Akshaya Tritiya gold marketing 2026: Offer playbooks for jewelry, banks, and digital gold platforms

Estimated reading time: ~8 minutes

Key Takeaways

- Leverage education-led campaigns with calculators, SIPs, and explainers to convert festival intent into recurring investments.

- Drive retail growth via jewelry EMI offer personalization with transparent APRs, multilingual videos, and AR try-ons.

- Boost bank/NBFC outcomes using sovereign gold bond marketing, compliant templates, and CRM-triggered personalization.

- Maximize conversions with muhurat-timed distribution, regionalization, and WhatsApp-first delivery.

- Sustain trust through compliance and measurement across disclosures, data privacy, and outcome-oriented KPIs.

The landscape of Akshaya Tritiya gold marketing 2026 represents a pivotal shift in how Indian financial and retail institutions engage with high-intent consumers during the “ever-increasing” festival of Akha Teej. This tactical guide provides jewelry brands, banks, NBFCs, and digital gold platforms with a comprehensive framework to capitalize on cultural buying intent through compliant offers and hyper-personalized content.

As we navigate the 2026 fiscal cycle, the convergence of high gold prices and digital-first consumer behavior necessitates a sophisticated approach to campaign orchestration. By integrating precious metal investment calculators and jewelry EMI offer personalization, brands can bridge the gap between traditional sentiment and modern financial pragmatism.

The 2026 Gold Market Landscape and Cultural Context

Akshaya Tritiya, falling on the Shukla Paksha Tritiya, remains the most significant window for wealth accumulation in the Indian subcontinent. In 2026, the market is characterized by a “value over volume” paradigm, where despite price resilience, consumer demand remains robust due to deep-seated cultural associations with prosperity.

Recent data from the World Gold Council (WGC) in early 2026 highlights enduring demand strength fueled by domestic price dynamics and a significant uptick in digital acquisition channels. While 2025 saw a 25% surge in sales value despite a dip in physical volume, 2026 is expected to follow a similar trajectory of premiumization and fractional investment.

To succeed, marketers must align their messaging with auspicious timings while addressing the budget-conscious nature of the modern buyer. This involves moving beyond generic “buy now” ads toward education-forward narratives that utilize gold price prediction videos and regionalized trust cues.

Sources:

- DrikPanchang: Akshaya Tritiya 2026 Muhurat

- GJEPC: Gold value surge analysis

- World Gold Council: Jan 2026 India market update

Digital gold investment campaigns that convert this season

In 2026, digital gold investment campaigns must evolve from simple prompts into wealth-building journeys. These campaigns leverage fractional gold purchases, Systematic Investment Plans (SIPs), and instant UPI-enabled checkouts to lower the barrier to entry for younger demographics.

The core of a successful digital gold strategy lies in the deployment of precious metal investment calculators. These tools allow users to visualize long-term wealth accumulation, such as “accumulating 50 grams over 18 months,” effectively turning a one-time festival purchase into a recurring financial habit.

Platforms like TrueFan AI enable the automation of these journeys by generating personalized explainer videos that address the user by name and city immediately after they interact with a calculator. This hyper-personalization significantly increases the conversion rate from “calculator user” to “SIP subscriber” by providing immediate, relevant value.

Tactical Execution for Digital Platforms:

- SIP Nudges and Round-ups: Implement automated triggers based on past app behavior, offering “muhurat-special” SIP start-ups with zero processing fees.

- Gold Savings Scheme Videos: Produce 45–60 second explainers that contrast lump-sum buying with disciplined SIPs, highlighting vaulting security and 24K purity.

- Gold Price Prediction Videos: Develop weekly educational series analyzing macro drivers like MCX trends and central bank flows to build authority and trust.

- WhatsApp-First Distribution: Use the WhatsApp Business API to deliver personalized investment plans and “price drop” alerts directly to the consumer’s primary communication channel.

By focusing on education and transparency, digital platforms can mitigate the “price shock” often associated with peak festival periods. Providing clear liquidity options and insurance details within the video content ensures that the consumer feels secure in their fractional ownership.

