AI marketing ROI justification 2026: A CFO-ready playbook for enterprise AI video investments

Estimated reading time: ~13 minutes

Key Takeaways

- CFO-grade metrics like NPV, IRR, payback, CAC, and CLV are essential to justify AI video investments.

- A transparent AI video ROI calculation must quantify incremental revenue and cost savings.

- Budget reallocation from low-ROI production to AI personalization drives capital efficiency in 2026.

- Compliance-first operations—DPDP, IT Rules, and synthetic media watermarking—de-risk deployment at scale.

- A staged 90/180/365 roadmap with governance and measurable lift accelerates enterprise rollout.

Securing CFO marketing budget approval for AI video requires more than just creative optimism; it demands a rigorous AI marketing ROI justification 2026. As enterprises move into the next fiscal cycle, Finance Leaders and Budget Committees are shifting their scrutiny from experimental “innovation” spend to defensible, P&L-linked outcomes. This playbook provides the framework to secure digital transformation investment metrics that withstand the most demanding fiscal year planning martech timelines.

The 2026 landscape is defined by a pivot toward hard ROI—specifically incremental revenue and capital efficiency. CFOs no longer accept soft productivity gains as the sole justification for technology spend optimization. Instead, they require an auditable AI video platform ROI calculation that demonstrates how synthetic media investments directly impact the bottom line while adhering to evolving Indian regulatory standards.

Sources:

Why AI video now? Enterprise AI investment strategies for 2026

Modern enterprise AI investment strategies have evolved into a phased, risk-adjusted model designed to prove desirability, feasibility, and viability before full-scale deployment. In 2026, AI video has emerged as the primary vehicle for this strategy because it addresses the “personalization paradox”—the need for one-to-one engagement without the linear costs of traditional production.

Platforms like TrueFan AI enable enterprises to bridge this gap by offering hyper-personalization at scale via robust APIs and CRM/CDP data injection. By utilizing real-time rendering and virtual reshoots, brands can iterate on creative assets in minutes rather than weeks, significantly compressing the time-to-market for complex campaigns.

The shift toward AI video is also driven by the need for massive localization. With the ability to support 175+ languages while maintaining voice authenticity, enterprises can now execute global or pan-India strategies with a single core asset. This capability directly influences personalization ROI measurement by ensuring that every customer interaction is culturally and linguistically relevant, driving higher read rates and conversions.

Sources:

CFO-grade metrics: digital transformation investment metrics that win approvals

To gain CFO marketing budget approval, marketing leaders must speak the language of the finance department. This involves moving beyond click-through rates and focusing on digital transformation investment metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and risk-adjusted payback windows.

TrueFan AI's 175+ language support and Personalised Celebrity Videos provide the necessary infrastructure to generate these high-yield returns. For a 2026 budget to be approved, the target IRR should typically exceed 15–20% for growth portfolios, with a payback period of less than 12 months for primary use cases. These metrics must be backed by sensitivity bands that account for potential variances in lift percentages and unit economics.

Furthermore, the CFO metrics stack must include Customer Lifetime Value (CLV) uplift and Customer Acquisition Cost (CAC) reduction. By automating the production of personalized videos, enterprises can reduce the “cost per creative” to near zero, allowing for a more efficient allocation of media spend. This efficiency is a cornerstone of AI marketing ROI justification 2026, proving that AI is not just a cost center but a margin expander.

Sources:

Marketing technology budget allocation for fiscal year planning martech

Effective marketing technology budget allocation in 2026 requires a strategic rebalancing of the portfolio toward high-ROI workflows. Within the constraints of fiscal year planning martech, organizations are increasingly adopting a “reinvest and consolidate” heuristic. This involves auditing the existing stack to identify overlapping tools in asset management, localization, and manual video editing.

A successful allocation strategy typically involves reinvesting 10–20% of the budget from low-performing content production into AI-driven personalization. By consolidating multiple point solutions into a single AI video platform, enterprises can achieve significant technology spend optimization. This consolidation not only reduces license fees but also simplifies the data governance and compliance overhead associated with managing multiple vendors.

The planning cycle for 2026 should follow a quarterly milestone approach. Q1 focuses on use-case selection and data readiness audits, while Q2 is dedicated to pilot execution and measuring incrementality. By Q3, the focus shifts to enterprise-wide rollout across channels like WhatsApp Business and email, followed by Q4 optimization and renewal negotiations based on hard performance data.

