Voice commerce vernacular India 2026: Enterprise playbook to win 650M regional-language shoppers

Estimated reading time: 12 minutes

Key Takeaways

- By 2026, India’s digital economy becomes voice-first and vernacular, making regional-language voice shopping the default for 650M+ users.

- Winning requires language-specific playbooks, code-mixing intelligence, and dialect-aware conversational AI.

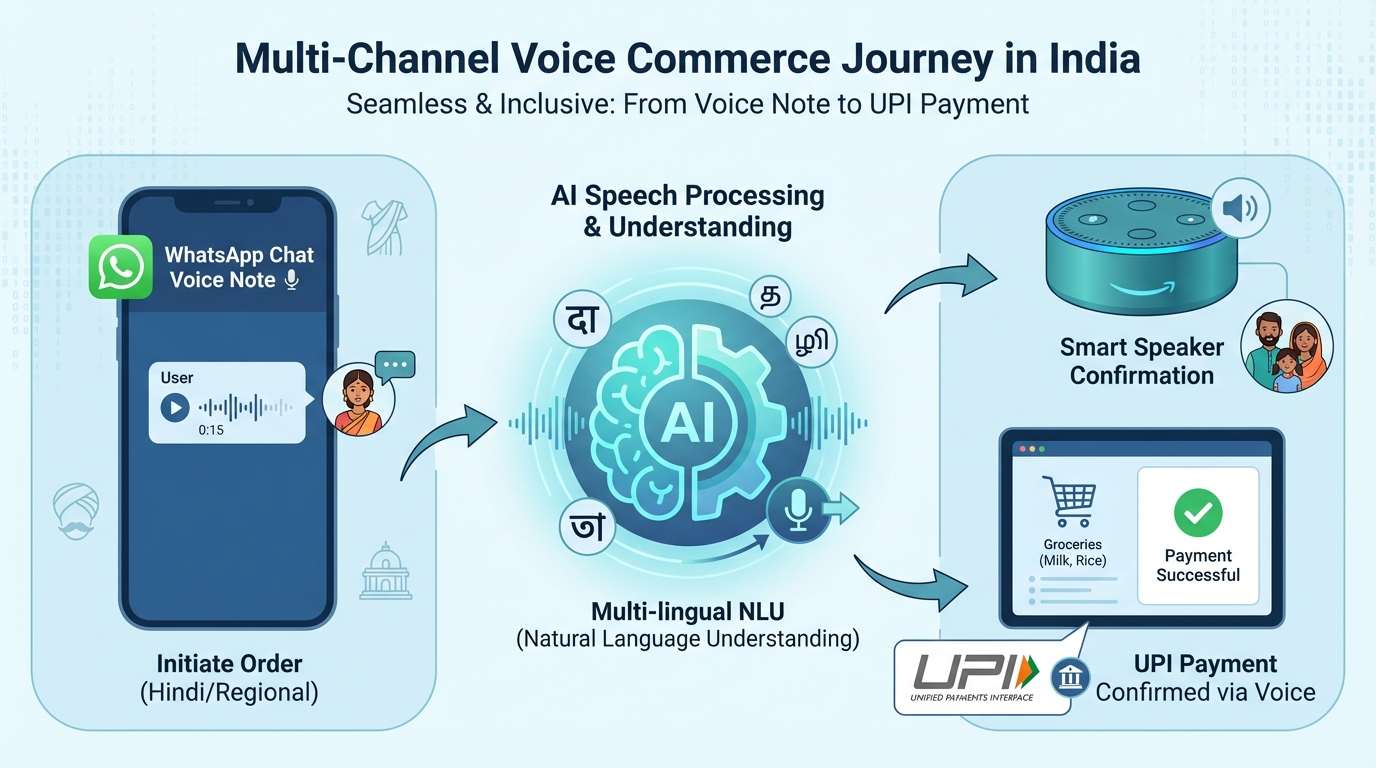

- Deploy a multi-channel strategy across WhatsApp, in-app assistants, and smart speakers with seamless UPI payments.

- Build an automation stack with ASR/NLU tuned to Indian phonetics, robust consent management, and real-time ROI tracking.

- Measure success via CVR, AOV, intent success rate, and agent deflection; scale through geo-split tests and personalized nudges.

By 2026, the digital landscape in India will have undergone a definitive transformation, shifting from a text-heavy, English-centric paradigm to a voice-first, vernacular-dominant ecosystem. For enterprise leaders, the ability to deploy a robust voice commerce vernacular India 2026 strategy is no longer a speculative advantage but a fundamental requirement for market share retention. As the “Next Billion” users come online, the friction of typing in non-native scripts is being replaced by the fluid ease of natural language commerce India.

