Behavioral Nudge Tax Marketing 2026: BFSI Video Playbooks for the March 31 Deadline

Estimated reading time: ~12 minutes

Key Takeaways

- Leverage behavioral economics (loss aversion, social proof, anchoring, scarcity) to drive conversions before March 31, 2026.

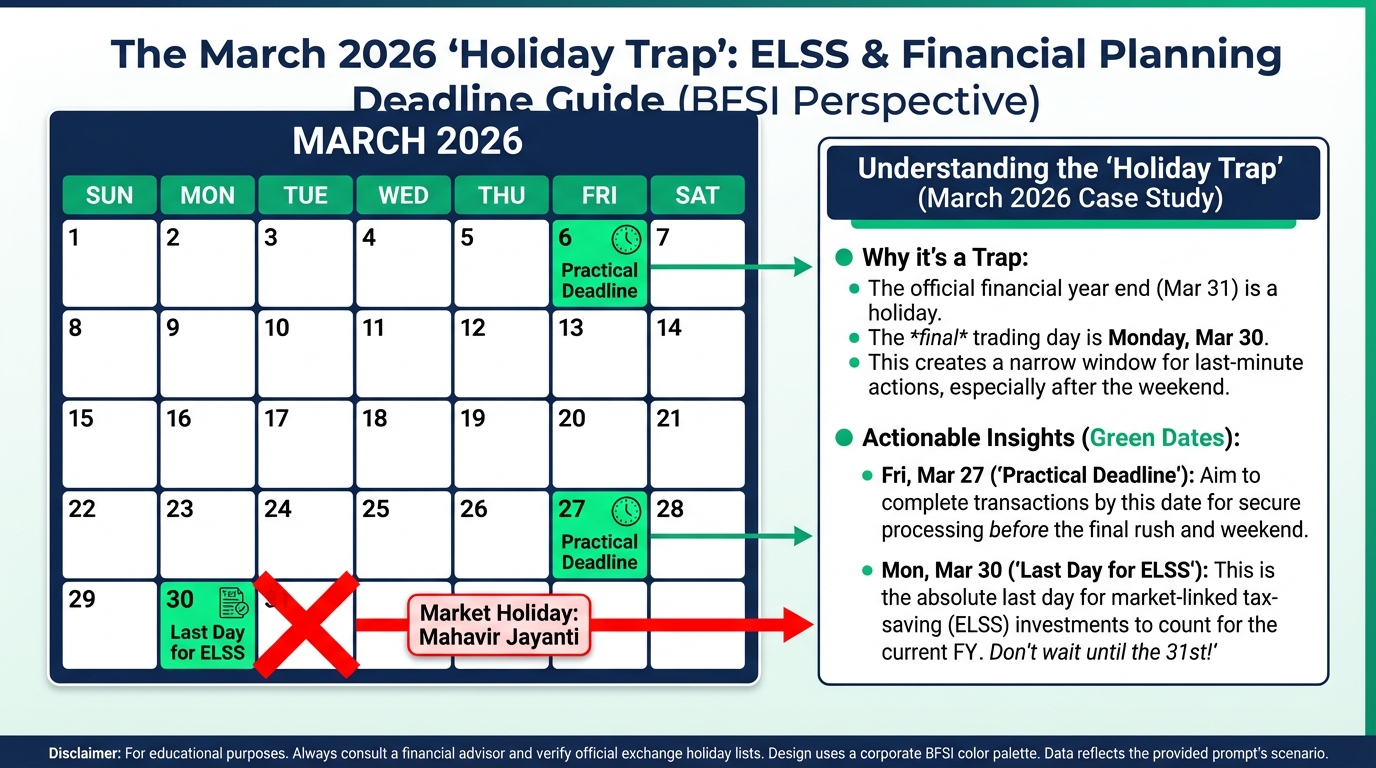

- Account for the “Holiday Trap” with Mahavir Jayanti on March 31; shift urgency to March 27–30 across campaigns.

- Use psychological trigger video campaigns across TOFU, MOFU, BOFU with personalized nudges and micro-commitments.

