Voice commerce vernacular India 2026: Capturing 540M regional users with Hindi, Tamil, Bengali voice shopping

Key Takeaways

- By 2026, 540M vernacular users will drive India’s commerce, making voice-first experiences essential across Hindi, Tamil, and Bengali.

- Conversational UPI (Hello! UPI, UPI 123Pay) enables secure voice checkout, cutting drop-offs and improving conversions.

- Success hinges on dialect-specific optimization, transcreation, and culturally tuned prompts—not mere translation.

- WhatsApp and smart speakers are key channels for discovery, cart recovery, and frictionless voice-activated offers.

- Multilingual voice marketing automation aligns ASR/NLU/TTS with CRM triggers and robust measurement for scalable ROI.

Voice commerce vernacular India 2026 isn’t a prediction—it’s a playbook for the next decade of digital dominance. As the Indian internet landscape matures, the shift from “keyboard-first” to “voice-first” is no longer optional for enterprises targeting the 540 million vernacular users who will define the market by 2026. This evolution encompasses shopping journeys initiated, advanced, or completed via voice interfaces across mobile assistants, smart speakers, in-app voice SDKs, IVR, and WhatsApp—all meticulously optimized for India’s rich tapestry of regional languages and dialects.

Why 2026 is the Tipping Point for Natural Language Commerce in India

The convergence of affordable high-speed data, a surge in smartphone penetration, and the maturation of Large Language Models (LLMs) has created a perfect storm for voice commerce vernacular India 2026. By 2026, India is projected to reach approximately 900 million smartphone users, with the vast majority of new entrants hailing from Tier-2 and Tier-3 cities. These users, often referred to as the “Bharat” segment, exhibit a distinct preference for local languages, with 70% of India’s internet users favoring vernacular content over English.

The economic stakes are monumental. India’s digital economy is on a trajectory to surpass $1 trillion by 2030, and the bulk of new transaction volume is expected to surge around the 2026 pivot point. The voice assistant and AI market in India is mirroring this growth, expanding from $153 million in 2024 to an estimated $957 million by 2030, representing a staggering 35.7% CAGR. For enterprises, this means that natural language commerce India is the primary vehicle for capturing the “Next Billion” shoppers who find traditional text-based interfaces intimidating or inefficient.

Furthermore, the scale of voice search in India has already crossed the 400 million user mark. Hindi voice searches alone have surged by 400% in recent years, signaling a deep-seated behavioral shift. As voice recognition technology achieves higher accuracy across diverse Indian accents, the barrier to entry for non-metro users collapses. This demographic is not just searching; they are exhibiting a higher purchase propensity. Global data indicates that voice shoppers are 4.31% more likely to complete a purchase compared to social media shoppers, a trend that is intensifying in the Indian context as trust in conversational interfaces grows.

Source: https://clickup.com/blog/marketing-trends-india-2026/

Source: https://buildmystore.io/vernacular-voice-commerce-unlocking-indias-next-billion-shoppers/

Source: https://www.roihunt.in/top-ecommerce-marketing-trends-in-2026/

Decoding Regional Language Voice Shopping Fundamentals

To succeed in regional language voice shopping, enterprises must move beyond simple translation and embrace “transcreation.” This involves understanding vernacular long-tail keywords—the natural-language, question-style, and code-mixed phrases that mirror how users actually speak. For instance, a user in Kanpur might ask, “सबसे सस्ता मिक्सर ग्राइंडर दिखाओ” (Show me the cheapest mixer grinder), while a user in Chennai might query, “சிறந்த வாஷிங் மெஷின் எது?” (Which is the best washing machine?).

Hindi Voice Search Optimization: The Core Engine

Hindi voice search optimization requires a sophisticated approach to “Hinglish” and colloquialisms. Content must be structured to answer direct questions about price, availability, and UPI payments. Tactics include:

- Implementing FAQ schema for conversational queries like “कैशबैक कब मिलेगा?” (When will I get the cashback?).

- Targeting featured snippets with 40-50 word answers that assistants can read aloud.

- Mapping code-mixed variants such as “best mobile 15000 ke niche” to relevant product pages.

Tamil Voice Commerce Campaigns: Dialect and UX

Tamil voice commerce campaigns must account for significant dialectical variations between regions like Chennai, Coimbatore, and Madurai. A “one-size-fits-all” Tamil voice bot will fail to build trust. Enterprises should:

- Tailor honorifics and verb forms to match local speech patterns.