Voice commerce represents the end-to-end shopping journey—encompassing discovery, product selection, carting, and payment—initiated through voice interfaces across assistants, mobile apps, and messaging platforms. By 2026, regional language voice shopping is projected to become the default interface for over 650 million users, unlocking a staggering $7.47 billion market opportunity. This growth is catalyzed by the convergence of high-speed connectivity, affordable hardware, and sophisticated conversational shopping AI that understands the nuances of Indian dialects.

Current projections indicate that 98% of Indian internet users will access content in Indic languages by 2026, with even urban demographics showing a marked preference for local language interactions. With smartphone penetration reaching 900 million devices and over 50% of users engaging with voice assistants daily, the infrastructure for a voice-led revolution is firmly in place. Enterprises that master vernacular long-tail keywords and voice-activated journeys today will define the retail hierarchy of the next decade.

Market Context: 650M Vernacular Users and Tier-2 Tailwinds

The center of gravity for India’s digital economy has shifted decisively toward Tier-2 and Tier-3 cities. This demographic shift is characterized by a “voice-first” behavioral pattern, where users bypass the complexities of digital literacy through verbal commands. In 2026, the addressable market for regional language voice shopping is not merely a subset of the internet population; it is the core engine of growth, representing over 650 million active consumers.

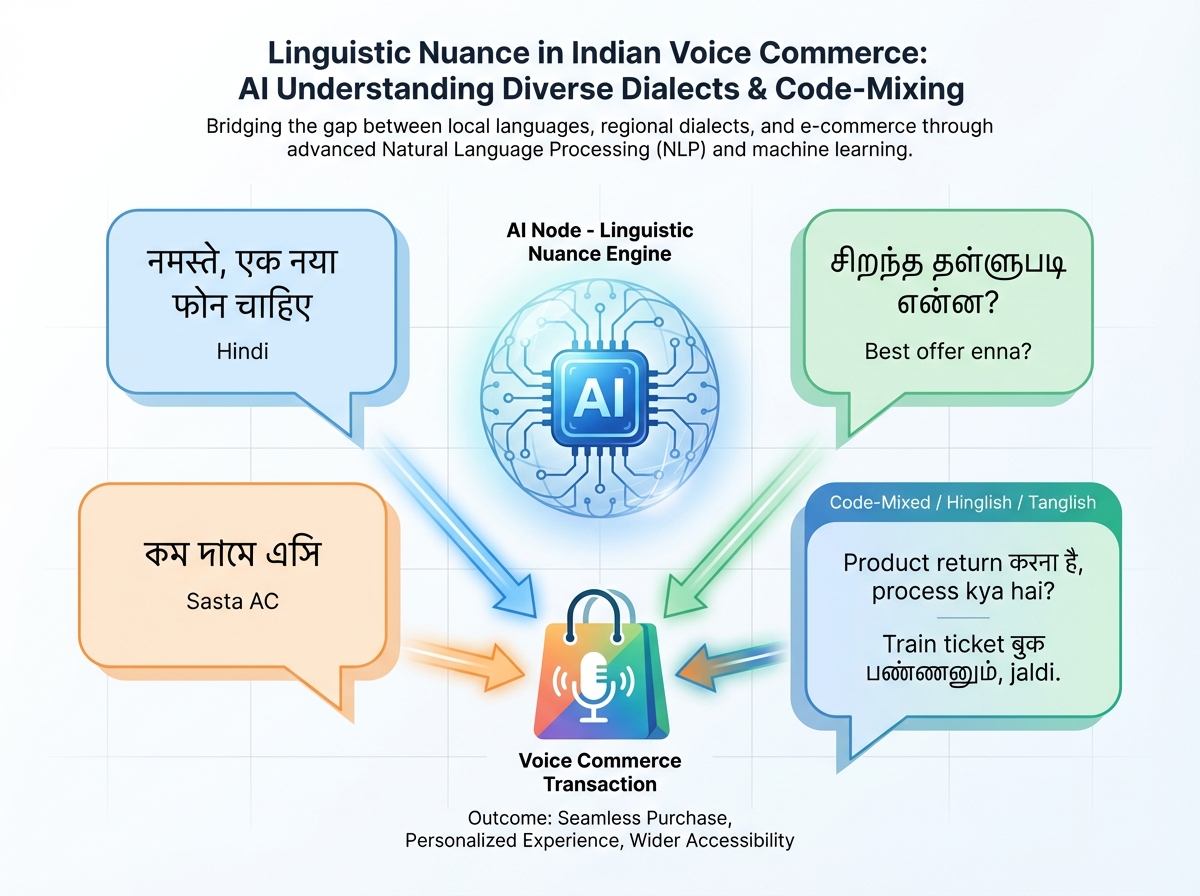

Data from recent industry analyses reveals that 57% of urban internet users now prefer Indic content, debunking the myth that vernacular preference is limited to rural areas. This “vernacularization” of the Indian internet is the most transformative trend of the decade, necessitating a complete overhaul of traditional SEO and SEM strategies. Enterprises must now account for natural language commerce India patterns that include code-mixed inputs, such as “Hinglish” or “Tanglish,” which reflect how people actually speak.