- Stay compliant with SEBI/RBI guidelines using balanced messaging and mandatory disclosures.

- Automate production with AI to achieve scale and speed while maintaining relevance and ROI.

The final quarter of the Indian financial year is traditionally defined by a frantic, last-minute rush toward tax-saving instruments. However, as we approach the 2025–26 fiscal year-end, the landscape of behavioral nudge tax marketing 2026 has evolved from generic reminders to sophisticated, data-driven psychological interventions. For Banking, Financial Services, and Insurance (BFSI) marketers, the challenge is no longer just about visibility; it is about cutting through the cognitive noise of a saturated market to drive immediate action before the clock strikes midnight on March 31.

The stakes for the March 31, 2026, deadline are uniquely high due to a critical calendar anomaly. While the official end of the financial year is Tuesday, March 31, 2026, this day is designated as a market holiday for Mahavir Jayanti, according to the NSE Holiday Calendar 2026. Consequently, the practical deadline for Equity Linked Savings Schemes (ELSS) and other market-linked instruments will likely shift to Monday, March 30, or even Friday, March 27, for certain banking operations. This “Holiday Trap” creates a compressed window for conversion, making March 31 urgency psychology a mandatory component of any successful BFSI strategy.

To navigate this complexity, enterprise marketing teams are turning to psychological trigger video campaigns that leverage behavioral economics to bypass decision paralysis. Platforms like TrueFan AI enable these institutions to deploy hyper-personalized video content at a scale previously thought impossible, ensuring that every “nudge” feels like a one-to-one consultation rather than a mass-market advertisement. By integrating cognitive biases—such as loss aversion, social proof, and anchoring—into the video funnel, BFSI brands can transform the annual tax-saving chore into a seamless, psychologically rewarding experience.

1. The Science of Choice: Behavioral Economics BFSI and Nudge Theory

Understanding the underlying mechanics of behavioral economics BFSI is the first step in constructing a high-conversion tax campaign. Human decision-making is rarely rational, especially under the pressure of a looming deadline. Instead, individuals rely on heuristics—mental shortcuts—to process complex financial information. Nudge theory, popularized by Richard Thaler and Cass Sunstein, suggests that subtle changes in “choice architecture” can significantly influence behavior without restricting options.

Loss Aversion: The Power of “Don't Lose”

In the context of tax season, loss aversion is perhaps the most potent psychological lever. Research indicates that the pain of losing is psychologically twice as powerful as the joy of gaining. In behavioral nudge tax marketing 2026, framing a campaign around “saving ₹62,400” is often less effective than framing it around “avoiding a ₹62,400 loss to the taxman.” This shift in perspective triggers a biological response that prioritizes immediate corrective action.

Scarcity and the Deadline Effect

Scarcity is not just about limited quantity; it is about limited time. The March 31 urgency psychology thrives on the “deadline effect,” where the perceived value of an action increases as the window for that action closes. When marketers highlight that the ELSS cutoff is actually March 27 due to bank holidays, they create a “double scarcity” effect—limited time compounded by operational constraints.

Social Proof: The Herd Mentality

Under conditions of uncertainty—such as choosing between ELSS, NPS, or a 5-year Tax Saver FD—investors look to the behavior of others. Social proof acts as a validator. Phrases like “Join 2.1 lakh investors who secured their 80C benefits this week” provide the necessary psychological safety net for a hesitant user to complete their transaction. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow brands to deploy social proof that resonates with specific demographics. A celebrity speaking in Marathi about “thousands of families in Pune” who have already invested carries significantly more weight than a generic English advertisement.

Anchoring and Adjustment

Anchoring occurs when an individual relies too heavily on an initial piece of information (the “anchor”) to make subsequent judgments. In tax marketing, the ₹1.5 lakh Section 80C limit serves as a natural anchor. By presenting this figure first, any subsequent investment amount (e.g., a ₹50,000 SIP) feels manageable and necessary in comparison to the total “gap” remaining.