- Design UX flows that transition seamlessly from a Tamil voice search to a Tamil Product Detail Page (PDP), culminating in a “Hello! UPI” voice-enabled payment prompt.

- Ensure native reviewer QA to maintain cultural resonance and ASR (Automatic Speech Recognition) accuracy.

Bengali Conversational AI Marketing: Cultural Cues

Bengali conversational AI marketing thrives on cultural context. During festivals like Durga Puja or Poila Boishakh, voice prompts should reflect the celebratory spirit. Key strategies include:

- Using NLU (Natural Language Understanding) to detect intent in a mix of Bangla and English.

- Providing clear voice disclosures for returns and Cash on Delivery (CoD) to mitigate the inherent skepticism often found in Tier-2/3 digital adoption.

- Personalizing offers based on district-specific trends and price sensitivities.

Source: https://www.gnani.ai/resources/blogs/how-voice-ai-is-making-shopping-accessible-in-tier-2-cities

Source: https://www.sentisight.ai/exploring-the-popularity-of-voice-commerce/

Source: https://about.fb.com/wp-content/uploads/2024/05/Win-With-Conversations-Report_2024.pdf

Tier-2 Voice Shopping Adoption: The Rise of Bharat

The narrative of Indian e-commerce is shifting from the metros to the heartland. Tier-2 voice shopping adoption is driven by a fundamental need for accessibility. For many users in smaller towns, typing in a regional script is cumbersome, whereas speaking is natural. This has led to a surge in non-metro adoption of smart speakers and voice-enabled mobile apps. Amazon and Flipkart have already recognized this, with Flipkart introducing a grocery voice assistant and Amazon enabling full voice shopping in Hindi to cater to this burgeoning segment.

The growth of voice assistant regional marketing is intrinsically linked to the smartphone base. Deloitte projects that as India nears 900 million smartphone users by 2026, the affordability of these devices will bring voice-first interfaces to the hands of those who were previously digitally excluded. This isn’t just about search; it’s about the entire funnel. Users are now comfortable asking their phones to “reorder my monthly ration” or “check my order status” in their mother tongue.

To capitalize on this, brands must integrate smart speaker commerce integration into their broader strategy. While mobile remains the primary device, smart speakers are becoming the “communal shopping hub” in Tier-2 households. Integrating shopping skills that allow users to apply coupons or find nearby stores via voice creates a frictionless experience that builds long-term loyalty. The data is clear: non-metro regions are seeing increased adoption of smart speakers for learning, music, and increasingly, commerce.

