January 2026 insurance renewal automation: AI-personalized video reminders that boost retention and upgrades in India’s BFSI

Key Takeaways

- January is India’s largest renewal cohort; automation with AI-personalized videos reduces lapse risk and boosts upgrades.

- WhatsApp-first journeys with one-click payments and localized content drive higher completion rates.

- DPDP Act 2023 compliance and consent orchestration must be built into the data architecture.

- Product-specific playbooks (motor, health, life) outperform generic reminders by addressing distinct needs.

- Policy upgrade incentive campaigns can lift renewal and ARPU when paired with transparent benefit explanations.

January 2026 insurance renewal automation can make or break your FY Q4 retention. In India’s BFSI sector, the first month of the year represents the single largest renewal cohort, often accounting for up to 35% of annual policy expirations. This seasonal surge creates massive operational bottlenecks, leading to high lapse rates and missed opportunities for policy upgrades. As we enter 2026, the traditional approach of generic SMS blasts and manual calling is no longer sufficient to capture the attention of a digitally fatigued consumer base.

Renewal automation in 2026 is defined as a data-triggered, multi-channel journey that programmatically delivers personalized reminders. These are not merely text-based alerts; they are sophisticated, AI-driven experiences enriched with personalized videos that explain premiums, showcase loyalty rewards, and integrate one-click payment links. By 2026, the Indian insurtech market is projected to reach a staggering $300 billion, driven by AI-led shifts and a “WhatsApp-first” consumer preference.

The landscape has evolved significantly. With the full implementation of the Digital Personal Data Protection (DPDP) Act 2023 and the emergence of advanced generative AI, insurers must now balance hyper-personalization with stringent compliance. Platforms like TrueFan AI enable insurance providers to transform static policy data into high-conversion video assets that speak the customer's language—literally and figuratively.

Source: BCG India Insurtech/AI Trends

Why January 2026 insurance renewal automation is critical in India

The January spike in India is a unique market reality. Unlike Western markets where renewals are more evenly distributed, the Indian BFSI sector sees a heavy concentration in January due to year-end financial planning and the historical timing of policy launches. Manual intervention during this period is physically impossible to scale. When thousands of policies expire simultaneously, the risk of “message fatigue” is at its peak. Customers are bombarded with generic reminders, leading them to ignore critical renewal deadlines.

Automation addresses this by ensuring a consistent cadence across the entire renewal window. It scales language localization, allowing a brand to communicate with a policyholder in Bihar in Bhojpuri and a customer in Chennai in Tamil simultaneously. Furthermore, automation allows for the dynamic assembly of benefit explanations. Instead of a generic “Renew your policy” message, the system can generate a video that says, “Hi Rajesh, your No Claim Bonus has reached 50%. Renew by January 15th to save ₹4,500 on your premium.”

Regulatory trust is the second pillar of this criticality. The IRDAI Master Circulars have clarified the “in-force” status of policies during the grace period for health and life insurance. This provides a strategic window for education-driven reminders. Automation allows insurers to utilize this grace period effectively, sending “soft” nudges that focus on the loss of continuity benefits rather than just the lapse of coverage. In 2026, failing to automate these complex, multi-stage journeys results in a direct loss of market share to more agile, AI-native competitors.

Source: IRDAI Health Master Circular

Source: IRDAI Life Master Circular

BFSI video personalization strategies that work in India

To cut through the noise in 2026, BFSI video personalization strategies must move beyond “Dear [Name]” text overlays. The modern Indian consumer demands visual comprehension. Personalized videos increase attention spans by up to 3x compared to text-only reminders because they simplify complex insurance jargon into digestible, human-centric narratives.

One of the most effective strategies is the use of personalized policy comparison videos. These videos dynamically compare a customer's current policy with a recommended upgrade. For example, if a health insurance policyholder has a ₹5 lakh sum insured, the AI can generate a video showing the benefits of upgrading to ₹10 lakh, highlighting the marginal premium increase versus the exponential increase in coverage for critical illnesses.

Another critical component is premium benefit explanation videos. These break down the “why” behind premium changes. If a premium has increased due to the policyholder entering a new age slab or due to medical inflation, the video can transparently explain these factors while simultaneously highlighting tax benefits under Section 80D or 80C. This transparency builds trust and reduces the likelihood of the customer shopping around for a cheaper, inferior product.

Insurance loyalty reward videos are the “secret sauce” for retention. By acknowledging a customer's tenure and claims-free years, insurers can create an emotional connection. Visualizing “loyalty points” or “cashback” that can be applied to the current renewal creates a tangible incentive to stay. When combined with renewal deadline countdown automation, where a dynamic timer counts down the days until the policy (and the associated rewards) expires, the psychological trigger of loss aversion becomes a powerful driver for immediate action.