Sources:

- Important Financial Timelines Before 31st March 2026 - Treelife

- NSE Market Holidays 2026 - CalendarLabs

2. Mapping Cognitive Biases to High-Conversion Video Tactics

The transition from theory to execution requires a precise mapping of cognitive biases to specific video elements. Cognitive bias ELSS marketing is particularly effective because it simplifies a complex equity product into a series of relatable, urgent decisions.

Scarcity Principle Investment Videos

To maximize the impact of scarcity, video creatives should move beyond static countdowns. Dynamic overlays that update in real-time—showing the exact hours remaining until the “Practical Bank Deadline”—create a visceral sense of urgency.

- Script Cue: “The clock is ticking. With markets closed on March 31, your last real chance to save on taxes is March 27. Don't let the holiday trap cost you your 80C benefits.”

- Visual Cue: A “Live Deadline” ticker that accounts for bank processing times, shifting from green to amber as the date approaches.

Loss Aversion Deadline Marketing

Loss-framed videos should focus on the tangible “leakage” of wealth. Using red color palettes and “crossed-out” savings icons can visually reinforce the concept of loss.

- Script Cue: “You’ve worked hard for your salary. Why give ₹62,400 of it away? Stop the tax leak today with a 2-minute ELSS setup.”

- Visual Cue: A digital “meter” showing money flowing away from a wallet, which stops only when the “Invest Now” button is highlighted.

Social Proof Tax Campaigns

Social proof is most effective when it is hyper-local. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow brands to deploy social proof that resonates with specific demographics. A celebrity speaking in Marathi about “thousands of families in Pune” who have already invested carries significantly more weight than a generic English advertisement.

- Script Cue: “Over 50,000 professionals in your city have already locked in their tax savings. Don't be the last one in the office to secure your future.”

- Visual Cue: A map of India with “Live Updates” showing clusters of investors in the user's specific region.

Reciprocity Principle Videos

Reciprocity involves giving the user something of value before asking for a conversion. In BFSI, this could be a “Tax-Saving Cheat Sheet” or a “2026 ELSS vs NPS Comparison Guide.”

- Script Cue: “Tax planning is confusing. We’ve simplified it. Download our free 3-step checklist to see exactly how much you can save before March 31.”

- Visual Cue: A preview of a clean, easy-to-read PDF document with a clear “Download Now” call-to-action (CTA).

Sources:

- Deadline to invest in ELSS for Section 80C tax break - Economic Times

- ELSS Definition and Features - SBI Securities

3. Orchestrating Psychological Trigger Video Campaigns Across the Funnel

A successful behavioral nudge tax marketing 2026 strategy requires a multi-stage funnel where each video serves a specific psychological purpose. By the time a user reaches the bottom of the funnel, the “nudge” should feel like a natural conclusion to their journey.

TOFU: The Awareness Anchor (10–15 Seconds)

The Top-of-Funnel objective is to break through the “Optimism Bias”—the belief that “I have plenty of time to do my taxes.”

- Focus: Scarcity + Anchoring.

- Strategy: Use a high-authority figure or celebrity to state the ₹1.5L anchor and the March 27 “Practical Deadline.”

- Channels: YouTube Bumper ads, Instagram Reels, and LinkedIn sponsored content.

MOFU: The Consideration Nudge (30–45 Seconds)

The Middle-of-Funnel objective is to resolve “Choice Overload” and “Decision Fatigue.”

- Focus: Reciprocity + Anchoring.

- Strategy: Provide a side-by-side comparison of ELSS, NPS, and FDs. Use anchoring to show that ELSS has the shortest lock-in period (3 years) compared to others, making it the “easiest” choice.

- Channels: In-app video interstitials, email marketing with video thumbnails, and educational webinars.

BOFU: The Conversion Trigger (20–30 Seconds)

The Bottom-of-Funnel objective is to overcome “Status Quo Bias” and drive the final click.

- Focus: Loss Aversion + Social Proof + Personalization.

- Strategy: This is where conversion psychology personalization becomes critical. A video addressing the user by name, mentioning their specific tax bracket, and showing a “80% Complete” progress bar can reduce the friction of the final transaction.