Source: https://voicebot.ai/2021/09/20/amazon-adding-voice-shopping-in-hindi/

Source: https://vomyra.com/blogs/the-future-of-voice-ai-in-india-trends-growth

Natural Language Commerce India: Payments and Conversational UPI

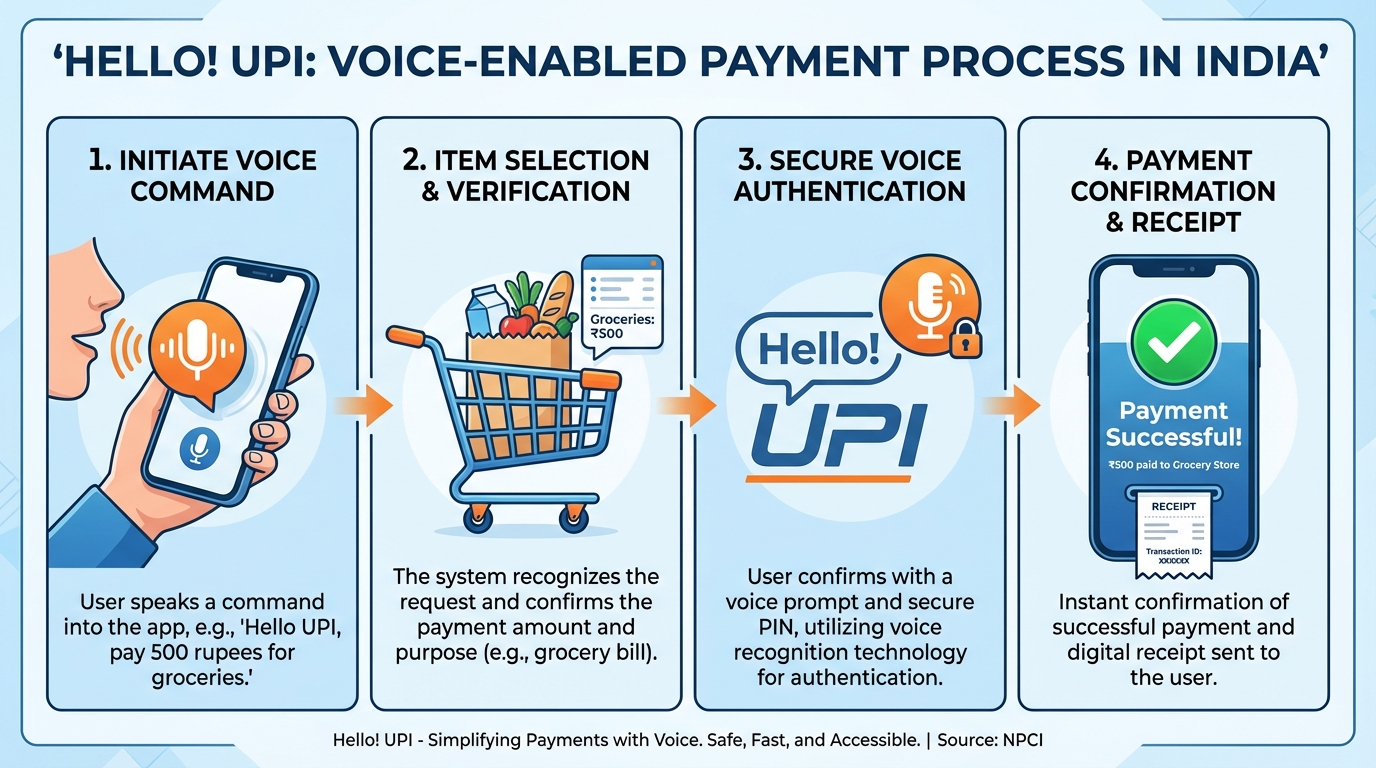

The final hurdle in any commerce journey is the payment, and in India, this means UPI. The introduction of “Hello! UPI” (voice-enabled UPI) and “UPI 123Pay” (IVR-based payments) has revolutionized natural language commerce India. These technologies allow users to complete transactions using only their voice, which is a game-changer for vernacular users who may struggle with complex app interfaces.

A typical conversational payment flow in 2026 looks like this:

- Voice Intent: User says, “मुझे आशीर्वाद आटा का 5 किलो का पैकेट चाहिए” (I want a 5kg packet of Aashirvaad Atta).

- Cart Summary: The assistant reads back the order and price in Hindi.

- Voice Confirmation: User confirms the order.

- Hello! UPI Prompt: The system initiates a voice-enabled UPI prompt.

- Secure PIN: The user enters their UPI PIN on their device (or via a secure IVR for 123Pay).

- WhatsApp Confirmation: A voice note receipt is sent via WhatsApp to confirm the transaction.

This seamless integration of voice and payments reduces drop-off rates significantly. Major financial institutions like SBI and HDFC, in collaboration with NPCI, are already showcasing these innovations at global forums. By removing the need to navigate multiple screens, brands can ensure that voice-activated personalized offers actually result in conversions rather than abandoned carts.

Source: https://paytm.com/blog/payments/upi/hello-upi/

Source: https://www.bajajfinserv.in/hello-upi

Multilingual Voice Marketing Automation & The TrueFan AI Engine

Scaling voice commerce across dozens of dialects and millions of users requires a robust multilingual voice marketing automation stack. This stack must orchestrate ASR, NLU, and TTS (Text-to-Speech) technologies while maintaining a centralized workflow for content operations. The goal is to deliver a consistent, high-quality experience whether the user is interacting via Alexa, a mobile app, or a WhatsApp voice bot.

Platforms like TrueFan AI enable enterprises to bridge the gap between static marketing and dynamic, voice-driven engagement. By leveraging advanced AI, brands can create hyper-personalized content that resonates with the specific linguistic nuances of their target audience. TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow brands to deliver offers that feel local and authentic, even at a national scale.

For instance, a brand could trigger a voice-activated personalized offer based on a user’s browsing history. If a user in West Bengal frequently searches for electronics, the system can automatically generate a Bengali-language video featuring a brand ambassador, delivered via WhatsApp, reinforcing a voice-exclusive discount. This level of integration ensures that the marketing message is not just heard but acted upon.

