY26).

The Budget Campaign Cadence

- T0 to T+2 Days: Launch budget impact assessment videos to C-suite and functional buyers to capture immediate interest.

- T+3 to T+14 Days: Deploy calculators and subsidy eligibility checker videos to move prospects into the middle of the funnel.

- T+15 to T+45 Days: Focus on enrollment pushes and documentation assistance for new schemes.

- Q1 FY26 (April-June): Transition to ROI proofs, case studies, and renewal offers as the new fiscal year begins.

Measurement, analytics, and ROI framing

To justify the investment in Union Budget 2026 marketing strategies, teams must instrument both leading and lagging metrics. Solutions like TrueFan AI demonstrate ROI through measurable uplifts in click-through rates (CTR) and conversion rates compared to non-personalized controls.

Key Performance Indicators (KPIs)

- Leading Metrics: CTR by sector/policy, eligibility checker completion rate, and watch-through rate on personalized videos.

- Lagging Metrics: Pipeline and revenue attributed to budget-themed campaigns, CAC by segment, and enrollment conversions.

- CFO-Ready Dashboards: Use CRM attribution to show how budget-day engagement led to Q1 revenue.

Frequently Asked Questions

What are the most effective Union Budget 2026 marketing strategies by sector in India?

The most effective strategies involve post-budget sector opportunities mapping. For BFSI, this means tax reform calculator videos; for Manufacturing, it involves fiscal incentive communication videos regarding PLI schemes; and for Energy, it focuses on subsidy eligibility checker videos.

How to launch government scheme enrollment campaigns within 48 hours of the Budget?

Success requires policy change marketing automation. By pre-building templates and using APIs like TrueFan AI, you can ingest official data from the PIB and render personalized enrollment guides in real-time.

How do tax reform calculator videos work for Indian taxpayers?

These videos use dynamic overlays to show a user their specific tax liability under the old vs. new regimes. The data is fed via API into a video template, allowing for a personalized financial planning experience delivered directly to the user's phone.

What is policy change marketing automation for Indian enterprises?

It is a system that connects official policy triggers (like a change in customs duty) to a rules engine that automatically generates and distributes relevant marketing content to the affected customer segments.

How to adapt marketing to regulatory change after the Budget?

Regulatory change marketing adaptation involves setting up governance workflows that allow for rapid content updates as new circulars are released, ensuring all marketing claims remain compliant with the latest government notifications.

Conclusion: Preparing for the 2026 Fiscal Catalyst

The Union Budget 2026 presents a unique window for budget-driven customer acquisition. By combining economic policy personalization with high-speed execution, enterprise teams can transform a complex government document into a powerful engine for growth. Whether it is through budget impact assessment videos for the C-suite or government scheme enrollment campaigns for the masses, the key is to act with speed, accuracy, and a personal touch.

For enterprises looking to lead the conversation, the time to build the automation architecture is now. By the time the Finance Minister stands to deliver the speech, your real-time playbook should already be in motion.