Sources:

Jewelry EMI offer personalization for retail growth

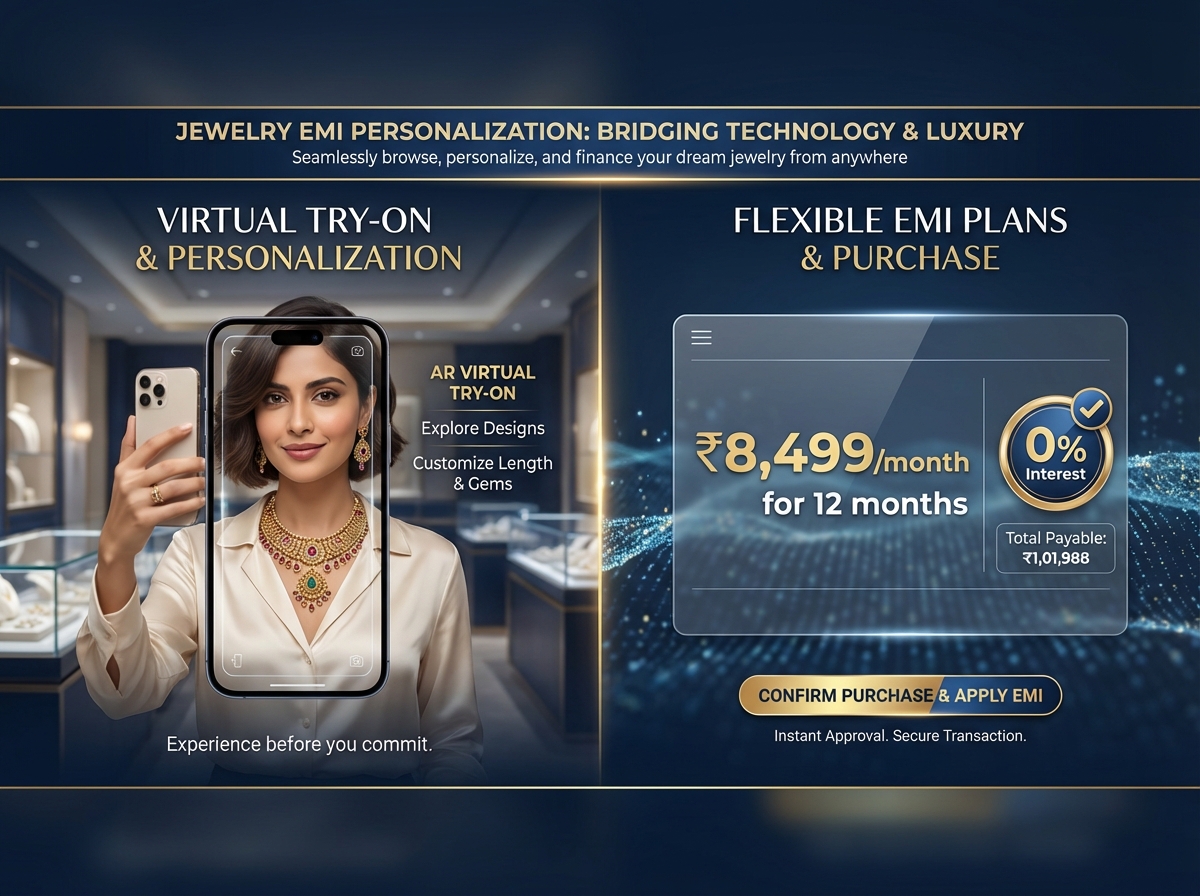

For traditional and modern retail jewelers, the 2026 Akshaya Tritiya season demands a shift toward jewelry EMI offer personalization. As ticket sizes for bridal and heavy-weight jewelry increase, providing tailored financing options based on a customer’s credit profile becomes a critical conversion lever.

