Vernacular Voice Commerce India 2026: How Enterprises Will Win 650M Regional Shoppers with Voice

Estimated reading time: 13 minutes

Key Takeaways

- By 2026, vernacular voice commerce will be the default interface for 650M regional users, unlocking a $7.47B opportunity.

- Winning requires multilingual voice marketing automation with dialect-aware NLU/ASR and consistent experiences across channels.

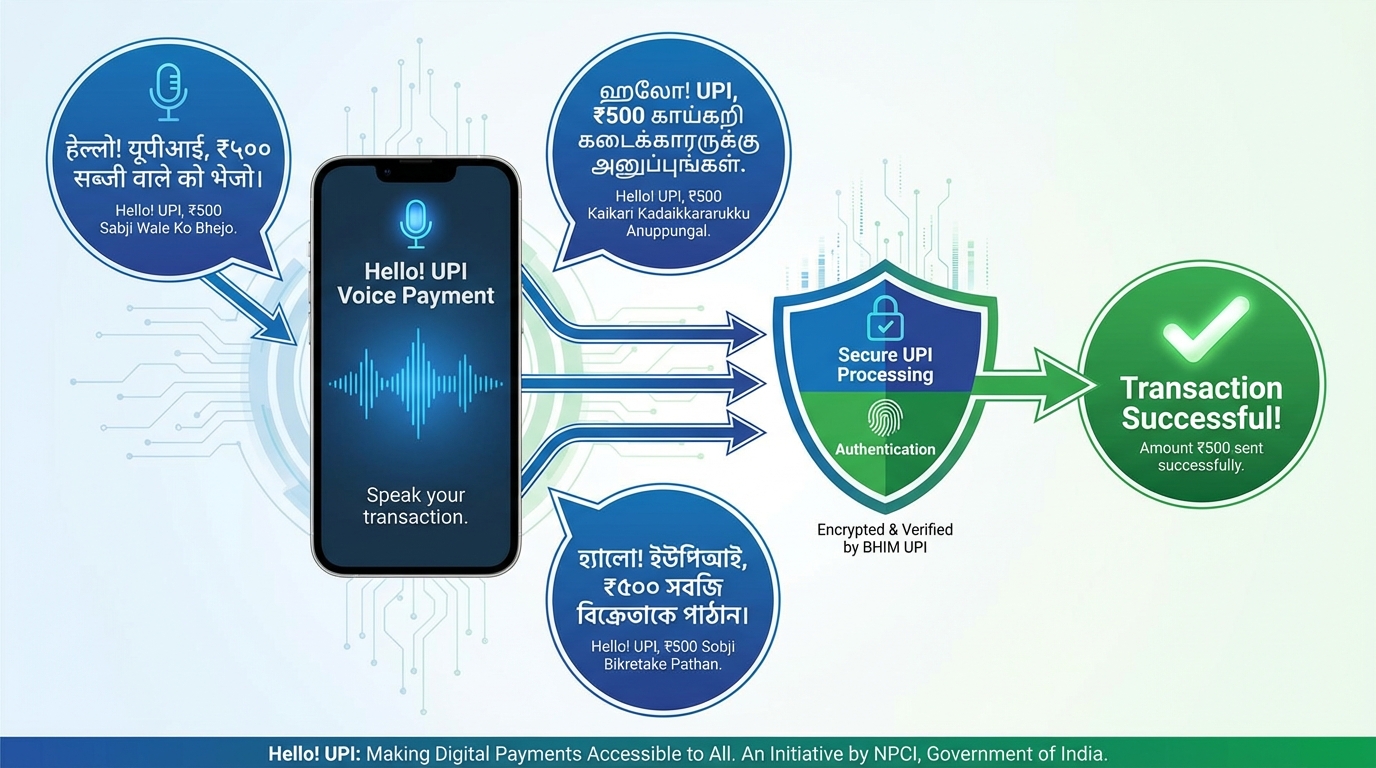

- Hello! UPI and WhatsApp voice journeys enable end-to-end voice shopping with higher trust and conversion.

- Vernacular long-tail SEO and schema (Speakable, HowTo) are critical for Hindi, Tamil, and Bengali voice discovery.

- Robust ROI measurement, governance, and security (consent, audit trails, fraud controls) safeguard scale and trust.

By 2026, the digital landscape in India will have undergone a seismic shift, where vernacular voice commerce India 2026 becomes the primary interface for over 650 million regional language users. As smartphone penetration nears 900 million and high-speed connectivity reaches the deepest corners of Tier-2 and Tier-3 cities, the traditional “type-and-search” model is being replaced by intuitive, voice-led discovery. For enterprises, this evolution represents a $7.47 billion opportunity that demands a sophisticated blend of multilingual AI, real-time personalization, and seamless payment integration.

