BNPL Default Prevention Campaigns: The 2026 Post-Festival Playbook for India’s Fintech Leaders

Key Takeaways

- Shift from reactive dunning to proactive, risk-sensing BNPL prevention strategies powered by dynamic financial health monitoring.

- Video-first, empathetic automation outperforms text-only reminders, improving cure rates and customer experience.

- Offer personalized repayment plans and micro-restructuring aligned to cash flow to reduce roll rates post-festivals.

- Ensure RBI- and FACE-aligned compliance with consent trails, transparency, frequency caps, and human handoffs for vulnerable users.

- Continuously optimize with AI-driven experimentation and feed outcomes back into default risk models for compounding gains.

The landscape of digital credit in India has reached a critical inflection point as we enter the December 2025–January 2026 cycle. BNPL default prevention campaigns are no longer just a collection of reactive reminders; they are now the primary safeguard for Buy Now, Pay Later (BNPL) providers and Non-Banking Financial Companies (NBFCs) navigating the post-festival liquidity crunch. As festive overspending from Diwali and year-end celebrations converges with the first salary cycle of the new year, lenders face a predictable yet dangerous spike in delinquency.

The challenge is multifaceted: multiple EMI due dates are converging, and the average Indian consumer is grappling with a temporary cash-flow imbalance. To maintain portfolio health, digital lenders must move beyond traditional “dunning” and embrace orchestrated BNPL default prevention campaigns that combine advanced risk sensing, empathetic automation, and video-first engagement. By integrating customer financial health monitoring with personalized repayment pathways, firms can protect their lifetime value (LTV) while adhering to the stringent 2026 regulatory landscape.

Recent industry data suggests that BNPL remains the fastest-growing pillar of digital credit in India, with the market projected to touch $50 billion by the end of 2026. However, this growth comes with increased regulatory scrutiny and a mandate for responsible collections. Lenders must now manage onboarding quality and post-purchase stress with surgical precision to avoid escalating roll rates.

Section 1: The Risk Sensing Brain—Customer Financial Health Monitoring and Prediction Models

The foundation of any successful BNPL default prevention campaigns strategy is the ability to predict stress before a payment is even missed. In 2026, leading Indian fintechs are moving away from static credit scores toward dynamic customer financial health monitoring. This involves the continuous, privacy-compliant analysis of a borrower’s real-time behavior, including UPI transaction velocity, inflow/outflow stability, and even app engagement signals.

By leveraging default risk prediction models, lenders can segment their portfolio into high, medium, and low-risk cohorts with unprecedented accuracy. These supervised machine learning models are calibrated on historical repayment outcomes, such as self-cure rates and Days Past Due (DPD) buckets. In the post-festival window, these models must be enriched with alternative data, such as recent “bounce” counts on other recurring payments or changes in BNPL basket sizes, which often signal a looming liquidity crisis.

Implementation requires a sophisticated tiering logic. For instance, a “Low Risk” customer (Score ≥0.8) might only require light, pre-due nudges via WhatsApp. Conversely, a “High Risk” customer (Score <0.5) necessitates early restructuring options and immediate agent callback availability. This proactive approach ensures that the lender is not just reacting to a default but preventing it through early intervention.

Model governance is equally critical. In alignment with the FACE Code of Conduct and RBI guidelines, these models must undergo periodic bias checks and re-training. As the Indian lending landscape shifts toward AI-driven scoring, the focus remains on “fair outcomes,” ensuring that automated decisions do not unfairly penalize vulnerable segments during periods of national financial stress.

Source: ET Edge Insights

Source: PwC India

Source: FACE Code of Conduct

Section 2: Empathetic Automation—The Video-First Communication Playbook

Communication is the bridge between a risk signal and a successful repayment. In 2026, empathetic payment reminder automation has replaced the aggressive, text-heavy dunning of the past. The goal is to use neutral, non-judgmental language that acknowledges the post-festival financial strain while providing clear, one-tap pathways to resolution. Video content has emerged as the most effective medium for this, offering a human touch that text simply cannot replicate.