Personalized EMI campaigns should go beyond generic “0% Interest” banners. Instead, they should feature dynamic video overlays that show exact monthly outgoings (e.g., “₹8,499/month for 12 months”) tailored to the specific collection the user is browsing.

TrueFan AI’s 175+ language support and Personalised Celebrity Videos allow retail brands to scale these offers across diverse linguistic regions in India. A customer in Coimbatore can receive a personalized video in Tamil explaining the EMI benefits for a temple jewelry set, while a shopper in Jaipur receives a similar message in Hindi for Polki designs.

Key Retail Playbook Components:

- Jewelry Virtual Try-On Campaigns: Integrate AR-led try-on widgets within social media ads to reduce the friction of “style uncertainty” before the customer visits the store.

- Wedding Jewelry Advance Booking: Promote price-protection schemes that allow customers to lock in current rates for future wedding dates, mitigating the risk of price volatility.

- Gold Gifting Personalization: Offer AI-generated “gift reveal” videos where a digital avatar or celebrity addresses the recipient by name, enhancing the emotional value of the purchase.

- Regional Goldsmith Partnerships: Collaborate with local karigars to showcase the craftsmanship behind the pieces, using docu-style video content to emphasize heritage and trust.

The integration of jewelry virtual try-on campaigns with localized influencer content creates a powerful “phygital” experience. This approach not only drives online engagement but also increases high-intent footfall to physical showrooms during the auspicious muhurat windows.

Sources:

Sovereign gold bond marketing and banking liquidity

Banks and NBFCs have a unique opportunity during Akshaya Tritiya to drive growth through sovereign gold bond marketing and strategic loan products. SGBs remain a preferred choice for investors seeking the dual benefit of gold price appreciation and a fixed 2.5% annual interest rate.

Marketing SGBs requires a focus on the “tax-efficient wealth” narrative. Campaigns should utilize tranche countdown timers and detailed explainers on the RBI Retail Direct portal to guide users through the application process. Clear communication regarding the 8-year tenure and capital gains tax exemptions is essential for compliance and trust.

Solutions like TrueFan AI demonstrate ROI through the creation of compliance-reviewed video templates that can be dynamically updated with the latest tranche details. These videos can be triggered via CRM data to reach existing customers who have previously shown interest in fixed-income or gold-linked instruments.

Bank/NBFC Growth Tactics:

- Gold Loan Top-Up Offers: Target existing gold loan customers with personalized videos offering incremental disbursals based on the 2026 surge in gold prices.

- Responsible Marketing: Ensure all gold loan top-up offers include clear APR examples, foreclosure charges, and risk warnings to maintain regulatory standards.

- SGB Tranche Explainers: Use multilingual video content to explain the “Gold + Interest” benefit, specifically targeting the post-tax returns compared to physical gold.

- CRM-Led Personalization: Deliver “Check Your Limit” deep links via WhatsApp with personalized video journeys, allowing customers to see their pre-approved loan amounts in real-time.

By positioning gold not just as an ornament but as a liquid asset, banks can capture a larger share of the household balance sheet during the festival. The use of sovereign gold bond marketing specifically appeals to the “paper gold” investor who prioritizes safety and government backing over physical possession.

Sources:

Timing, Distribution, and Auspicious Muhurat Reminders

The success of any Akshaya Tritiya gold marketing 2026 campaign is heavily dependent on timing. The “Muhurat” or auspicious window is when the majority of transactions occur, making auspicious muhurat reminders a critical component of the distribution strategy.

A tiered distribution plan ensures that the brand remains top-of-mind throughout the month-long festival cycle:

- Pre-Buzz (T-30 to T-7): Focus on education, SIP setups, and EMI pre-approvals. This is the time to deploy precious metal investment calculators to capture early intent.

- Peak (T-1 to T+1): Deploy real-time, geo-targeted reminders. Use WhatsApp and Push notifications to alert users of the exact start and end times of the muhurat in their specific city.

- Post-Festival (T+2 to T+14): Retarget users who engaged but didn’t convert with “price protection” offers or SGB tranche follow-ups.