The transition to regional language voice shopping is not merely a trend; it is a structural response to the “literacy and typing friction” that has long hindered e-commerce adoption in rural India. With 70% of India’s internet users now preferring local languages over English, the demand for end-to-end voice journeys—from product discovery on WhatsApp to voice-activated UPI payments—is skyrocketing. Enterprises that fail to adapt their stacks for Hindi, Tamil, Bengali, and various dialects risk losing relevance in a market where the “next billion users” are already speaking their way into the economy.

Market context for 2026 reveals that India’s voice AI market is projected to grow from approximately $153 million in 2024 to nearly $957 million by 2030, representing a staggering CAGR of 35.7%. This growth is fueled by the convergence of local Large Language Models (LLMs), the government-backed Bhashini initiative, and the widespread adoption of “Hello! UPI” voice payments. The enterprise readiness gap, however, remains significant, particularly in orchestrating these complex, multi-dialect journeys while maintaining strict governance and ROI measurement.

Source: AI Vernacular Voices: Inside India's Scramble for Data

Source: Digital Marketing Trends for 2026 India Market Focus

Source: India's Internet Users to Exceed 900 Million in 2025

1. The 2026 Imperative: Why Regional Language Voice Shopping is Non-Negotiable

The surge in tier-2 voice commerce adoption is driven by a fundamental change in user behavior. In 2026, voice is no longer a novelty; it is an accessibility tool that bridges the gap between digital intent and technical capability. For a shopper in Kanpur or Madurai, speaking a query in their native dialect is significantly more natural than navigating a complex English-centric app interface.

Data from 2026 indicates that Hindi voice searches have surged by over 400%, reflecting a broader trend where regional language voice shopping dominates daily interactions. This shift is supported by the fact that social commerce is on track to reach $70 billion by 2030, with a massive portion of these transactions initiated through voice-led social platforms. The friction of typing in non-native scripts is a major barrier that voice AI effectively dismantles, allowing users to interact with brands as they would with a local shopkeeper.

Furthermore, the “Hello! UPI” initiative by NPCI has revolutionized the final mile of the commerce journey. By enabling voice-activated payments, the system allows non-tech-savvy users to authorize transactions using simple voice commands in their preferred language. This integration of fintech and voice AI is a critical enabler for enterprises looking to capture the trust and wallet share of rural and semi-urban populations.

Platforms like TrueFan AI enable enterprises to bridge this gap by providing hyper-personalized, celebrity-led video content that speaks directly to users in their native tongue. By combining the trust of a familiar face with the ease of a localized voice, brands can create high-impact engagement that resonates far more deeply than generic text-based advertisements. This level of localization is essential for navigating the cultural nuances of the Indian market.

Source: How Voice AI is Making Shopping Accessible in Tier-2 Cities

Source: The Future of Voice AI in India: Trends and Growth

Source: Beyond UPI: How India is Redefining the Future of Fintech

2. Architectural Foundations: Multilingual Voice Marketing Automation for the Enterprise

To succeed in 2026, enterprises must move beyond basic chatbots and implement robust multilingual voice marketing automation frameworks. This involves orchestrating intent-aware, dialect-specific voice campaigns across multiple touchpoints, including WhatsApp, mobile apps, IVR, and smart assistants. The goal is to create a unified experience where the user’s language preference and context are preserved throughout the entire customer lifecycle.

The architecture for such a system begins with a robust Data and Triggers layer. By integrating signals from Customer Data Platforms (CDP) and CRM systems, enterprises can initiate voice experiences based on real-time user behavior, such as cart abandonment or loyalty milestones. For instance, a user who frequently browses in Bengali should automatically receive a voice-led re-engagement nudge in that specific language, rather than a generic English notification.

The core of this architecture is the NLU (Natural Language Understanding) and ASR (Automatic Speech Recognition) layer. In the Indian context, this requires models that are specifically tuned for Indian accents, code-switching (Hinglish, Tanglish), and regional dialects. A critical coverage gap often missed by competitors is the failure to handle “mixed-mode” queries where users blend English technical terms with regional grammar. Enterprise-grade systems must include dialect adaptation and graceful fallback mechanisms to ensure that the conversation never hits a dead end.

TrueFan AI's 175+ language support and Personalised Celebrity Videos provide a powerful delivery mechanism for these automated campaigns. By using API-driven video and voice callouts, enterprises can generate millions of unique videos where a brand ambassador addresses a customer by name and references their specific context in their local language. This level of scale—achieving perfect lip-sync and voice retention—is what separates market leaders from those still struggling with traditional, static creative assets.

