RBI rate decision marketing 2026: Enterprise BFSI playbook for restructuring videos, balance transfers, and interest rate benefit calculators

Estimated reading time: ~10 minutes

Key Takeaways

- Leverage the Feb–Apr MPC Golden Window to convert policy attention into high-intent pipelines.

- Use interest rate benefit calculators and personalized videos to move borrowers from education to action.

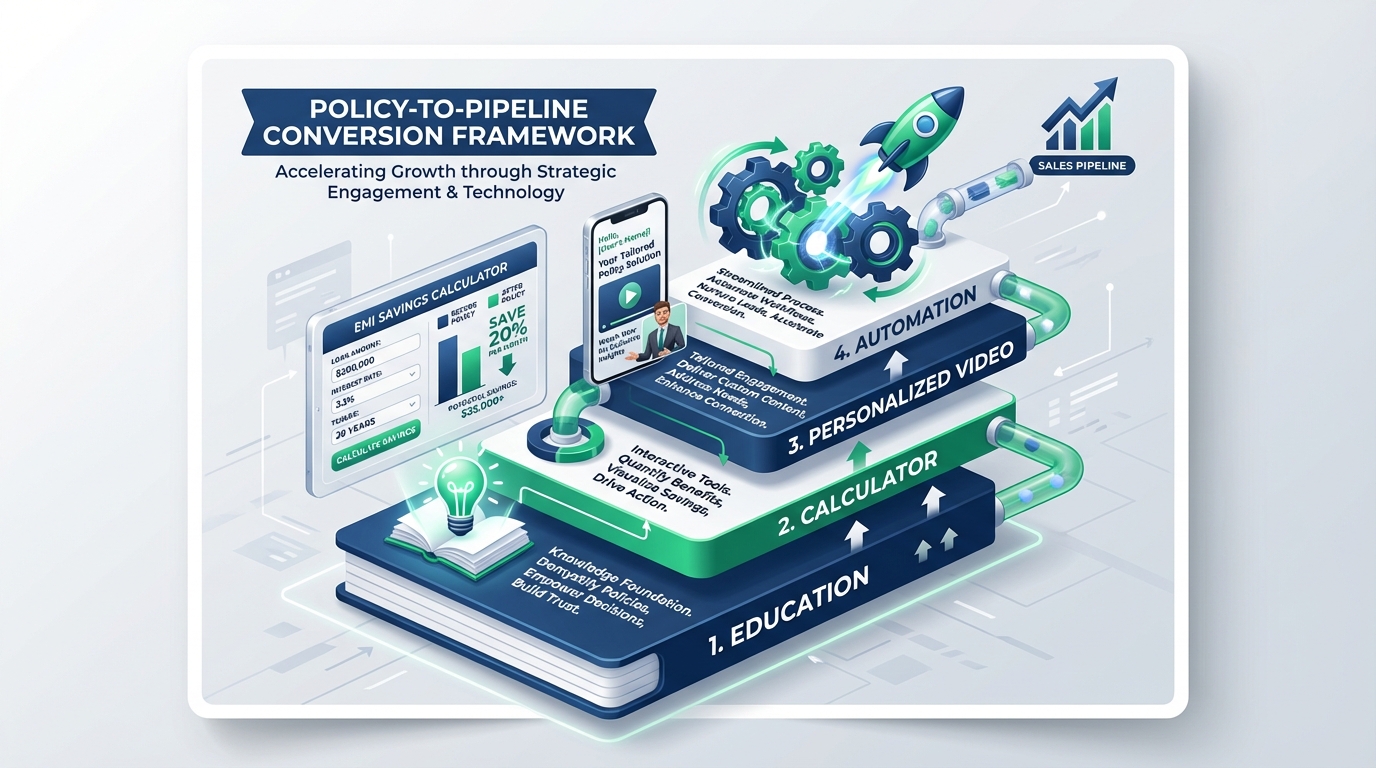

- Build a four-layer policy-to-pipeline framework: education, calculators, personalized offers, and automation.

- Execute with compliance-first journeys: KFS linking, APR transparency, and fair lending resets.

- Measure beyond CTR with balance transfer value, restructuring acceptance, and NII uplift.

The landscape of RBI rate decision marketing 2026 has shifted from reactive communication to proactive, data-driven engagement. As the Monetary Policy Committee (MPC) concluded its February 2026 session, the decision to maintain the repo rate at 5.25% signaled a strategic "neutral" stance. For enterprise BFSI leaders, this pause is not a signal to wait, but a high-velocity window to capture mindshare through sophisticated monetary policy customer education and automated refinancing journeys.

