RBI policy marketing automation 2026: A policy-to-acquisition playbook for BFSI rate decision marketing

Estimated reading time: ~11 minutes

Key Takeaways

- Turn RBI decisions into financial opportunity triggers that auto-map to product actions across loans and cards.

- Use real-time policy impact videos and EMI reduction calculators to drive clarity and conversions within hours.

- Prioritize floating rate conversions, balance transfers, and instant approvals based on cohort signals.

- Maintain compliance-first creative with clear disclosures and measurable attribution to disbursals.

- Build the four-layer automation fabric (Data, Decisioning, Creative, Delivery) to go live in 1–3 hours post-MPC.

The landscape of Indian retail lending changed irrevocably on February 6, 2026. When the RBI Monetary Policy Committee (MPC) announced its decision to maintain the repo rate at 5.25%, it signaled more than just a pause in the rate cycle; it signaled a race for market share. In this environment, RBI policy marketing automation 2026 RBI rate decision marketing 2026 playbook has emerged as the critical differentiator for BFSI Marketing Directors and Fintech Growth Teams who must translate complex regulatory shifts into immediate customer acquisition.

The stakes for BFSI rate decision marketing have never been higher. Within minutes of a policy announcement, customer intent shifts from speculative to actionable. Financial institutions that rely on manual creative cycles—taking days or weeks to update their messaging—inevitably lose the “share of wallet” to agile competitors. These competitors utilize automated frameworks to deploy targeted loan and card offers within hours of the Governor’s press conference.

Platforms like TrueFan AI enable this level of agility by bridging the gap between high-level policy data and hyper-personalized customer outreach. By automating the creative production layer, banks can now move from a policy “hold” or “cut” to a live, personalized video campaign across millions of customers before the news cycle even cools. This playbook provides the operational blueprint for mastering this transition.

Sources:

- The Hindu: RBI MPC keeps repo rate unchanged at 5.25% (Feb 6, 2026)

- Times of India Live: RBI MPC Meeting 2026 Live Updates

Mastering policy announcement personalization and financial opportunity triggers

To execute a successful RBI policy marketing automation 2026 strategy, marketing teams must first understand the mechanics of the Monetary Policy Committee. The MPC is a statutory committee responsible for fixing the benchmark policy interest rate (repo rate) to contain inflation while supporting growth. Their decisions, typically announced through the RBI press releases hub, dictate the cost of funds for the entire banking system.