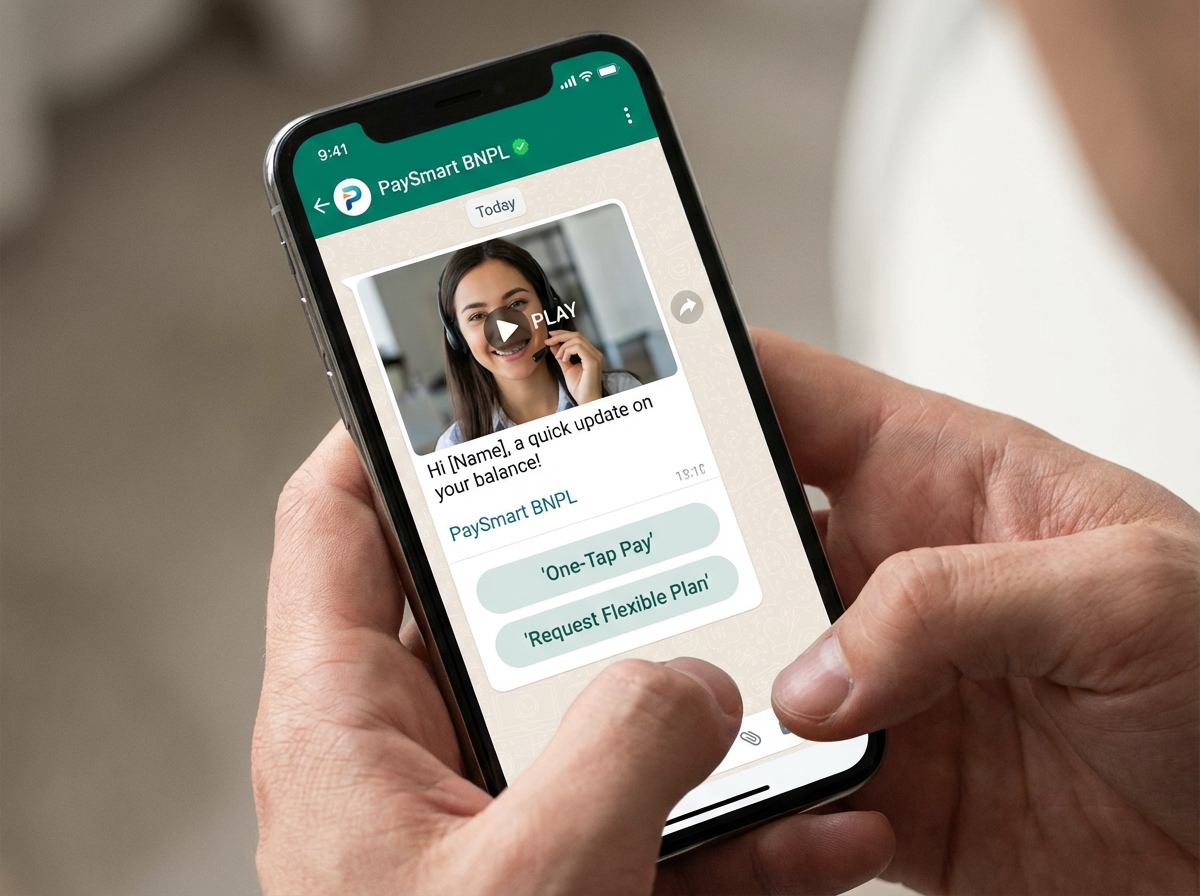

A high-performing sequence begins five days before the due date (T-5). A simple explainer video, delivered via WhatsApp, highlights the upcoming payment and the benefits of maintaining a healthy credit score. On the due date (T0), a personalized video reminder featuring a “one-tap pay” link can significantly boost same-day completion. If a payment is missed, the tone shifts at D+2 to a supportive inquiry, offering personalized repayment plans rather than a demand for immediate full payment.

Platforms like TrueFan AI enable lenders to scale this level of personalization across millions of borrowers simultaneously. By merging data fields such as the borrower’s name, due amount, and preferred language, lenders can deliver a bespoke experience that feels like a 1-on-1 consultation. This is particularly effective for festival loan recovery videos, which normalize the situation and de-stigmatize the temporary inability to pay.

Compliance guardrails are non-negotiable in this phase. The RBI’s digital lending guidelines emphasize transparency and the prohibition of “dark patterns” or harassment. Every automated message must include a clear opt-out and respect frequency caps. By using financial stress customer support as the ultimate escalation point, lenders ensure that high-risk individuals are met with human empathy rather than automated persistence.

