Financial Year-End Marketing 2026: AI Urgency Campaigns That Convert Before March 31

Estimated reading time: 12 minutes

Key Takeaways

- Leverage AI-driven urgency and personalized videos to move customers from intent to execution before March 31.

- Deploy regional, video-first communication to maximize trust and comprehension across diverse audiences.

- Use countdown timers, smart reminders, and WhatsApp-first journeys to accelerate last-mile conversions.

- Embed compliance and governance (SEBI/AMFI disclaimers, audit trails) into every asset to protect brand integrity.

- Measure beyond CTRs with KPIs like incremental AUM, ELSS/NPS conversions, and advisor booking friction reduction.

The countdown to March 31, 2026, represents the most critical window for the Indian BFSI sector, as millions of salaried professionals scramble to finalize their tax-saving investments. In this high-stakes environment, traditional generic reminders are no longer sufficient to capture attention in a saturated digital landscape. Financial year-end marketing 2026 demands a shift toward hyper-personalized, AI-driven urgency that transforms passive interest into immediate action for ELSS, NPS, and insurance products.

As we approach the final 14 days of the fiscal year, the psychological pressure on taxpayers peaks, creating a unique opportunity for brands to deploy March 31 tax saving campaigns that utilize real-time data. By integrating personalized video content with dynamic countdown timers, financial institutions can bridge the gap between "intent" and "execution." Platforms like TrueFan AI enable enterprises to orchestrate these complex, data-rich journeys at a scale previously thought impossible, ensuring every customer receives a bespoke roadmap to tax efficiency.

1. Navigating the 2026 BFSI Landscape with Strategic March Retention Strategies

The marketing paradigm in 2026 is defined by a "fewer ideas, better execution" philosophy, where depth of engagement outweighs breadth of reach. For CMOs and Wealth Management Directors, BFSI March retention strategies must now account for a projected 6.5% GDP growth rate, which has bolstered consumer confidence and increased the average ticket size for late-cycle investment surges.

Success in this fiscal year-end depends on capturing high-intent micro-moments through AI-led automation and precision measurement. The 2026 playbook emphasizes that Indian brands must pivot toward regional, voice-led, and video-first communication to maintain relevance. This is particularly vital in the BFSI sector, where trust is the primary currency and compliance is the non-negotiable foundation.

To maximize the lifetime value of existing customers, retention strategies must move beyond simple "top-up" requests. Instead, they should focus on holistic financial health checks that highlight gaps in 80C utilization or insurance coverage. By leveraging dynamic overlays and virtual reshoots, brands can keep their messaging agile, reflecting real-time market shifts or regulatory updates right up until the midnight deadline on March 31.

Source: Adgully: Marketing in Transition 2026

Source: S&P Global: India Fiscal 2026 Insights

Source: Exchange4Media: Marketing and Advertising in 2026

2. Scaling ELSS and NPS Conversions via Personalized Urgency Videos

Equity Linked Savings Schemes (ELSS) and the National Pension System (NPS) remain the cornerstones of tax planning under Section 80C and 80CCD(1B). However, the complexity of lock-in periods and market risks often leads to last-minute decision paralysis. To counter this, ELSS investment urgency videos should be deployed to provide clarity on the 3-year mandatory lock-in while highlighting the potential for long-term wealth creation.

TrueFan AI's 175+ language support and Personalised Celebrity Videos allow BFSI brands to deliver these complex messages in the customer's preferred regional dialect, significantly increasing comprehension and trust. For instance, a video can dynamically pull a user’s current 80C utilization and state: "Hi Rajesh, you have ₹43,000 remaining in your 80C limit. Investing this in ELSS today could save you ₹13,000 in taxes."

Similarly, NPS enrollment deadline marketing should focus on the exclusive ₹50,000 deduction available under Section 80CCD(1B). By mapping employer codes and contribution history, AI-generated videos can guide corporate employees through a seamless top-up process. These videos should feature one-tap "Invest Now" buttons and real-time countdowns to March 31, creating a frictionless path from the video interface to the payment gateway.

To further reduce friction, the integration of 80C tax benefit calculator videos is essential. These interactive assets allow users to input their EPF, PPF, and insurance premiums to see their residual tax-saving headroom instantly. The video then dynamically recommends an optimal split between ELSS and NPS based on the user's risk profile and age, effectively acting as a digital financial advisor.