The surge in tier-2 voice shopping adoption is further fueled by the reduction of transactional friction. For a first-time shopper in a town like Gorakhpur or Salem, a voice interface removes the intimidation factor of a complex app UI. By leveraging AI-driven personalization, brands can deliver voice-activated personalized offers that resonate with local cultural contexts, leading to higher trust and conversion rates. The 2026 market is one where the interface is invisible, and the conversation is the conversion.

Source: Regional Language Voice Shopping 2026 Opportunity

Source: IAMAI-Kantar Report: Indic Language Preference

Source: India’s Digital Surge: 1B Users by 2026

Source: Talking Tech: Voice and Vernacular Powering India

Channel Landscape: Where Regional Voice Shopping Happens

To effectively capture the 2026 shopper, enterprises must deploy a multi-channel voice strategy that meets users where they are most comfortable. The landscape is dominated by three primary pillars: messaging ecosystems, in-app assistants, and smart speakers. Each channel serves a distinct psychological need, from the high-trust environment of WhatsApp to the utility-driven nature of smart home devices.

WhatsApp has emerged as the “operating system” for Bharat, where voice notes and push-to-talk prompts drive the commerce flow. In this ecosystem, conversational shopping AI facilitates a seamless transition from product discovery to UPI-based payment within a single chat thread. For instance, a user might send a voice note asking for “sasti aur achhi chai patti” (cheap and good tea leaves), triggering an automated flow that presents options, applies a discount, and confirms the order via a voice-guided checkout.

In-app voice assistants are simultaneously evolving to handle complex retail queries. Leading platforms like Flipkart have already demonstrated the efficacy of voice search in Hindi and English, paving the way for more sophisticated smart speaker commerce integration. By 2026, these assistants will utilize context-aware prompts to guide users through vast catalogs using voice assistant regional marketing techniques. Smart speakers, once considered a luxury for metros, are seeing rapid adoption in non-metro cities as they become central hubs for routine replenishment and household management.

Source: Flipkart Voice Search and Regional Support

Source: Smart Speaker Adoption in Non-Metro India

Source: Vernacular Voice Commerce: Unlocking the Next Billion

Language Playbooks: Optimizing for Hindi, Tamil, and Bengali

A monolithic approach to the Indian market is a recipe for failure in 2026. Enterprises must develop language-specific playbooks that account for the unique linguistic structures and consumer behaviors of different regions. Hindi voice search optimization, for example, requires a deep understanding of code-mixing and transliteration. Users often blend Hindi verbs with English nouns, creating a “Hinglish” syntax that standard NLP models frequently struggle to parse.

For Tamil voice commerce campaigns, the focus shifts toward hyper-localization and cultural resonance. This involves not just translating text, but localizing idioms, units of measurement, and even the timing of offers to coincide with regional festivals like Pongal. A successful Tamil voice journey might include dialect-specific voice campaigns that recognize the subtle differences between Chennai Tamil and Coimbatore Tamil, ensuring the AI assistant sounds like a trusted local advisor rather than a robotic translator.

In the East, Bengali conversational AI marketing must navigate the complexities of “Banglish” and the distinct preferences of the Kolkata urbanite versus the rural consumer in West Bengal or Tripura. Intent models must be robust enough to handle clarification prompts like “Kolkata te sabcheye sasta rice cooker kothay pabo?” (Where can I find the cheapest rice cooker in Kolkata?). By building a library of vernacular long-tail keywords for each language, brands can ensure they appear in the “speakable” results that voice assistants prioritize.

Source: Digital Marketing Trends for 2026: India Focus

Source: The Rise of AI-Native Advertising in India

Source: India Voice Assistant Market Forecast

Enterprise Blueprint: Multilingual Voice Marketing Automation

Scaling regional language voice shopping across a continental market requires a sophisticated automation architecture. This blueprint must integrate Automatic Speech Recognition (ASR) and Natural Language Understanding (NLU) tuned specifically for Indian phonetics and accents. The goal is to achieve a Word Error Rate (WER) that allows for fluid conversation even in low-bandwidth environments common in Tier-2 regions.