Source: RBI Digital Lending FAQs

Source: CleverTap Fintech Engagement

Source: M2P Fintech

Section 3: Strategic Video Templates for Retention and Recovery

To execute BNPL default prevention campaigns effectively, lenders need a diverse library of video assets. These templates should be designed to address specific psychological barriers to repayment. The first category is festival loan recovery videos. These scripts acknowledge the joy of the recent festivities—be it Diwali, Christmas, or New Year—and gently transition into the practical reality of the due date. The visual cues should be localized, using regional languages and culturally relevant imagery to build trust.

The second category is payment flexibility offer videos. These are triggered when a customer is identified as “Medium Risk” by the default risk prediction models. Instead of a standard reminder, the video presents 2–3 tailored options: splitting the bill into two installments, paying 30% now and the rest after the next salary credit, or shifting the due date by a few days. This transparency in options reduces the “ostrich effect,” where borrowers ignore communications because they feel overwhelmed.

Thirdly, financial wellness video content serves as a long-term retention tool. These videos provide coaching on budgeting for January, tips on staggering dues, and the mechanics of UPI auto-pay. By positioning the lender as a financial partner rather than just a creditor, firms can improve customer loyalty. This content often includes 50/30/20 budgeting guidelines adapted for the Indian context, helping users navigate the “lean” months of the first quarter.

Finally, credit score education videos are essential for explaining the long-term consequences of delinquency. Many BNPL users in India are “new-to-credit” and may not fully grasp how a 30-day delay impacts their future ability to secure home or car loans. These videos use data from bureaus like TransUnion CIBIL to show how a quick “catch-up” payment can minimize score impact, turning a potential default into a moment of financial education.

Source: TransUnion CIBIL CMI

Source: TrueFan AI Enterprise Solutions

Section 4: Policy Levers—Personalized Repayment Plans and Restructuring

Beyond communication, the actual structure of the debt must be flexible. BNPL retention strategies India now rely heavily on payment restructuring automation. This involves policy-driven workflows that enable micro-reschedules or “skip-a-pay” options within pre-approved guardrails. For a low-risk customer, this might be as simple as a one-click date shift to T+5 (aligned with their salary credit). For higher-risk segments, it may involve a structured catch-up plan over several weeks.

The key to successful personalized repayment plans is alignment with the borrower's cash flow. If data shows a customer typically receives their salary on the 7th of the month, but their BNPL due date is the 1st, the system should automatically offer a realignment. This reduces the friction of payment and demonstrates that the lender understands the borrower's financial reality. In 2026, these offers are often presented through interactive video interfaces where the user can “tap” their preferred plan.

Regulatory alignment is paramount when offering these levers. The RBI requires absolute transparency regarding fees and interest. There can be no “hidden” costs in a restructured plan; every additional rupee charged for a deferral must be disclosed upfront in simple language. Furthermore, lenders must ensure that their BNPL default prevention campaigns account for Default Loss Guarantee (DLG) arrangements with their NBFC partners, ensuring that risk transfer implications are managed within the automated workflow.

Operationalizing this requires a robust integration between the risk engine and the CRM. When a default risk prediction model flags a potential stress signal, the system should instantly check the “offer menu” available for that specific risk tier. This ensures that the customer receives a solution that is both helpful for them and sustainable for the lender’s balance sheet.

Source: RBI DLG FAQs

Source: Credgenics Collections Automation

Section 5: Governance, Compliance, and Ethical Collections in 2026

In the current regulatory climate, the “how” of collections is just as important as the “how much.” BNPL default prevention campaigns must be built on a foundation of ethical conduct and rigorous compliance. This starts with consent. Every outreach channel—be it WhatsApp, SMS, or IVR—must have a logged consent trail and a functional opt-out mechanism. In 2026, the RBI has intensified its focus on “fair conduct,” meaning any form of harassment, shaming, or use of “dark patterns” in reminders is strictly prohibited.

Lenders must also implement strict frequency caps. Bombarding a borrower with ten notifications a day is not only ineffective but also a violation of industry self-regulation standards set by FACE (Fintech Association for Consumer Empowerment). A compliant cadence typically involves a pre-due explainer, a due-day reminder, and a supportive post-due nudge, with significant “cooling-off” periods in between.

Transparency in local languages is another critical pillar. TrueFan AI's 175+ language support and Personalised Celebrity Videos allow lenders to communicate complex financial terms in the borrower’s native tongue, ensuring that disclosures about interest rates or late fees are fully understood. This parity in language is not just a “nice-to-have”; it is a core component of the “Fair Practices Code” for digital lenders in India.