Regionalization plays a massive role here. A “one size fits all” approach fails in a country where gold buying traditions vary from the Dhanteras-like fervor in the North to the deep-rooted Akha Teej traditions in the West and South. Regional goldsmith partnerships can be highlighted through localized video content that speaks to specific community aesthetics and trust factors.

Using event-triggered rendering, brands can swap creative assets in under 30 seconds to reflect real-time price changes or stock availability. This agility is what separates market leaders from laggards in the high-stakes 2026 environment.

Sources:

- Sunday Guardian: 2026 precious metals surge context

- DrikPanchang: Regional muhurat timing variations

Compliance, Governance, and Performance Measurement

In the financial services and jewelry sectors, trust is the primary currency. Every digital gold investment campaign and gold loan top-up offer must be anchored in rigorous compliance and data governance.

Compliance Checklist for 2026:

- Investment Education: All gold price prediction videos must carry a disclaimer stating that content is for educational purposes and not financial advice.

- EMI Transparency: Disclose APRs, processing fees, and T&Cs upfront. Use “soft-check” journeys to ensure credit scores are not impacted during the discovery phase.

- SGB Disclosures: Clearly link to RBI or bank official pages for redemption and interest rules.

- Data Privacy: Ensure ISO 27001/SOC2 standards are met when handling customer data for personalized video rendering.

KPIs for Strategic Success:

- Digital Gold: Aim for a calculator CTR of 8–12% and a SIP start rate of at least 3–5% among calculator users.

- Jewelry Retail: Target a VTO session start rate of 10–15% and an advance booking conversion lift of 20% over the baseline.

- Banking: Monitor for a 12–18% eligibility check rate on top-up offers and a 4–7% lead submission rate for SGB campaigns.

By measuring engagement at every touchpoint—from the first 3 seconds of a personalized video to the final click on a WhatsApp deep link—brands can optimize their creative spend in real-time. The goal is to create a seamless, high-trust journey that respects the cultural significance of the day while providing modern financial utility.

Strategic Conclusion

The 2026 Akshaya Tritiya season presents a unique opportunity for brands to blend tradition with technology. By focusing on Akshaya Tritiya gold marketing 2026 strategies that prioritize personalization, education, and regional relevance, jewelry brands and financial institutions can drive unprecedented growth.

Success in this competitive landscape requires more than just a discount; it requires a commitment to the customer’s financial well-being and cultural journey. Whether through precious metal investment calculators or jewelry virtual try-on campaigns, the brands that win will be those that provide the most value in the most personal way.

Get your Akshaya Tritiya gold marketing 2026 kit today and see a TrueFan AI Enterprise demo for hyper-personalized videos on WhatsApp in under 30 seconds.

Frequently Asked Questions

What is the best time to buy gold on Akshaya Tritiya 2026?

The most auspicious timings, or Muhurat, vary by city and local panchang. Use auspicious muhurat reminders tailored to your location. Generally, the window spans the duration of the Tritiya Tithi, while specific “Choghadiya” timings are preferred for high-value purchases.

Are gold price prediction videos reliable for making investment decisions?

Gold price prediction videos are educational tools, not guarantees. They analyze macro factors like inflation, currency moves, and central bank flows. Consult a certified advisor and consider disciplined SIPs instead of timing market peaks.

How does jewelry EMI offer personalization benefit the buyer?

Jewelry EMI offer personalization shows plans tailored to your budget and credit profile, clarifying monthly outflow and costs upfront. This transparency makes high-value jewelry more accessible without straining immediate liquidity.

Can I invest in Sovereign Gold Bonds (SGB) through digital marketing links?

Yes. Reputable bank campaigns (e.g., SBI) and the RBI Retail Direct portal provide secure application links. Ensure you use official, verified destinations and complete KYC as required.

How can platforms like TrueFan AI help brands during the festival rush?

TrueFan AI enables hyper-personalized, multilingual video content at scale—from celebrity greetings to custom EMI explainers—so each customer feels uniquely valued, driving engagement and conversion during peak demand.