Source: Bhashini: Catalyzing Multilingual AI Infrastructure

Source: India's Digital Surge in 2026: A Billion User Market

3. Conversational Shopping AI Personalization: Bridging the Dialect Divide

In 2026, conversational shopping AI personalization is the key to unlocking the “Bharat” market. This goes beyond simple translation; it involves the real-time adaptation of dialogue, offers, and content to match the user’s specific intent and micro-context. For a shopper in West Bengal, the AI should not only speak Bengali but also understand regional preferences, local festivals like Durga Puja, and colloquialisms that build immediate rapport.

Tactically, this requires sophisticated intent stacks that can handle complex commerce journeys. Whether a user is browsing, comparing products, or requesting a return, the AI must maintain context across the conversation. For example, if a user asks, “Is this cooker better than the one I bought last year?” in Tamil, the system must retrieve the previous purchase data and provide a comparative analysis in the same language, using natural, conversational phrasing rather than robotic, literal translations.

Another critical aspect of personalization is the use of regional dialect shopping videos. These short, dialect-accented explainers or offer nudges serve as powerful conversion tools. By embedding “say this now” overlays in local scripts, brands can guide users through a voice-activated CTA, such as “Boliyega ‘coupon apply karo’” (Say ‘apply coupon’). This reduces the cognitive load on the user and makes the digital shopping experience feel as familiar as a physical interaction.

Solutions like TrueFan AI demonstrate ROI through their ability to generate these dialect variations at scale. By allowing brands to swap lines and offers without the need for expensive reshoots, the platform enables a level of agility that was previously impossible. This is particularly relevant for high-frequency nudges on platforms like WhatsApp, where the speed of delivery and the relevance of the content are the primary drivers of engagement and conversion.

Source: Exploring the Popularity of Voice Commerce

Source: 13 Digital Marketing Trends Every Indian Brand Must Watch in 2026

4. The Omni-Channel Playbook: WhatsApp, Smart Speakers, and Voice-Activated Offers

An effective vernacular voice commerce India 2026 strategy must be omni-channel, meeting the user wherever they are most comfortable. While mobile apps remain important, the real growth is happening on “super-apps” like WhatsApp and through smart speaker commerce integration. In 2026, these channels are no longer silos but integrated parts of a single, voice-enabled ecosystem.

WhatsApp voice journeys are particularly potent for the Indian market. Enterprises are using voice notes for cart recovery, price drop alerts, and replenishment reminders. Because voice notes feel more personal and are easier to consume than long text messages, they see significantly higher open and engagement rates. A user receiving a voice message from a trusted brand ambassador in their local dialect is far more likely to take action than one receiving a standard SMS.

The integration of voice assistant regional integration (Alexa, Google Assistant) allows for a hands-free shopping experience that is perfect for home environments. Users can browse, add to cart, and check order status using localized intents in Hindi, Tamil, or Bengali. The challenge here is managing “progressive disclosure”—providing just enough information at each step of the voice journey to avoid overwhelming the user, while still ensuring they have all the details needed to make a purchase.

Voice-activated offer redemption is another high-impact area. The flow typically involves an eligibility check, followed by a voice confirmation from the user, which then triggers a “Hello! UPI” collect request. This seamless transition from voice discovery to voice payment is the “holy grail” of frictionless commerce. To prevent fraud, enterprises must implement robust controls, such as tokenized coupons and anomaly detection, ensuring that the convenience of voice does not come at the cost of security.

5. Vernacular Long-Tail Optimization: Mastering Hindi, Tamil, and Bengali Search

To capture organic traffic in a voice-first world, enterprises must master vernacular long-tail optimization. Voice queries are fundamentally different from typed searches; they are longer, more conversational, and often include a mix of languages. A user won’t type “best idli cooker,” but they might say, “Enna idli cooker best?” in Tamil or “Sabse accha idli cooker kaunsa hai?” in Hindi.

The first step in this strategy is query mining. Enterprises should analyze assistant logs, site search data, and WhatsApp transcripts to identify the natural-language patterns users actually use. This data is then used to build language-specific FAQ hubs and enable “Speakable” and “HowTo” schema. This ensures that when a user asks a question to their smart speaker, your brand’s content is the one being read back as the authoritative answer.

Hindi voice commerce optimization requires a deep understanding of code-switching and transliteration. Many users will use English brand names but Hindi grammar. Your SEO strategy must account for these variations, ensuring that your content is discoverable regardless of how the user chooses to phrase their request. Similarly, Tamil voice search marketing must account for the formal and informal variations of the language, as well as the specific honorifics used in different regions of Tamil Nadu.