Source: ClearTax: ELSS Lock-in Period Explained

Source: NPS Trust: Benefits of NPS

Source: ClickUp: Marketing Trends India 2026

3. Automating Last-Minute Insurance and Portfolio Health Checks

The final weeks of the fiscal year often see a surge in health and term insurance purchases as taxpayers look to maximize deductions under Section 80D and 80C. Last-minute insurance purchase automation is critical here to streamline the underwriting process. AI-driven videos can present pre-filled applications to existing customers, highlighting the specific "sum assured" gap in their current portfolio.

These automated journeys should include "medical slot booking" integrations and UPI payment links directly within the video interface. By showing a live timer that reflects the remaining hours until the tax-benefit cutoff, brands can drive a sense of necessary urgency. This approach is particularly effective for "top-up" health plans, where the decision-making process is shorter than for primary life cover.

Simultaneously, providing fiscal year-end portfolio review videos serves as a powerful engagement tool for wealth management firms. These videos offer a concise snapshot of the user's realized and unrealized gains, SIP performance, and asset allocation. By identifying rebalancing opportunities that also offer tax advantages—such as harvesting long-term capital gains or shifting to tax-efficient debt instruments—brands position themselves as proactive partners in the user's financial journey.

The 2026 trend toward "culture-led, real-time content agility" means these portfolio reviews should be delivered via WhatsApp-first journeys. This ensures that the information is accessible on the device the user checks most frequently, allowing for immediate consultation bookings if the user requires deeper professional advice before the year-end deadline.

Source: Boston Institute of Analytics: Early 2026 Marketing Trends

Source: Tantrash: Top Digital Marketing Trends India 2026

4. High-Impact Campaigns for HNI and Corporate Segments

For High Net Worth Individuals (HNIs), the year-end focus shifts from basic tax saving to sophisticated wealth preservation and bespoke allocations. HNI wealth management campaigns in 2026 utilize AI to create "virtual RM" introductions, where a personalized video from their Relationship Manager summarizes the year's performance and suggests time-bound opportunities. These sequences should emphasize exclusivity, offering concierge hotlines and private calendar links for one-on-one consultations.

On the other end of the spectrum, corporate employee tax saving drives offer a massive scale opportunity. By partnering with HR and Payroll departments, BFSI brands can run co-branded campaigns that are triggered on salary credit days. These drives use employee master data to personalize videos that explain how to top up NPS via payroll or opt into group insurance add-ons.

The mechanics of these corporate drives involve SSO-enabled microsites where employees can authorize deductions with a single tap. The use of QR codes at office kiosks that lead to personalized video explainers can bridge the gap between physical office presence and digital execution. For corporate NPS, it is vital to clarify the tax treatment of employer contributions, ensuring employees understand the full scope of their benefits under Section 80CCD(2).

To maintain high conversion rates across these segments, the messaging must be tailored to the specific tax slab and retirement goals of the individual. A junior associate's video will focus on the basics of 80C, while a C-suite executive's video will highlight the nuances of NPS Tier II or Section 54EC bonds for capital gains.

Source: PFRDA: NPS for Corporates

Source: Campaign Asia: Trends Shaping Marketing in 2026

5. Orchestrating Urgency with Reminders and Countdown Videos

The final 72 hours before March 31 require a specialized orchestration of tax planning reminder automation. This involves multi-channel nudges across WhatsApp, SMS, and app push notifications, with frequency caps to avoid "notification fatigue." The logic should be built on a suppression model: once a user converts or completes their 80C limit, all urgency-based marketing must cease immediately to maintain a positive user experience.

Investment deadline countdown videos are the most effective tool in this phase. These videos feature server-synced timers that reflect the exact time remaining until 23:59 IST on March 31. If a payment fails or a KYC document is rejected, the system should automatically trigger a "recovery" video that provides instant troubleshooting steps, such as alternative payment methods or digital KYC refresh links.