The current economic climate, characterized by a pause after the aggressive cuts of 2025, creates a unique psychological trigger for borrowers. Customers are no longer just looking for the lowest rate; they are seeking transparency in transmission and optimization of their debt portfolios. This playbook outlines how banks and NBFCs can leverage BFSI policy impact marketing to convert policy updates into high-intent pipelines.

Executive Policy Snapshot: The Feb 2026 Context

On February 6, 2026, RBI Governor Sanjay Malhotra announced that the repo rate would remain unchanged at 5.25%. This decision, following the Union Budget, reflects a cautious approach toward balancing inflation targets with sustainable growth. While the headline rate remains stable, the underlying liquidity operations and FX swaps are expected to improve monetary transmission, effectively lowering borrowing costs for high-quality retail and MSME segments.

For marketing teams, this "stable but dovish" outlook is the ideal environment for refinancing opportunity automation. When rates are volatile, customers are often too paralyzed to act; when rates stabilize at a lower threshold, the "wait-and-see" approach ends. This is the moment to deploy interest rate benefit calculators that demonstrate the long-term impact of even a 25-50 basis point differential on a 20-year home loan.

Sources:

- Moneycontrol: RBI MPC Feb 2026 Live Updates

- Economic Times: RBI Monetary Policy 2026 Highlights

- NDTV: RBI Repo Rate Unchanged Post-Budget

- Times of India: MPC Meeting February 2026 Updates

The Strategic Window: Why Feb–Apr MPC Matters for Acquisition and Retention

The period between the February and April MPC meetings represents the "Golden Window" for BFSI acquisition. During these eight weeks, consumer interest in financial planning peaks as they align their portfolios with the new fiscal year. Data from 2025 suggests that search queries for "loan restructuring" and "balance transfer" spike by 45% within 48 hours of an RBI announcement.

Platforms like TrueFan AI enable enterprise lenders to capitalize on this surge by delivering hyper-personalized content at the exact moment of intent. By automating the creation of rate cut benefit videos, institutions can move faster than the competition, reaching the customer’s inbox before the news cycle cools. This speed is critical because the "transmission" of rate benefits often happens in waves, and the first mover usually captures the highest-quality balance transfers.

Refinancing Opportunity Automation and Liquidity Levers

Institutional levers such as Open Market Operations (OMOs) and FX swaps are currently supporting lower effective borrowing costs. Marketing teams must work closely with Treasury and Risk departments to understand the "effective" rate reduction, even if the repo rate is paused. This allows for the creation of floating rate loan campaigns that focus on the reduction of the spread or the introduction of limited-time fee waivers.

The goal is to move beyond generic "Apply Now" buttons. Instead, use the T0 to T+14 day window to deploy a sequence of educational and offer-led content. This sequence should begin with monetary policy customer education (explaining the "why") and transition into EMI reduction personalization (explaining the "how much").

Policy-to-Pipeline Conversion Framework: A Layered Approach

To convert a macro-economic event like an RBI rate decision into a micro-level conversion, enterprise BFSI players must adopt a four-layer framework. This ensures that the customer is educated, empowered, and then offered a solution that fits their specific financial profile.

Layer 1: Monetary Policy Customer Education

The first barrier to conversion is often a lack of understanding. Most borrowers do not know how the repo rate affects their specific External Benchmark Linked Rate (EBLR). Your marketing should simplify these concepts using plain-language visuals. Explain the difference between a "pause" and a "cut," and how liquidity in the banking system eventually leads to lower EMIs.

Layer 2: Interest Rate Benefit Calculators

Interactive interest rate benefit calculators are the most effective lead magnets in the BFSI space. These tools should allow users to input their current ROI, residual principal, and tenure. The output must be granular: total interest saved over the remaining tenure, the "break-even" point after considering processing fees, and the specific reduction in monthly EMI. By embedding these calculators within loan restructuring video campaigns, you create a seamless transition from consumption to calculation.

Layer 3: Personalized Video Offers

Generic videos are no longer sufficient for the sophisticated 2026 consumer. Rate cut benefit videos must be personalized with the customer’s name, their actual loan account details, and the specific savings they stand to gain. For instance, a video could state: "Hello Ramesh, with the latest RBI stance, your Home Loan EMI could drop by ₹2,400. Click here to see your new repayment schedule."

Layer 4: Refinancing Opportunity Automation

The final layer is the orchestration of these assets through a CDP or CRM. Triggers should be set for customers where the rate differential is ≥50 basis points or for those who have shown high intent by completing a calculator journey. This automation ensures that the EMI reduction personalization reaches the right person at the right time, significantly reducing the cost of acquisition.

Product Playbooks: Portfolio-Specific Strategies for 2026

Different loan portfolios require distinct messaging and offer structures. Below are the playbooks for the four primary BFSI categories.