Bengali conversational commerce presents its own set of unique challenges, including a softer affirmative tone and specific regional greetings. By leveraging the BHASHINI ecosystem, enterprises can improve their Indic language coverage and accuracy, ensuring that their AI models are not just translating words but capturing the cultural essence of the communication. This level of detail is what builds long-term trust with regional shoppers.

6. ROI and Governance: Measuring Success in the Voice-First Era

As with any enterprise initiative, voice commerce ROI measurement is critical for securing long-term investment. In 2026, the KPI framework for voice commerce has matured beyond simple engagement metrics. Enterprises are now looking at Quality, Commerce, and Marketing metrics to get a holistic view of their performance.

Quality metrics include ASR Word Error Rate (WER) by language and dialect, as well as intent-resolution rates. If your AI is failing to understand 30% of Tamil queries, your ROI will inevitably suffer. Commerce metrics focus on the bottom line: add-to-cart via voice, UPI conversion rates for voice-initiated payments, and the average order value (AOV) of voice shoppers compared to traditional users. Interestingly, data suggests that voice shoppers often have a higher repeat purchase rate due to the convenience of the interface.

Governance and security are equally paramount. Enterprises must ensure strict consent management and audit trails for all voice interactions. With the rise of synthetic media, protecting brand integrity is a major concern. This is why choosing partners with a strong security posture is essential. For example, TrueFan AI is ISO 27001 and SOC 2 certified, ensuring that all celebrity-led content is generated ethically and securely, with built-in moderation to prevent the misuse of AI technology.

A critical coverage gap often overlooked is the “accessibility and privacy” review for elderly users. As voice commerce becomes a primary tool for senior citizens in Tier-2 cities, enterprises must ensure that their systems are not only easy to use but also provide clear, transparent information about how data is being used. This transparency is the foundation of the trust required to win in the 2026 vernacular market.

Conclusion

The era of vernacular voice commerce India 2026 is not a distant possibility; it is the current reality for enterprises aiming to lead in the world’s fastest-growing digital economy. By 2026, the ability to serve 650 million regional language users through intuitive, voice-first experiences will be the primary differentiator between market leaders and also-rans. Success requires more than just translation; it demands a strategic integration of multilingual voice marketing automation, deep dialect-level personalization, and secure, voice-activated payment systems.

As we have explored, the convergence of Tier-2 smartphone growth, the “Hello! UPI” revolution, and advanced generative AI tools has created a perfect storm of opportunity. Enterprises that invest now in building robust voice architectures—focused on trust, accessibility, and cultural relevance—will be the ones to capture the loyalty of the “next billion” shoppers. The journey from discovery to purchase is being rewritten in the native tongues of Bharat, and voice is the pen that is writing it.

To stay ahead of the curve and operationalize these complex journeys at scale, enterprises should look toward specialized partners who understand the unique nuances of the Indian market. Whether it’s through hyper-personalized video nudges or seamless assistant integrations, the goal remains the same: to make digital commerce as natural and effortless as a conversation in one’s own home. The future of India is speaking; it’s time for your brand to listen and respond.

Frequently Asked Questions

What is the projected market size for voice commerce in India by 2026?

By 2026, India’s voice commerce market is expected to be a significant contributor to the broader $7.47 billion voice AI opportunity projected for 2030. With over 900 million internet users, a large portion of whom are in Tier-2+ cities, voice is becoming the primary transaction interface for regional shoppers.

How does “Hello! UPI” impact vernacular voice commerce?

“Hello! UPI” allows users to make payments using simple voice commands in their native language. This removes the final barrier to entry for non-tech-savvy users, enabling a complete end-to-end voice journey from product discovery to payment confirmation.

Why is dialect-specific personalization important for Indian brands?

India is a land of thousands of dialects. A generic Hindi or Tamil translation often feels robotic and untrustworthy. Dialect-specific personalization, such as that offered by TrueFan AI, ensures that the brand speaks the actual language of the customer, including local idioms and cultural nuances, which significantly drives engagement and conversion.

What are the biggest technical challenges in implementing voice commerce?

The primary challenges include high ASR (Automatic Speech Recognition) error rates for regional accents, the complexity of “code-switching” (mixing English and local languages), and the need for low-latency rendering to ensure a smooth, conversational experience without frustrating delays.

How can enterprises measure the ROI of their voice commerce initiatives?

ROI should be measured through a combination of commerce KPIs (conversion rates, AOV, repeat purchase rates) and technical KPIs (intent resolution, word error rate). Additionally, marketing lift can be measured by comparing engagement on voice-led campaigns versus traditional text-based outreach.