The technical components of this automation include:

- ASR/NLU for Regional Dialects: Moving beyond standard Hindi to capture the nuances of Bhojpuri, Marwari, or Dakkhani.

- Dynamic TTS: Using natural prosody and emotion to make voice assistants sound less robotic and more like a helpful local shopkeeper.

- Orchestration: Linking CRM triggers to voice-first channels to ensure the right offer reaches the right user at the right time.

Source: https://www.truefan.ai/

Source: https://mmaglobal.com/files/documents/mma_voice_playbook_0.pdf

Voice-Activated Personalized Offers: The Implementation Playbook

To move from strategy to execution, enterprises need a phased roadmap for voice-activated personalized offers. This involves a deep dive into data, a commitment to dialectical accuracy, and a focus on measurable KPIs. Solutions like TrueFan AI demonstrate ROI through enhanced engagement and higher conversion rates by making every interaction feel uniquely tailored to the individual user.

Phase 0: Discovery and Feasibility

Before launching, audit your existing search logs and IVR transcripts. Identify the most common vernacular long-tail keywords your customers are already using. This data will form the foundation of your NLU models and FAQ clusters.

Phase 1: The Three-Market Pilot

Launch a pilot in three key markets: Uttar Pradesh (Hindi), Tamil Nadu (Tamil), and West Bengal (Bengali). Focus on 10-15 high-intent queries such as product discovery, price comparison, and order tracking. Integrate “Hello! UPI” for a frictionless checkout and use WhatsApp for post-purchase communication.

Phase 2: Scaling and Automation

Once the pilot demonstrates success, expand to additional languages like Telugu, Marathi, and Kannada. This is where multilingual voice marketing automation becomes critical. Automate the generation of localized creatives and use AI to monitor ASR Word Error Rates (WER) in real-time.

Phase 3: Optimization and Deep Personalization

Deepen your CRM integration to trigger voice offers based on lifecycle events—such as a “reorder nudge” for a customer whose monthly supplies are likely running low. Use A/B testing to refine dialect scripts, testing whether a formal or casual tone performs better in specific regions.

Measurement Framework:

- ASR Accuracy: Monitor WER by language and dialect.

- Intent Capture: Measure how accurately the NLU identifies the user’s goal.

- Conversion Rate (CVR): Track the percentage of voice interactions that lead to a purchase.

- Average Order Value (AOV): Compare voice-driven AOV against traditional text-based AOV.

Source: https://www.truefan.ai/case-study

Source: https://www.royalways.com/blog/13-digital-marketing-trends-every-indian-brand-must-watch-in-2026/

Strategic Recommendations for 2026

As we approach 2026, the mandate for Indian enterprises is clear: embrace the voice. The “Bharat” user is not just a demographic; they are the new majority. By prioritizing voice commerce vernacular India 2026, brands can unlock unprecedented growth in previously untapped regions.

- Prioritize the “Big Three”: Start with Hindi, Tamil, and Bengali. These languages cover a vast portion of the high-growth Tier-2/3 markets.

- Invest in NLU, not just Translation: Ensure your systems understand the intent behind the dialect, not just the literal words.

- Bridge the Trust Gap: Use voice-to-WhatsApp handoffs and localized video content to reassure users during the payment and return processes.

- Iterate with Data: Use ASR error logs as your most valuable feedback loop. If your system can’t understand a specific regional accent, retrain it until it can.

The future of commerce in India is vocal, local, and hyper-personalized. Those who master the art of the conversation today will own the market in 2026.

Source: https://www.truefan.ai/blogs/voice-commerce-personalization-india

Source: https://www.gnani.ai/resources/blogs/how-voice-ai-is-making-shopping-accessible-in-tier-2-cities

Vernacular Long-Tail Optimization: Mastering Hindi, Tamil, and Bengali Search

To capture organic traffic in a voice-first world, enterprises must master vernacular long-tail optimization reference. Voice queries are fundamentally different from typed searches; they are longer, more conversational, and often include a mix of languages. A user won’t type “best idli cooker,” but they might say, “Enna idli cooker best?” in Tamil or “Sabse accha idli cooker kaunsa hai?” in Hindi.