Sources:

AI video platform ROI calculation: methodology, data model, and benchmarks

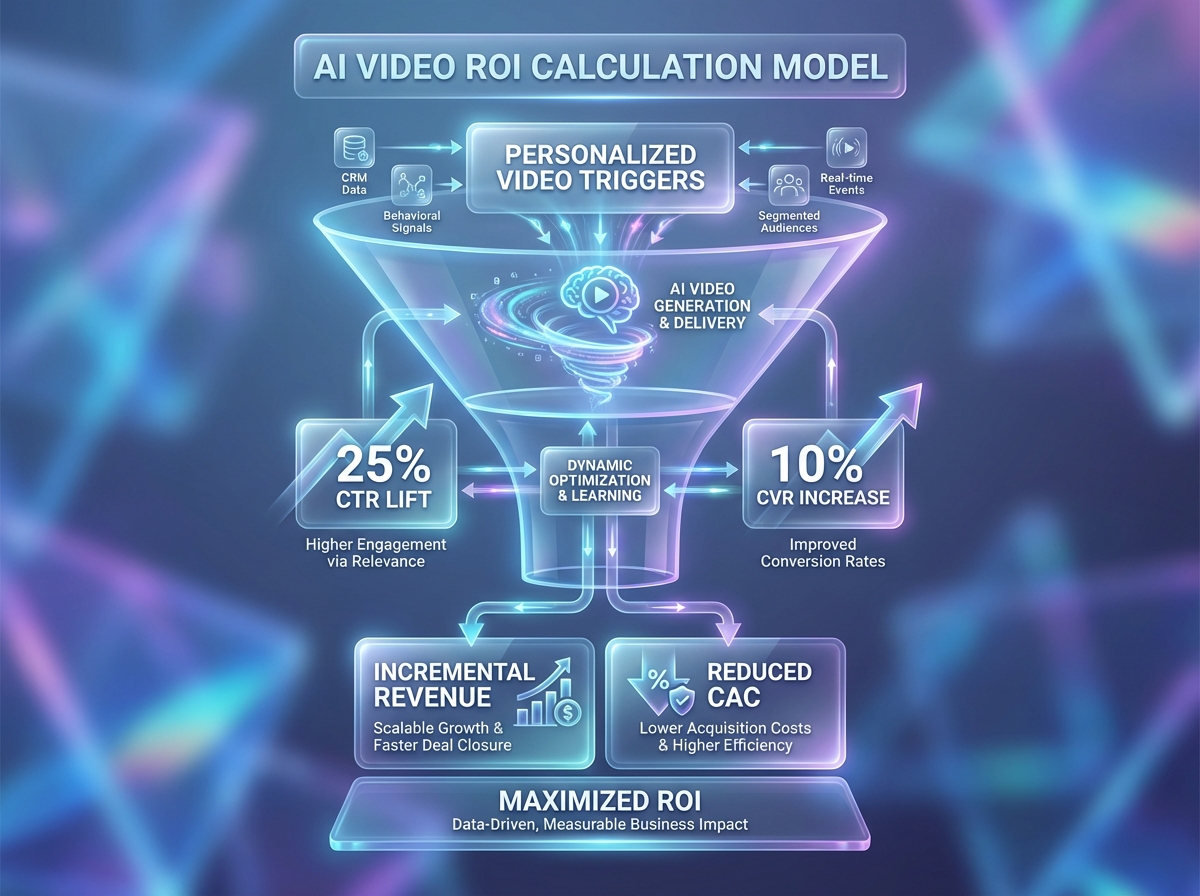

The core of any successful budget pitch is a transparent AI video platform ROI calculation. This methodology must account for both incremental revenue and direct cost savings. Incremental revenue is calculated by multiplying the baseline conversions by the delta in conversion rate (CVR) achieved through personalized video, then factoring in the Average Order Value (AOV) and margin.

Solutions like TrueFan AI demonstrate ROI through their ability to deliver measurable funnel movement. For example, a pilot might show a 25% increase in CTR and a 10% lift in CVR when using personalized video triggers via WhatsApp. When these figures are plugged into a multi-period cash flow model, the NPV of the investment becomes clear, providing a solid foundation for personalization ROI measurement.

Cost savings are equally vital. These include the avoidance of physical reshoots, the elimination of manual localization costs, and the reduction of agency fees. By integrating the AI video platform directly with the CRM/CDP, enterprises can automate the entire lifecycle of a video asset, from generation to delivery. This automation reduces the “concept-to-go-live” time from weeks to minutes, creating a significant competitive advantage in fast-moving markets.

Sources:

Personalization ROI measurement and marketing automation cost-benefit analysis

To accurately perform personalization ROI measurement, enterprises must implement a detailed event taxonomy. This involves tracking a customer's journey from the moment a video is delivered to the final retention event. Key milestones include watch-through rates at 5, 50, and 100%, as well as downstream actions like CTA clicks and lead generation.