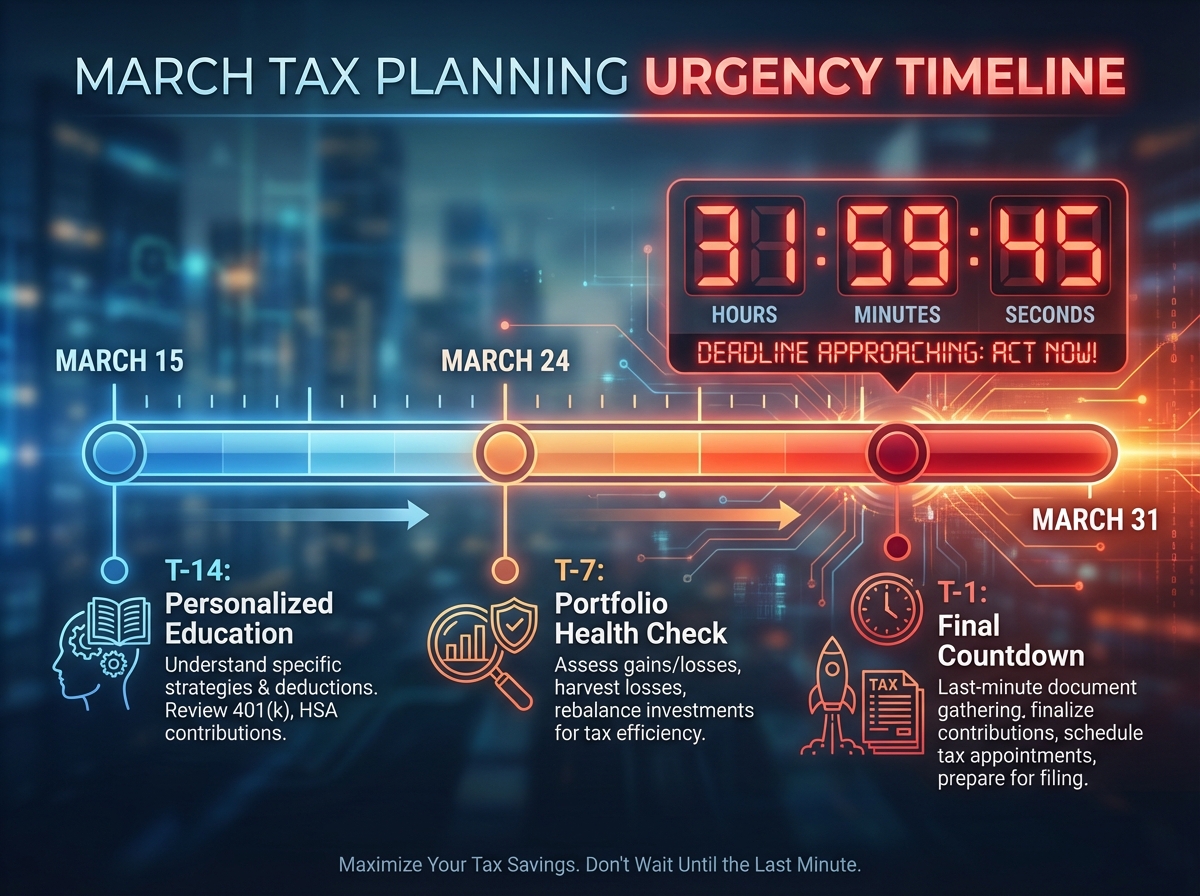

This level of automation requires a robust integration between the brand's CRM, CDP, and the video generation engine. By analyzing the "T-minus day curve," marketers can adjust the intensity of the messaging. For example, T-14 might focus on "Planning," while T-3 focuses on "Execution," and T-1 focuses on "Last Chance."

The 2026 digital growth momentum in India mandates that these journeys be "WhatsApp-primary." With the majority of salaried professionals managing their lives through this platform, delivering a personalized video with an embedded "Pay Now" link directly in the chat interface can significantly reduce the time-to-conversion during the final March 31 rush.

Source: ClickUp: India Marketing Trends 2026

Source: AMFI: SEBI Advertisement Code for Mutual Funds

6. Enhancing Trust through Advisory and Referral Programs

Despite the rise of AI, human expertise remains a critical factor in high-value financial decisions. Financial advisory video consultations bridge this gap by using AI to qualify leads and schedule meetings with human advisors. A personalized video invite can summarize the user's tax-saving needs and offer a one-click link to a video meet, ensuring that the advisor enters the conversation with a full understanding of the client's intent.