- Channels: WhatsApp Business API, personalized SMS links, and retargeting banners.

Retargeting: The Commitment Loop

If a user abandons the journey, use commitment consistency campaigns. Remind them of their previous interaction (e.g., “You calculated your savings last week”) to trigger the psychological need to be consistent with their past actions.

Sources:

4. Reducing Decision Fatigue and Driving Micro-Commitments

One of the primary reasons for tax-season drop-offs is “Choice Overload.” When presented with 50 different ELSS funds, the human brain often chooses “none of the above” to avoid the risk of making a mistake. Decision fatigue reduction is a core pillar of modern BFSI UX.

The Power of Defaults

In behavioral economics BFSI, defaults are the most powerful nudges. By pre-selecting a “Recommended” ELSS fund based on the user's risk profile and pre-filling their SIP amount based on their remaining 80C limit, you remove the cognitive load of calculation.

Tactic: Use a video to explain why this default was chosen: “Based on your preference for high-growth, we’ve pre-selected our Top-Rated ELSS fund for you. One tap to confirm.”

Micro-Commitment Tax Saving Videos

A large goal (saving ₹1.5L) can be daunting. Micro-commitment tax saving videos break this down into tiny, non-threatening steps.

- Step 1: A 5-second video asking, “Do you want to see your potential tax savings?” (User taps ‘Yes’).

- Step 2: A 10-second video showing the calculation.

- Step 3: A 15-second video asking, “Should we set a reminder for March 27?” (User taps ‘Yes’).

By the time the user is asked to invest, they have already said ‘Yes’ three times, making the final ‘Yes’ significantly more likely due to the principle of commitment and consistency.

Solutions like TrueFan AI demonstrate ROI through these micro-interactions, allowing brands to test which “small asks” lead to the highest “big conversions.” For instance, a campaign for a leading travel portal saw a 17% higher WhatsApp read rate simply by personalizing the destination in a video nudge, proving that relevance reduces the “mental tax” of processing an ad.

Sources:

- Behavior Analytics Market Size and Statistics 2026 - Fortune Business Insights

- 2026 Bank Marketing Trends - ABA Banking Journal

5. Risk, Ethics, and the 2026 Implementation Roadmap

While behavioral nudge tax marketing 2026 is highly effective, it must be balanced with the stringent regulatory environment of the Indian BFSI sector. SEBI and the RBI have tightened rules around digital advertising and “finfluencer” conduct to ensure that nudges do not cross the line into coercion or misinformation.

Compliance-First Nudging

Every psychological trigger video campaign must adhere to SEBI’s mandate for balanced communication. This means that while you can highlight the benefits of ELSS, you must also clearly state the risks and the 3-year lock-in period.

- Mandatory Disclaimer: “Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.”

- Digital Ad Rules: Per the 2025-2026 SEBI guidelines, all digital ads must include clear disclosures and avoid misleading claims regarding “guaranteed” returns in equity-linked products.

The 2026 Implementation Timeline

To execute a flawless March 31 campaign, BFSI teams should follow this holiday-aware roadmap:

- T–8 Weeks (Early February): Segment your audience based on past tax behavior. Draft scripts for each cognitive bias.

- T–6 Weeks (Mid-February): Launch TOFU “Awareness” videos. Seed social proof by highlighting early-bird investors.

- T–4 Weeks (Early March): Deploy MOFU “Comparison” videos. Offer reciprocity assets (checklists/calculators).

- T–2 Weeks (Mid-March): Shift to BOFU “Personalization.” Start the countdown variants.

- T–7 to T–1 Day (The Final Surge): This is the “Holiday Trap” window. Between March 24 and March 30, deploy high-frequency, loss-aversion-heavy nudges via WhatsApp and SMS.

By automating this timeline, enterprises can save thousands of man-hours. TrueFan AI reports that its enterprise partners have saved an average of 3,888 hours of creative production time by using AI-generated revisions instead of traditional editing for these multi-variant campaigns.