Execution is increasingly “WhatsApp-first.” By leveraging the WhatsApp Business API and “Flows,” insurers can embed these personalized videos directly into a chat interface. This allows the customer to watch the video, view policy details, and complete the payment via UPI without ever leaving the app. This frictionless journey is essential for the 45% of Indian renewals expected to be completed via mobile messaging platforms by 2026.

Source: Gupshup WhatsApp for Insurance

Source: SBI General WhatsApp Case Study

Product-line playbooks for motor insurance renewal videos and health insurance policy reminders

Each insurance product line requires a bespoke approach to personalization. A “one size fits all” video will fail to resonate because the pain points of a car owner differ vastly from those of a head of a family seeking health coverage.

Motor Insurance Renewal Videos

For motor insurance, the focus is on speed and compliance. The AI video should ingest data such as the vehicle model, registration number, and current NCB percentage.

- Scene 1: Greet the customer by name and show a visual of their specific car model.

- Scene 2: Explain the continuity of the No Claim Bonus (NCB) and the risks of losing it if the policy lapses.

- Scene 3: Introduce policy upgrade incentive campaigns, such as adding a “Zero Depreciation” or “Engine Protect” rider for a nominal fee.

- Scene 4: A clear CTA with a countdown timer and a “Pay via WhatsApp” link.

Behavioral nudges here should focus on the legal requirement of third-party insurance and the convenience of avoiding a physical vehicle inspection if renewed before the expiry date.

Health Insurance Policy Reminders

Health insurance reminders must be more empathetic and benefit-heavy.

- Scene 1: Recap the current benefits, specifically mentioning the number of cashless hospitals in the customer's specific city.

- Scene 2: Use personalized policy comparison videos to show how adding a family member or increasing the sum insured provides better protection against rising medical costs.

- Scene 3: Highlight tax savings under Section 80D.

- Scene 4: Mention portability rights, as per IRDAI guidelines, to show transparency and confidence in the product's value.

TrueFan AI's 175+ language support voice sync accuracy guide and Personalised Celebrity Videos can be particularly effective here, as health insurance is often a family-wide decision where regional language communication builds deeper trust with elder family members.

Life Insurance Renewal Personalization

- Scene 1: Visualize the “Protection Gap”—the difference between current sum assured and the family's actual needs based on income data.

- Scene 2: Explain the compounding benefits of staying invested and the “persistency bonus” unlocked with this renewal.

- Scene 3: Remind the customer of the Section 80C tax benefits, which are a major driver for January renewals in India.

- Scene 4: Use insurance loyalty reward videos to show the customer their “Gold” or “Platinum” status and the exclusive benefits it brings.