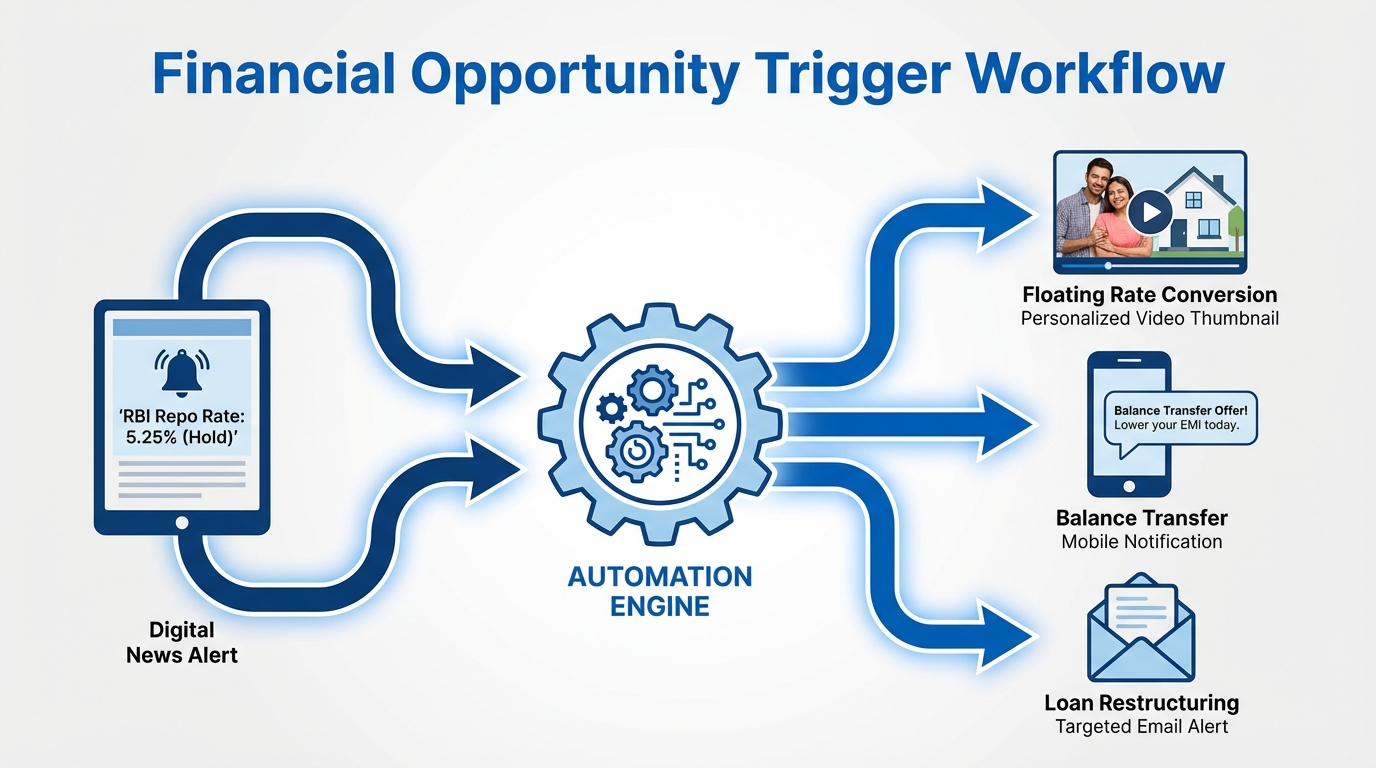

Effective policy announcement personalization requires more than just a “breaking news” banner. It involves the orchestration of data triggers, creative assets, and delivery channels to auto-switch offers based on the specific MPC outcome. Whether the decision is a cut, a hold, or a hike, your marketing engine must have pre-modeled “financial opportunity triggers” ready to fire.

A financial opportunity trigger is a pre-defined condition—such as a 25 basis point (bps) cut—that maps directly to a product-level action sequence. For example, a rate cut might trigger instant loan approval campaigns for high-credit-score cohorts, while a rate hold (like the February 2026 decision) might trigger floating rate conversion campaigns for existing borrowers stuck on older, higher-margin benchmarks.

The February 2026 context is particularly instructive. With the repo rate held at 5.25%, the focus shifted from “rate cut benefit marketing” to “optimization marketing.” This means prioritizing credit card balance transfer offers and home loan restructuring. By contextualizing the current pause within the broader 2025-2026 cycle, lenders can provide the necessary monetary policy customer education that builds trust and drives conversion.

Sources:

Home loan acquisition via EMI reduction calculators and transfer offers

In the home loan segment, the primary objective post-RBI announcement is to reduce attrition among existing borrowers and conquest new ones from competitors. This is achieved through a combination of home loan transfer offers and transparent EMI reduction calculators. When a rate decision is announced, the immediate question every homeowner asks is: “How does this affect my monthly outflow?”

For existing floating-rate borrowers, the strategy should focus on floating rate conversion campaigns. If the RBI holds rates but the market expects a future downward trend, lenders can offer to switch customers from MCLR (Marginal Cost of Funds Based Lending Rate) to repo-linked lending rates (RLLR) if it provides a net benefit. This proactive approach prevents the customer from seeking a transfer to another bank.