The first step in this strategy is query mining. Enterprises should analyze assistant logs, site search data, and WhatsApp transcripts to identify the natural-language patterns users actually use. This data is then used to build language-specific FAQ hubs and enable “Speakable” and “HowTo” schema. This ensures that when a user asks a question to their smart speaker, your brand’s content is the one being read back as the authoritative answer.

Hindi voice commerce optimization requires a deep understanding of code-switching and transliteration. Many users will use English brand names but Hindi grammar. Your SEO strategy must account for these variations, ensuring that your content is discoverable regardless of how the user chooses to phrase their request. Similarly, Tamil voice search marketing must account for the formal and informal variations of the language, as well as the specific honorifics used in different regions of Tamil Nadu.

Bengali conversational commerce presents its own set of unique challenges, including a softer affirmative tone and specific regional greetings. By leveraging the BHASHINI ecosystem, enterprises can improve their Indic language coverage and accuracy, ensuring that their AI models are not just translating words but capturing the cultural essence of the communication. This level of detail is what builds long-term trust with regional shoppers.

Source: https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2093333

Source: https://exchange.scale.com/public/blogs/how-flipkart-used-ai-to-scale-e-commerce-7-lessons-learned

The Omni-Channel Playbook: WhatsApp, Smart Speakers, and Voice-Activated Offers

An effective vernacular voice commerce India 2026 strategy must be omni-channel, meeting the user wherever they are most comfortable. While mobile apps remain important, the real growth is happening on “super-apps” like WhatsApp and through smart speaker commerce integration. In 2026, these channels are no longer silos but integrated parts of a single, voice-enabled ecosystem.

WhatsApp voice journeys are particularly potent for the Indian market. Enterprises are using voice notes for cart recovery, price drop alerts, and replenishment reminders. Because voice notes feel more personal and are easier to consume than long text messages, they see significantly higher open and engagement rates. A user receiving a voice message from a trusted brand ambassador in their local dialect is far more likely to take action than one receiving a standard SMS.

The integration of voice assistant regional integration (Alexa, Google Assistant) allows for a hands-free shopping experience that is perfect for home environments. Users can browse, add to cart, and check order status using localized intents in Hindi, Tamil, or Bengali. The challenge here is managing “progressive disclosure”—providing just enough information at each step of the voice journey to avoid overwhelming the user, while still ensuring they have all the details needed to make a purchase.

Voice-activated offer redemption is another high-impact area. The flow typically involves an eligibility check, followed by a voice confirmation from the user, which then triggers a “Hello! UPI” collect request. This seamless transition from voice discovery to voice payment is the “holy grail” of frictionless commerce. To prevent fraud, enterprises must implement robust controls, such as tokenized coupons and anomaly detection, ensuring that the convenience of voice does not come at the cost of security.

Frequently Asked Questions

How to optimize for Hindi voice search on mobile?

Hindi voice search optimization involves structuring your website’s content to mirror natural speech. Focus on vernacular long-tail keywords and “Hinglish” phrases. Implement FAQ schema and ensure your site loads quickly on Tier-2 networks. Use colloquialisms like “sasta” (cheap) or “achha” (good) in your metadata to capture high-intent voice queries.

What data is needed for dialect-specific voice campaigns?

To run successful dialect-specific voice campaigns, you need a comprehensive lexicon of regional terms, pronunciation guides (phonemes), and a deep understanding of local honorifics. You should also collect “confusion matrices” from your ASR logs to identify where the system struggles with specific accents, allowing for continuous model retraining.

How to measure ROI from smart speaker commerce integration?

ROI for smart speaker commerce integration is measured through event tracking of voice-initiated tasks. Key metrics include reorder frequency (voice is excellent for staples), basket uplift through voice-activated cross-selling, and reduction in customer support costs via voice-led self-service.

How do conversational UPI flows work with voice checkout?

In a conversational shopping AI flow, the user confirms their order via voice. The system then triggers a “Hello! UPI” prompt. The user can authorize the payment using a voice command or by entering their PIN on a linked mobile device. This creates a secure, hands-free transaction experience that is ideal for multitasking or for users with limited digital literacy.

How does TrueFan AI support vernacular voice commerce?

TrueFan AI provides the creative engine for scaling these efforts. By using TrueFan AI’s 175+ language support, brands can generate personalized video content that complements voice interactions. For example, after a user completes a voice purchase, they could receive a personalized video in their local dialect confirming the order and offering a “thank you” discount for their next purchase, thereby bridging the gap between voice utility and emotional brand building.