Source: IRDAI Portability Guidance

Source: Life Insurance Innovation Trends

Policy lapse prevention strategies and the automated renewal reminder system

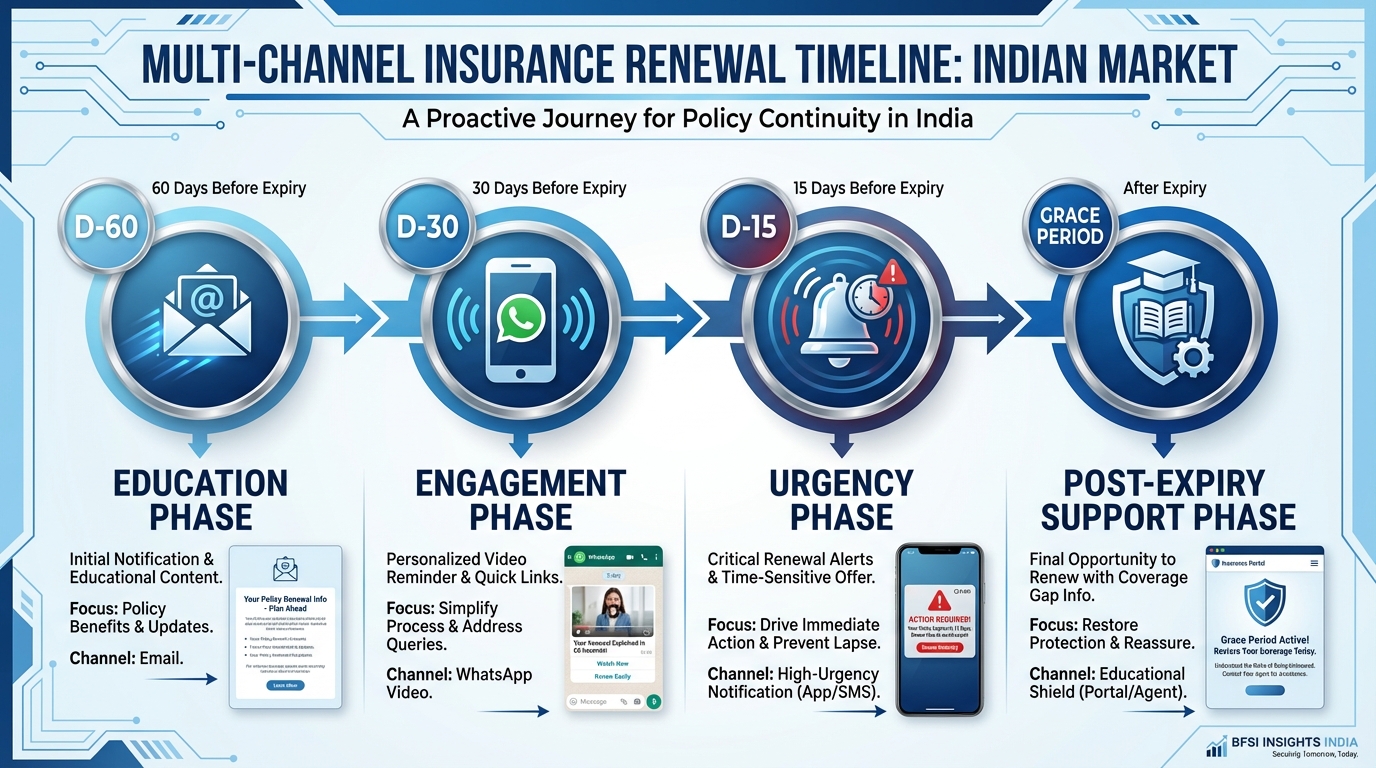

Preventing a policy lapse requires a multi-channel, multi-stage strategy that begins long before the expiry date. An enterprise-grade automated renewal reminder system must be orchestrated to deliver the right message at the right time.

The Multi-Channel Cadence

- D-60 (The Education Phase): An initial email and video introduction. The tone is informative, recapping the year's coverage and upcoming benefits.

- D-30 (The Personalization Phase): A WhatsApp video featuring a personalized breakdown of the renewal premium and any loyalty rewards.

- D-15 to D-7 (The Urgency Phase): High-frequency nudges across WhatsApp and SMS. This is where renewal deadline countdown automation is most effective.

- D-3 to D-1 (The Critical Phase): A high-urgency video highlighting the immediate loss of benefits (NCB, waiting period continuity) if payment isn't made.

- T+Grace (The Recovery Phase): Educational videos explaining that the policy is still “in-force” for claims but requires immediate payment to maintain long-term benefits.

Behavioral Design and Failover Logic

The system should utilize behavioral design principles like loss aversion and social proof. For instance, “92% of customers in Mumbai renewed their health plan this week—don't lose your cashless benefits.” If a customer hasn't engaged with the digital reminders by T-3, the system should trigger an automated “failover” to a human agent, providing them with the customer's interaction history to make a more informed save-call.

Data Architecture and DPDP Compliance

An enterprise-grade system must ingest data from the Policy Administration System (PAS) and CRM via real-time APIs. This includes not just policy details, but also “consent flags” as required by the Digital Personal Data Protection (DPDP) Act 2023. In 2026, compliance is not optional; it is a core feature. The system must handle explicit consent, purpose limitation, and the right to withdraw consent seamlessly. Solutions like TrueFan AI demonstrate ROI through their ability to integrate with these complex data environments while maintaining ISO 27001 and SOC 2 security standards.

Source: Digital Personal Data Protection Act 2023

Source: IAPP Analysis on DPDP Rules 2025

Policy upgrade incentive campaigns and measurement benchmarks

The ultimate goal of January 2026 insurance renewal automation is not just to retain the customer, but to increase their Lifetime Value (LTV). This is achieved through strategically designed policy upgrade incentive campaigns.

Upgrade Logic and Eligibility

Not every customer should be offered an upgrade. The automation system should use eligibility filters based on:

- Persistency Score: Is the customer a chronic late-payer?

- Claim History: Have they exhausted their current sum insured?

- Premium Sensitivity: Based on past behavior, are they likely to accept a 10% increase for 50% more coverage?

The AI video can then present a “Good-Better-Best” scenario, visually showing the delta in benefits. For example, “For just ₹200 more per month, remove your room-rent capping and get a global cover.”