The math behind these campaigns must be precise and personalized. An effective EMI reduction calculator uses the standard formula: EMI = [P × r × (1 + r)^n] / [(1 + r)^n − 1]. For a customer with a ₹50 lakh principal (P), a monthly interest rate (r) of 0.708% (8.5% annually), and 120 months remaining (n), the EMI is approximately ₹61,993. If a 25 bps cut brings the rate to 8.25%, the EMI drops to ₹61,325.

To scale this, marketing teams should deploy loan restructuring personalized videos. These videos can dynamically insert the customer's name, their specific principal outstanding, and the exact monthly savings they would realize by switching or transferring. Real-time policy impact videos that show a side-by-side comparison of current vs. new EMI structures are significantly more effective than static emails.

Sources:

Scaling business loan refinancing videos and instant loan approval campaigns

The SME and MSME sectors are highly sensitive to interest rate fluctuations, as these directly impact working capital and cash flow. Post-MPC, the focus for business lending should be on business loan refinancing videos that highlight the long-term savings of moving to a lower-cost credit line. For many small businesses, a 0.5% difference in interest can mean the difference between hiring a new employee or delaying expansion.

For new-to-bank prospects, the goal is speed. Instant loan approval campaigns should be triggered for pre-approved limits based on GST revenue stability and bank statement cash flow filters. By integrating financial opportunity triggers with bureau data (e.g., targeting scores of 725+), lenders can send personalized offers that say: “The RBI has held rates, but we’ve lowered ours for your business. Get ₹20 Lakhs in your account today.”

The messaging in these campaigns must be grounded in “cash flow relief.” Instead of just mentioning a percentage, the creative should state: “At 11.5% vs 12.0%, your monthly outflow improves by ₹4,200; your cumulative cash flow relief over 12 months is ₹50,400.” This tangible benefit is what drives a business owner to click the “Apply Now” button.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow banks to reach MSME owners in their preferred regional language, which is a critical coverage gap often missed by competitors. A business owner in Coimbatore receiving a personalized video in Tamil explaining the impact of the RBI policy on their specific loan is far more likely to engage than one receiving a generic English SMS.

Credit card balance transfer offers and monetary policy customer education

Credit cards represent a unique opportunity post-RBI announcement, particularly for “revolvers”—customers who carry a balance month-to-month. While credit card APRs are not directly linked to the repo rate in the same way home loans are, the general interest rate environment influences consumer sentiment and the cost of unsecured debt.

Marketing teams should prioritize credit card balance transfer offers during these windows. These offers allow users to move high-interest debt from a competitor's card to yours at a lower rate (often 0–2% processing fee) for a fixed tenure. This is a powerful acquisition tool when combined with monetary policy customer education that explains why now is the right time to consolidate debt.

The policy announcement personalization for cards should include illustrative payoff timelines. For example, a video could show: “You are currently paying 42% APR on your other card. Transfer your ₹1,00,000 balance to us at 12% for 6 months and save ₹15,000 in interest.” This level of detail transforms a generic offer into a personalized financial solution.

Furthermore, for “transactors” (those who pay in full), the focus should shift to category-specific EMI conversion. If the RBI stance suggests a period of high liquidity, banks can push low-cost EMI offers for large-ticket purchases. The key is to use instant loan approval campaigns logic to offer these conversions in real-time, right after a transaction is detected on the customer's card.

Building the real-time policy impact videos automation fabric

The technical infrastructure required for RBI policy marketing automation 2026 consists of four distinct layers: Data, Decisioning, Creative, and Delivery. This “automation fabric” ensures that the transition from the Governor's speech to a customer's WhatsApp WhatsApp catalog video marketing inbox happens in under three hours.

The Data Layer ingests the RBI outcome (cut/hold/hike) and maps it against customer attributes like current product, risk tier, and channel permissions. The Decisioning Layer then applies rules: “If the rate holds AND the customer's floating rate is > 9.5%, THEN trigger the floating rate conversion campaigns workflow.” This logic ensures that every offer sent is relevant and beneficial to the recipient.