Finally, there must be a clear protocol for “vulnerable” customers. If a borrower indicates job loss or a medical emergency through a reply or a call, the automated system must immediately hand off the case to financial stress customer support. These trained agents operate under scripts that prioritize assistance over coercion, offering long-term deferrals or hardship programs that protect the customer’s dignity while managing the lender's risk.

Source: RBI Digital Lending Guidelines

Source: FACE Resource Center

Section 6: Measuring Success and the Role of AI-Driven Personalization

To optimize BNPL default prevention campaigns, lenders must track a specific set of KPIs that go beyond simple recovery rates. “Cure metrics” are the gold standard in 2026. This includes the self-cure rate (the percentage of users who pay after a pre-due nudge without human intervention) and the roll-rate reduction (the success in preventing a 0-DPD account from moving to 30-DPD). Additionally, tracking the “PTP (Promise to Pay) Kept” rate provides insight into whether the personalized repayment plans offered were actually realistic for the borrower.

Experimentation is the engine of improvement. Lenders should run A/B tests comparing video-based reminders against traditional text-only SMS. Early 2026 benchmarks suggest that video-led campaigns see a 35% higher view-through rate and a 20% lift in immediate CTA clicks. Optimization also extends to the “first 5 seconds” of the video—testing different hooks, such as a greeting in a local dialect versus a direct mention of a fee waiver, can yield significant marginal gains in cure rates.

Solutions like TrueFan AI demonstrate ROI through their ability to automate these complex, high-volume video workflows. By integrating directly with a lender's CRM, the platform can trigger a payment flexibility offer video the moment a customer financial health monitoring system detects a missed salary credit. This real-time responsiveness is what separates market leaders from laggards in the high-stakes post-festival window.

Ultimately, the goal is a virtuous cycle: outcomes from the December–January campaigns are fed back into the default risk prediction models. This allows the AI to learn which cohorts responded best to which offers, refining the strategy for the next seasonal spike. As the Indian BNPL market matures, this data-driven, empathetic approach will be the primary driver of sustainable growth and portfolio resilience.

Source: TrueFan AI Enterprise Offering

Source: PwC India Fintech Report

Frequently Asked Questions

How do BNPL default prevention campaigns differ from traditional collections?

Traditional collections are often reactive and focus on recovering debt after a default has occurred. In contrast, BNPL default prevention campaigns are proactive and data-driven. They use customer financial health monitoring to identify stress signals before a payment is missed, using empathetic communication and flexible policy levers to keep the customer current.

Are personalized video reminders compliant with RBI guidelines?

Yes, provided they adhere to the principles of transparency, consent, and fair conduct. Videos must clearly state the due amount, date, and any applicable fees without using coercive language. Platforms like TrueFan AI ensure that all content is moderated and aligned with the latest regulatory standards for digital lending in India.

What are the most effective “policy levers” for post-festival recovery?

The most effective levers include personalized repayment plans such as “split-bills” (50% now, 50% in 15 days) and “date-shifts” that align the due date with the borrower's actual salary credit. These options, when presented through payment flexibility offer videos, significantly reduce the psychological barrier to repayment during a liquidity crunch.

How does AI improve default risk prediction models in 2026?

In 2026, AI models incorporate real-time alternative data, such as UPI transaction patterns and app engagement, rather than relying solely on historical bureau data. This allows for a more granular understanding of a borrower's immediate financial health, enabling lenders to trigger empathetic payment reminder automation at the exact moment it is most needed.

Can these campaigns be localized for regional markets in India?

Absolutely. Localization is critical for trust. Effective campaigns use festival loan recovery videos in the borrower's preferred regional language (e.g., Hindi, Tamil, Marathi). TrueFan AI's 175+ language support allows for perfect lip-sync and cultural nuance, ensuring the message resonates across India's diverse demographic landscape.

What should I do if a customer continues to miss payments despite these interventions?

If automated nudges and flexibility offers fail, the case should be escalated to financial stress customer support. These agents are trained to conduct deeper affordability assessments and offer more significant restructuring or hardship programs, ensuring compliance with the FACE Code of Conduct and RBI's fair practices mandate.

Source: RBI Digital Lending FAQs

Source: FACE Code of Conduct

Source: TrueFan AI