Measurement and Optimization

To ensure the success of these campaigns, BFSI leaders must track specific 2026-relevant KPIs:

- Renewal Uplift: The percentage increase in renewals compared to the previous January.

- Lapse Reduction: The decrease in policies entering the grace period.

- Upgrade Conversion Rate: The percentage of customers who opted for a higher premium plan during renewal.

- Video Completion Rate: A critical metric for measuring the effectiveness of the creative content.

- WhatsApp Read and Response Rates: Measuring the engagement on the primary delivery channel.

By 2026, AI-driven journeys are expected to deliver a 10-20% uplift in renewal rates and a 25-40% reduction in lapses for Indian insurers who adopt these technologies early. The ROI is further amplified by the reduction in creative production costs—AI-generated videos can save over 3,800 hours of manual editing and localization time for a typical enterprise campaign.

Source: BCG India AI ROI Trends

Source: ET CIO on Automation Impact

How TrueFan AI scales enterprise-grade personalization

For large-scale BFSI entities, the challenge isn't just creating one video; it's creating millions of them. This is where the technical infrastructure of the partner becomes the deciding factor. TrueFan AI is designed specifically for this level of enterprise scale and complexity.

One of the most significant technological breakthroughs for 2026 is the “Virtual Reshoot.” Traditionally, if an insurer wanted to change a single line in a celebrity endorsement—perhaps to update a discount percentage or a new regulatory disclosure—they would need to schedule a new shoot. TrueFan AI’s technology allows for infinite variations from a single 15-minute shoot. The AI can alter speech and lip movements in existing footage to deliver new lines with perfect sync, allowing brands to A/B test different offers in real-time without additional production costs.

Furthermore, the platform's ability to render personalized videos in under 30 seconds personalized video onboarding ensures that the customer experience remains “live.” Whether distributed via WhatsApp, email, or personalized microsites, the delivery is instantaneous. For an industry as sensitive as insurance, security is the foundation. TrueFan AI provides ISO 27001 and SOC 2 certified environments, ensuring that policyholder data is encrypted and used only for the intended purpose of personalization, fully aligning with the DPDP Act 2023 mandates.

By integrating TrueFan AI's API-first architecture with existing CRM and PAS systems, Indian insurers can move from “mass marketing” to “one-to-one engagement.” This shift is what will define the leaders of the Indian BFSI sector in 2026 and beyond.

Frequently Asked Questions

What is the standard renewal cadence for January in India?

The ideal cadence begins at D-60 with educational content, followed by a personalized video nudge at D-30. Urgency should be escalated from D-15 to D-1 using renewal deadline countdown automation. Post-expiry, the focus should shift to “grace period education” to prevent permanent lapses.

Is my policy in force during the grace period?

Yes, as per the IRDAI Life and Health Master Circulars, policies remain “in-force” during the grace period (typically 15-30 days). However, any claim made during this period may have the unpaid premium deducted from the settlement. It is critical to use policy lapse prevention strategies to ensure customers renew before this window closes to maintain continuity benefits like NCB and waiting period credits.

How does WhatsApp renewal via Flows and UPI work?

WhatsApp “Flows” allow for a structured, app-like experience within the chat. The customer receives a personalized video, clicks a “View Details” button which opens a form with their policy info, and then proceeds to a “Pay Now” button that triggers a UPI deep link (GPay, PhonePe, etc.). This entire journey happens without the user leaving WhatsApp.

What consent is needed under the DPDP Act for personalized videos?

Under the DPDP Act 2023, insurers must obtain “explicit, informed, and specific” consent to use personal data for creating personalized marketing content. The notice must clearly state what data is being used (e.g., name, policy type) and for what purpose (e.g., creating a renewal reminder video).

Does TrueFan AI support DPDP Act compliance?

Yes, TrueFan AI is built with a “privacy-by-design” approach. It ensures that all celebrity assets are legally consented and that user data used for personalization is processed in a secure, encrypted environment. The platform supports data minimization and provides clear audit trails for consent management, making it a trusted partner for Indian BFSI enterprises.

Can AI videos help in upselling riders during renewal?

Absolutely. Policy upgrade incentive campaigns are most effective when delivered via video. By visually demonstrating the “gap” in current coverage and the “protection” offered by a rider (like an OPD cover or Zero-Dep), insurers can see a significant lift in average premium per user (ARPU).

Final Call to Action

Ready to transform your January 2026 retention? See a live demo of how January 2026 insurance renewal automation with personalized videos can lift your conversion rates by 20%. Request a 2-week POC today and send your first 10,000 personalized renewal videos in any of India’s 175+ languages.