For users who are still undecided, tax consultant referral programs can remove the final barrier to action. By offering introductions to vetted tax professionals via video, brands can provide the "expert stamp of approval" that many users need before committing large sums to ELSS or NPS. These programs can be incentivized, where the user receives a discount on tax filing services if they complete their investments through the platform.

The post-consultation experience is equally important. An AI-generated recap video summarizing the advisor's recommendations and providing direct links to the suggested investment products ensures that the momentum from the meeting is not lost. This "human-in-the-loop" approach combines the efficiency of AI with the trust of professional advice, which is essential for navigating the complexities of the Indian tax code.

In 2026, the ability to offer these consultations in regional dialects is a major competitive advantage. By using AI to lip-sync advisor videos into 175+ languages, brands can reach the "Next Billion" users who are increasingly entering the formal investment market but prefer to receive financial advice in their mother tongue.

7. Governance, Compliance, and Year-End Measurement

In the BFSI sector, marketing is only as good as its compliance framework. Year-end compliance marketing must be woven into every video and message. This includes the mandatory display of SEBI/AMFI disclaimers: "Mutual fund investments are subject to market risks, read all scheme related documents carefully." AI platforms allow for these disclaimers to be dynamically overlaid, ensuring they are legible and present for the required duration.

Solutions like TrueFan AI demonstrate ROI through comprehensive analytics that track not just views, but "time-to-CTA" and "calculator completion" rates. For enterprise-grade governance, these platforms provide ISO 27001 and SOC 2-grade controls, ensuring that PII (Personally Identifiable Information) is handled with the highest level of security. Audit trails and proof-of-view logs are essential for meeting regulatory requirements during the high-volume March period.

Measurement of these campaigns should go beyond simple CTRs. Primary KPIs must include incremental AUM (Assets Under Management), ELSS/NPS conversion counts, and the reduction in advisor booking friction. By comparing the 2026 performance against the 2025 baseline, brands can quantify the impact of "better execution" and AI-driven personalization.

Finally, the post-March 31 period should be used for a thorough post-mortem. Analyzing which language cohorts performed best, which presenter styles (e.g., celebrity vs. professional advisor) drove higher trust, and at what point in the countdown urgency peaked will provide the data needed to refine the strategy for the 2027 fiscal year.

Frequently Asked Questions

1. What is the deadline for tax-saving investments for FY 2025-26?

The absolute deadline is March 31, 2026. However, most experts recommend completing transactions by March 25 to account for bank holidays, KYC processing times, and potential payment gateway congestions. Using investment deadline countdown videos can help you stay on track.

2. How much can I save in taxes through ELSS and NPS?

Under Section 80C, you can invest up to ₹1.5 lakh in ELSS to reduce your taxable income. Additionally, Section 80CCD(1B) allows for an extra ₹50,000 deduction specifically for NPS contributions. 80C tax benefit calculator videos on platforms like TrueFan AI can help you calculate your exact savings based on your income slab.

3. What is the lock-in period for ELSS compared to other tax-saving instruments?

ELSS has the shortest lock-in period among all 80C options at just 3 years. In comparison, PPF has a 15-year lock-in, and Tax-Saving FDs have a 5-year lock-in. This makes ELSS a highly liquid yet tax-efficient option for many investors.

4. Are there specific disclaimers required for ELSS and NPS marketing?

Yes, all mutual fund and NPS promotions must adhere to the SEBI and AMFI advertisement codes. This includes clear risk disclosures and the standard "market risk" disclaimer. Year-end compliance marketing ensures these are correctly placed in every personalized video.

5. Can I claim tax benefits for insurance premiums paid on March 31?

Yes, as long as the premium is paid and the receipt is generated before the midnight cutoff on March 31, you can claim the deduction for that financial year. Last-minute insurance purchase automation helps ensure that the issuance process is timestamped correctly for your tax records.

6. How does AI personalization improve conversion in NPS enrollment deadline marketing?

AI personalization addresses the user by name, references their specific tax-saving gap, and provides a direct link to contribute. This removes the "search friction" of navigating a complex portal, making it much more likely that a user will complete the transaction during a busy workday.