Home Loan Balance Transfer Offers and Floating Rate Campaigns

Home loans are the most rate-sensitive products in a bank's portfolio. With the Feb 2026 pause, the focus should be on "Tenure Optimization."

- Targeting: Borrowers with EBLR resets due within 60 days and a credit score above 750.

- The Offer: Home loan balance transfer offers that include a 0% processing fee for the first 14 days post-MPC.

- Creative Strategy: Use EMI reduction personalization to show a side-by-side comparison of their current bank's interest outgo versus your institution’s offer.

- Compliance: Ensure the Key Fact Statement (KFS) is prominently linked, detailing the spread over the benchmark and the reset frequency.

Personal Loan Refinancing Videos and Debt Consolidation Marketing

In a stable rate environment, high-APR personal loans are prime candidates for consolidation.

- Targeting: Customers with multiple active unsecured loans or high credit card utilization.

- The Offer: A single "Consolidation Loan" with a "Fee Holiday" if the balance is transferred within the policy week.

- Creative Strategy: Personal loan refinancing videos that visualize the "mental relief" of moving from four EMIs to one, while highlighting the total interest saved.

- Keywords: Debt consolidation marketing, personal loan refinancing videos.

Credit Card Balance Transfer Journeys

Credit card revolvers are often looking for an exit strategy from high-interest debt.

- Targeting: Revolvers with a utilization ratio above 70% but a clean repayment history.

- The Offer: Credit card balance transfer at 0% for the first 6 months, transitioning to a low fixed APR thereafter.

- Creative Strategy: A video journey that explains how a balance transfer works, using a calculator to show the difference between paying the "Minimum Amount Due" on a card versus a structured BT plan.

Business Loan Restructuring Campaigns (MSME/SME)

MSME digital transformation 2026 are the backbone of the economy and are highly sensitive to cash flow fluctuations.

- Targeting: Small business owners in sectors with seasonal cash flow cycles.

- The Offer: Business loan restructuring campaigns offering a tenor extension or a temporary moratorium to align with their revenue cycles.

- Creative Strategy: Quantify the "Monthly Cash Flow Relief." Instead of focusing on the rate, focus on the "Working Capital" unlocked by the restructuring.

Sources:

Compliance-First Execution: Navigating RBI Mandates in 2026

In 2026, the RBI’s focus on "Fair Lending Practices" and "Transparency" is at an all-time high. Any marketing campaign centered around loan restructuring video campaigns must be built on a foundation of compliance.

Floating Rate Reset Obligations

According to the updated RBI guidelines (Jan 10, 2025), lenders must provide borrowers with the option to choose between increasing the EMI, extending the tenure, or a combination of both during a rate reset. Your monetary policy customer education videos must clearly state these options. Failure to provide these choices or failing to communicate them transparently can lead to significant regulatory penalties.

Key Fact Statement (KFS) and APR Transparency

The KFS is no longer just a document; it is a mandatory part of the digital journey. Every interest rate benefit calculator and personalized video must provide a direct link to the customer’s specific KFS. This document must clearly disclose the Annual Percentage Rate (APR), which includes all associated costs like processing fees, documentation charges, and insurance premiums.

Penal Charges and Fair Lending

The RBI's stance on penal charges is clear: they must be treated as "charges" and not as "penal interest" that is capitalized. When marketing fixed rate conversion offers, ensure that the terms regarding foreclosure and switching fees are stated without ambiguity. Transparency in these areas builds long-term trust and reduces the risk of mis-selling claims.

Sources:

Creative System and Personalization Blueprint: The TrueFan AI Advantage

To execute RBI rate decision marketing 2026 at scale, enterprise BFSI firms require a creative engine that can handle millions of permutations in real-time. This is where the integration of advanced AI becomes a competitive necessity.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow banks to reach diverse demographics across India with a single campaign. Imagine a scenario where a farmer in rural Maharashtra receives a personalized video in Marathi explaining his business loan restructuring options, while a tech professional in Bengaluru receives a video in English about home loan balance transfer offers.

The Personalization Data Schema

To drive effective EMI reduction personalization, your creative system should ingest the following data points:

- Customer Name & Language Preference: For immediate engagement.

- Current Loan Parameters: ROI, residual principal, and remaining tenure.

- Proposed Offer: New ROI, processing fee waivers, and tenure options.

- Calculated Outcomes: Monthly EMI savings and total interest reduction.

- Dynamic CTAs: Routing the user to a pre-filled application form or a direct line to their Relationship Manager.

Virtual Reshoots and Rapid Updates

One of the biggest challenges in BFSI marketing is the shelf-life of creative assets. A video made for a "Rate Cut" becomes obsolete during a "Pause." Solutions like TrueFan AI demonstrate ROI through features like "Virtual Reshoots," which allow marketing teams to update the script and voiceover of a video post-MPC announcement without needing a new production cycle. This ensures that your rate cut benefit videos are always accurate and compliant with the latest policy stance.