Sources:

Conclusion: The Future of BFSI Marketing is Behavioral

As we look toward the March 31, 2026, deadline, the “business as usual” approach to tax marketing is no longer sufficient. The combination of a compressed holiday schedule and an increasingly distracted consumer base requires a shift toward behavioral nudge tax marketing 2026. By moving away from “shouting” at customers and moving toward “nudging” them through psychological trigger video campaigns, BFSI brands can drive meaningful ROI while providing genuine value to their users.

The integration of nudge theory implementation within video funnels allows for a level of empathy and precision that static ads cannot match. Whether it is through the scarcity of a holiday-aware deadline, the social proof of a regional celebrity, or the reduction of decision fatigue through smart defaults, the goal remains the same: to make the right financial choice the easiest financial choice.

In the final ten days of March 2026, the brands that win will not be the ones with the largest budgets, but the ones with the most sophisticated understanding of human psychology. By leveraging the power of AI-driven personalization and behavioral economics, BFSI institutions can ensure that no investor is left behind in the “Holiday Trap” of 2026.

Data Points & Projections for 2026:

- Market Closure: March 31, 2026, is a confirmed NSE holiday (Mahavir Jayanti).

- Creative Efficiency: AI-driven video platforms save an average of 3,888 hours in production for large-scale BFSI campaigns.

- Engagement Lift: Personalized video nudges see a 3.2x higher participation rate in reader activation contests compared to standard email.

- Conversion Impact: Hyper-personalized travel nudges resulted in a 17% increase in WhatsApp message read rates for major Indian brands.

- Scale: Leading AI platforms have already delivered over 1.5 million personalized videos to 5 million+ users in the Indian market.

Primary Keyword: behavioral nudge tax marketing 2026

Secondary Keywords used: behavioral economics BFSI, March 31 urgency psychology, psychological trigger video campaigns, micro-commitment tax saving videos, cognitive bias ELSS marketing, scarcity principle investment videos, social proof tax campaigns, loss aversion deadline marketing, reciprocity principle videos, anchoring effect tax benefits, commitment consistency campaigns, nudge theory implementation, decision fatigue reduction, conversion psychology personalization.

2. Mapping Cognitive Biases to High-Conversion Video Tactics (Additional Internal Resource References)

The transition from theory to execution requires a precise mapping of cognitive biases to specific video elements. Cognitive bias ELSS marketing is particularly effective because it simplifies a complex equity product into a series of relatable, urgent decisions. Leverage Personalised Celebrity Videos to amplify social proof at scale.

7. Implementation Addendum: Technical Execution Resource

For engineers, the integration involves connecting the Seller NP’s CRM to a video generation engine. Using a POST request to the post_new_request endpoint, the system sends variables like seller_name, city, and category_id. The engine then renders a modular video using pre-approved templates and returns a signed URL via a webhook. This URL is then automatically pushed to the seller’s WhatsApp thread.

Frequently Asked Questions

What is the actual deadline for ELSS investments in 2026?

While the financial year ends on March 31, 2026, that day is a market holiday (Mahavir Jayanti). To ensure your ELSS units are allotted within FY 2025–26, complete your transaction by Monday, March 30, or earlier if using third-party payment aggregators.

How does ELSS compare to other Section 80C options?

ELSS is an equity mutual fund with a 3-year lock-in period—the shortest among 80C options. PPF has a 15-year tenure, and Tax-Saver FDs have a 5-year lock-in. ELSS offers market-linked return potential with higher risk.

Can I use celebrity videos for financial products under SEBI rules?

Yes—provided the content is not misleading, includes mandatory risk disclaimers, and avoids specific buy/sell recommendations unless by a registered advisor. TrueFan AI ensures consent-first, brand-safe celebrity content and workflows.

Why is “Loss Aversion” more effective than “Gain Framing” in tax ads?

The threat of losing existing money (paying more tax) creates stronger, immediate cognitive dissonance than the promise of future gain. This drives quicker corrective action.

How can I implement personalization for a database of 1 million users?

Manual personalization at this scale is impractical. API-driven orchestration connected to a generative video pipeline can create unique, compliant videos for each user in seconds—integrated with your CRM and messaging stack.