The Creative Layer is where the most significant innovation occurs. Using real-time policy impact videos, lenders can dynamically generate thousands of unique video assets. These assets include dynamic fields for the customer's name, their specific EMI delta, and even a localized voiceover. This eliminates the need for fresh shoots every time the RBI meets.

Solutions like TrueFan AI demonstrate ROI through this creative agility. Their API-driven approach allows for sub-30s rendering SLAs, meaning a bank can pivot its entire creative strategy for millions of users within the same afternoon as the MPC announcement. This “hours, not days” capability is the hallmark of a mature RBI policy marketing automation 2026 strategy.

The T-minus/T-plus Orchestration Timeline

- T–7 to T–1: Build segments and suppression lists. Finalize DLT-registered SMS and WhatsApp catalog video marketing guide. Pre-render video “shells” for all three possible outcomes (cut, hold, hike). Cultural celebration marketing automation for Q1

- T0 (Announcement Hour): The moment the repo rate is announced, the system auto-switches to the correct creative set. High-propensity cohorts are prioritized for the first wave of outreach.

- T+1 to T+7: Launch retargeting for non-openers. Use performance insights to iterate on scripts. Broaden the audience for interest rate change campaigns as market sentiment stabilizes.

Compliance, measurement, and FAQs for BFSI rate decision marketing

Operating in the Indian BFSI sector requires strict adherence to RBI communication guardrails. All marketing materials, especially those involving loan restructuring personalized videos or business loan refinancing videos, must be non-misleading and include explicit disclosures. “Indicative savings” must be clearly labeled, and fair lending principles must be maintained across all automated decisioning.

Measurement is equally critical. Beyond standard CTRs, teams must track the “calculator completion rate” and “application-to-disbursal” delta. By linking EMI reduction calculators directly to the loan application system, marketers can attribute every rupee of disbursed volume back to the specific policy-triggered campaign. This data-driven approach allows for continuous optimization of the automation fabric.

Conclusion and Strategic Call to Action

The era of static, slow-moving BFSI marketing is over. As we navigate the complexities of the 2026 interest rate cycle, the ability to automate the “policy-to-acquisition” journey is no longer a luxury—it is a survival requirement. By integrating financial opportunity triggers, real-time policy impact videos, and EMI reduction calculators, your institution can turn every RBI announcement into a high-conversion acquisition event.

Primary CTA: Book a 48-hour “policy-to-acquisition” sprint with our team to activate your instant loan approval campaigns, floating rate conversion campaigns, and credit card balance transfer offers ahead of the next MPC window.

Secondary CTA: See a live demo of how real-time policy impact videos with embedded EMI reduction calculators can transform your repo-linked portfolio engagement.

KPI Model: Measuring the Impact of Personalized Campaigns

Success in RBI rate decision marketing 2026 is measured by more than just click-through rates. Enterprise leaders must look at the entire funnel, from video engagement to final disbursement. Post-purchase engagement automation guide

Frequently Asked Questions

How fast can we go live post-announcement?

With a pre-built automation fabric and API-triggered creative templates, campaigns can switch and go live within 1 to 3 hours of the RBI press conference. This includes the generation of real-time policy impact videos for millions of users.

What if the RBI decides to hold the rate instead of cutting it?

A “hold” scenario is an excellent opportunity to focus on floating rate conversion campaigns and credit card balance transfer offers. Use the window for monetary policy customer education to explain long-term planning implications.

How do we ensure the math in our EMI reduction calculators is accurate?

Power calculators with the same core banking APIs used for official loan servicing so that “indicative savings” in marketing match the terms offered during the application process.

Can we personalize videos for customers in rural areas?

Yes. TrueFan AI’s 175+ language support enables localized, automated campaigns so customers across India receive policy impacts in their native language, improving engagement and comprehension.

How do we handle DLT registration for these rapid-fire campaigns?

Pre-register templates for all three outcomes (cut/hold/hike) at least 7 days before the MPC meeting. This lets the automation engine insert variables and deploy instantly post-decision.