Platforms like TrueFan AI enable enterprises to bridge the gap between voice discovery and visual conversion by delivering hyper-personalized video content. This orchestration layer allows a brand to trigger a voice-led push notification—such as a price drop alert in Bengali—and follow it up with a visual nudge. TrueFan AI’s 175+ language support and Personalised Celebrity Videos provide the necessary cultural resonance to convert a voice inquiry into a confirmed order, creating a high-touch experience at an automated scale.

The technical stack must also prioritize data and consent management. As voice data is inherently personal, enterprises must implement encrypted payload storage and clear opt-in/out flows in the user’s native language. By centralizing segmentation and analytics, brands can track the performance of voice-activated personalized offers in real-time, adjusting their multilingual voice marketing automation strategies based on which dialects and channels are yielding the highest lifetime value (LTV).

Measurement and ROI: The CFO’s Framework for Voice Commerce

The transition to voice-led retail must be justified by rigorous financial metrics. A comprehensive voice commerce ROI measurement framework moves beyond simple click-through rates to analyze the entire funnel, from initial voice activation to repeat purchase behavior. For the CFO, the primary value drivers are increased conversion rates (CVR), higher average order values (AOV), and significant savings in customer service through agent deflection.

Solutions like TrueFan AI demonstrate ROI through significant lifts in click-through rates and reduced cart abandonment in regional markets. By delivering a personalized video nudge from a recognized celebrity in the user’s native tongue immediately after a voice-initiated cart action, brands see a marked decrease in the “hesitation gap” common among first-time digital shoppers. This assisted revenue—where voice discovery leads to a confirmed app or WhatsApp checkout—is a critical KPI for 2026.

Furthermore, enterprises must employ geo-split testing in Tier-2 states to measure the incremental lift of voice-activated journeys against traditional text-based interfaces. By monitoring metrics such as the “intent success rate” (how often the AI correctly understands the user’s request) and “session stitching” across channels, leadership can gain a granular view of how regional language voice shopping contributes to the bottom line. The ultimate goal is a reduction in Customer Acquisition Cost (CAC) as voice becomes a more natural and less expensive entry point for the next 650 million users.

2026 Roadmap: From Pilots to National Scale

The journey toward winning the 650 million regional-language shoppers begins with a phased implementation strategy. In the first 90 days, enterprises should focus on high-intent, high-frequency categories like grocery or personal care, utilizing Hindi-first flows on WhatsApp. This initial phase allows for the refinement of ASR models and the building of a robust library of vernacular long-tail keywords based on actual user queries.

By the second half of the year, the strategy should expand to include Tamil and Bengali, incorporating voice-activated personalized offers driven by a centralized decisioning engine. This is the stage where smart speaker commerce integration becomes vital, capturing the user during their daily routines at home. Advanced personalization, such as celebrity-led nudges, should be integrated here to differentiate the brand in an increasingly crowded voice landscape.

The final phase involves deep-diving into dialect-specific voice campaigns and advanced cross-selling techniques. By 2026, the most successful enterprises will be those that have moved beyond simple translation to true linguistic and cultural fluency. The future of commerce in India is not just digital; it is vocal, local, and hyper-personalized. The playbook is clear: listen to the consumer, speak their language, and automate the conversation.

Frequently Asked Questions

How does voice commerce handle the diversity of Indian dialects in 2026?

Modern conversational shopping AI utilizes deep learning models trained on massive datasets of Indian speech, including code-mixed languages like Hinglish. These systems are designed with dialect-specific lexicons that allow them to recognize regional synonyms and accents, ensuring high accuracy across various states.

Can users complete payments entirely through voice in Tier-2 cities?

Yes, the integration of UPI with voice interfaces allows for seamless transactions. Typically, a user initiates the payment via voice, and a secure deep-link is sent to their mobile device for final biometric or PIN confirmation, ensuring both ease of use and high security.

What are the most effective vernacular long-tail keywords for retail?

Effective keywords are phrased as natural questions, such as “Sabse sasta AC kaun sa hai?” (Which is the cheapest AC?) or “Tamil la best skin care products enna?” (What are the best skin care products in Tamil?). Optimizing for these conversational queries is essential for appearing in voice search results.

How does TrueFan AI integrate with existing voice commerce stacks?

TrueFan AI functions as a personalization and engagement layer that integrates via API with existing CRMs and WhatsApp Business accounts. When a voice-led trigger is detected—such as a product inquiry or a cart abandonment—the system can automatically generate and deliver a personalized video nudge in any of 175+ languages to drive the user toward completion.

What is the expected timeline for a pilot-to-scale deployment?

A standard roadmap involves a 90-day pilot focusing on a single language (usually Hindi) on WhatsApp. This is followed by a 180-day expansion into Tamil and Bengali, with full-scale multilingual voice marketing automation and smart speaker integration achieved within a year.