Channels, Sequencing, and the T0–T+14 Cadence

Timing is the most critical variable in BFSI policy impact marketing. A well-structured 14-day cadence ensures that you capture the initial wave of interest and follow up with those who need more time to decide.

T0 (Policy Day): The Education Phase

- Action: Launch a "Policy Decoder" video on the homepage and social media.

- Goal: Monetary policy customer education.

- Asset: A 60-second explainer on what the 5.25% pause means for the average borrower.

T+1 to T+3: The Personalization Phase

- Action: Deploy personalized rate cut benefit videos via WhatsApp and Email to high-propensity segments.

- Goal: Drive users to interest rate benefit calculators.

- Asset: "Ramesh, see how the new RBI stance saves you ₹5 Lakhs over 15 years."

T+4 to T+10: The Nudge Phase

- Action: Retarget users who used the calculator but didn't start an application.

- Goal: Address friction points like processing fees or documentation.

- Asset: Fixed rate conversion offers for those seeking long-term certainty in a "neutral" rate environment.

T+11 to T+14: The Urgency Phase

- Action: Final "Offer Ending" notifications and RM outreach.

- Goal: Close the pipeline before the next news cycle begins.

- Asset: Refinancing opportunity automation triggers for a final "Last Chance" video.

KPI Model: Measuring the Impact of Personalized Campaigns

Success in RBI rate decision marketing 2026 is measured by more than just click-through rates. Enterprise leaders must look at the entire funnel, from video engagement to final disbursement.

Leading Indicators

- Video View-Through Rate (VTR): Are customers watching the personalized savings reveal?

- Calculator Completion Rate: What percentage of users are inputting their data to see the "Break-Even"?

- Pre-Approval Click-Through Rate: The ultimate measure of offer relevance.

Core Conversions

- Balance Transfer Value: The total book value migrated from competitors.

- Restructuring Acceptance Rate: Particularly for the MSME and SME segments.

- Cost of Acquisition (CAC): How much did the automated video journey reduce the need for expensive tele-calling?

Financial Impact

- Incremental Net Interest Income (NII): The long-term value of the retained or acquired book.

- Fee Income: Revenue generated from processing fees and conversion charges.

- Churn Mitigation: The number of customers who stayed with the bank after being offered a proactive restructuring deal.

Conclusion: The Future of BFSI Marketing is Personal

The RBI rate decision marketing 2026 playbook is no longer about broad-based advertising. It is about precision, speed, and empathy. By combining monetary policy customer education with the power of refinancing opportunity automation, banks can transform a routine regulatory update into a powerful engine for growth.

As we move toward the April 2026 MPC, the institutions that win will be those that treat every borrower as an individual. Whether it is through personal loan refinancing videos or business loan restructuring campaigns, the goal remains the same: providing the right financial solution, at the right rate, through a personalized experience that builds lasting trust.

Book a TrueFan AI enterprise demo to see how you can launch personalized, compliant video campaigns in minutes.

Recommended Internal Links

- Boost Conversions with Tax Saving ROI Calculators in 2026

- B2B Sales Video Personalization 2026: Accelerate Deals

- MSME digital transformation 2026: Growth campaigns that work

- Regional Language Video SEO: Strategies for 2026 Growth

- AMC renewal automation April 2026: boost retention ROI

Frequently Asked Questions

What does the repo rate pause at 5.25% mean for my existing Home Loan EMI?

A pause means the benchmark rate remains stable. However, improved system liquidity can still lower your effective borrowing cost via a reduced spread or fee waivers. It’s a good time to use interest rate benefit calculators to evaluate if a balance transfer reduces your total interest and EMI.

When should I consider fixed rate conversion offers instead of staying with a floating rate?

If you believe rates have bottomed and may rise, a fixed rate provides repayment certainty. A practical rule: switch when the break-even period—time to recover conversion fees through savings—is under 12–18 months.

Does a balance transfer always result in savings?

Not always. Account for processing, legal, and documentation charges plus your residual tenure. Transfers typically deliver maximum value in the first half of a home loan when interest dominates the EMI.

How does TrueFan AI help in creating these campaigns?

TrueFan AI automates millions of personalized videos with 175+ language support and celebrity-led creatives, turning calculators and rate updates into compliant, conversion-ready journeys tailored to each customer.

What are my rights during a floating rate reset?

Per RBI guidelines, lenders must inform you of changes and offer options: increase EMI, extend tenure, or combine both. You may also switch to a fixed rate per policy. APR and KFS disclosures must be clear and accessible.