A comprehensive marketing automation cost-benefit analysis should also quantify the time saved by internal teams. In 2026, the value of “creative agility” is at an all-time high. By using virtual reshoots and AI-driven editing, marketing teams can save thousands of production hours annually. These hours can then be redeployed to higher-value strategic tasks, further improving the organization's overall capital efficiency.

Media efficiency is another critical component. Personalized videos often result in higher quality scores on advertising platforms, leading to lower CPMs and better yield. When combined with the reduced rework costs associated with AI video, the total economic impact becomes undeniable. This data-driven approach ensures that the AI marketing ROI justification 2026 is rooted in verifiable performance rather than vanity metrics.

Sources:

AI adoption enterprise costs: TCO, hidden line items, and optimization levers

Understanding AI adoption enterprise costs requires a deep dive into the Total Cost of Ownership (TCO). Beyond the initial license fees, enterprises must account for integration costs with CRM/CDP systems, data pipeline engineering, and cloud/GPU usage. Hidden line items often include the cost of information security reviews, content moderation, and compliance with the Digital Personal Data Protection (DPDP) Act.

However, these costs can be offset through strategic technology spend optimization. For instance, the ability to perform localization in 175+ languages within a single platform eliminates the need for multiple regional agencies. Furthermore, built-in moderation and watermarking tools reduce the legal and brand risk associated with synthetic media, potentially lowering insurance premiums and legal oversight costs.

Governance is a major factor in the 2026 TCO model. Enterprises must invest in audit trails and consent capture mechanisms to meet the requirements of India's IT Rules. While these represent an upfront cost, they are essential for long-term sustainability. A platform that integrates these features natively allows for a more streamlined and cost-effective implementation, ensuring that the ROI remains positive even after accounting for compliance overhead.

Sources:

Budget stakeholder videos: accelerate CFO marketing budget approval

One of the most effective ways to accelerate CFO marketing budget approval is to use the technology itself to make the case. Budget stakeholder videos are short, role-personalized video briefs that align the various members of the budget committee. By creating a custom video for the CFO, CMO, and Head of Legal, you can address their specific concerns and demonstrate the platform's value in a highly engaging format.

For the CFO, the video should focus on the NPV/IRR summary and risk mitigation strategies like DPDP compliance and watermarking. For the CMO, the narrative should highlight funnel impact and creative agility. These videos can be triggered directly from the CRM and delivered via WhatsApp, allowing you to track engagement and follow up with stakeholders who have shown interest.

This approach not only proves the efficacy of the technology but also demonstrates a level of strategic thinking that CFOs appreciate. It moves the conversation from “what is this technology?” to “how quickly can we deploy this to achieve these results?” By providing a clear, visual representation of the ROI, you can significantly shorten the approval cycle for your 2026 marketing investments.

Union Budget 2026 technology planning: implications for enterprise investments in India

The Union Budget 2026 technology planning landscape has significant implications for how Indian enterprises allocate their capital. With a strong government push on AI infrastructure and data sovereignty, organizations must carefully consider their build-vs-buy strategies. The focus on domestic semiconductor ecosystems and cloud sovereignty may influence the cost structures of AI platforms over the next fiscal year.

Compliance is no longer optional. The 2026 IT Rules mandate strict content provenance, including watermarking and labeling of all synthetic media. Enterprises that fail to implement these controls risk not only legal penalties but also significant brand damage. Therefore, any AI marketing ROI justification 2026 must include a detailed plan for regulatory adherence and rapid takedown workflows.

Furthermore, the budget signals a shift toward private-led innovation in the AI space. This creates an opportunity for enterprises to partner with local AI leaders who understand the nuances of the Indian market, from linguistic diversity to specific data privacy requirements. Aligning your technology spend with these national priorities can often lead to additional incentives or smoother regulatory pathways, further enhancing the ROI of your AI investments.

Sources:

Technology spend optimization scenarios for 2026

To provide a truly CFO-ready playbook, you must present multiple technology spend optimization scenarios. These scenarios allow the budget committee to visualize the impact of different investment levels on the organization's financial health.

- The Consolidate Scenario: In this model, the organization retires 2–3 redundant point tools for editing and localization. By redeploying 10–15% of this OPEX into a centralized AI video platform, the enterprise can achieve a neutral budget impact while significantly increasing its creative output and personalization capabilities.

- The Reinvest Scenario: This more aggressive approach involves shifting 20–30% of the budget from low-ROI traditional brand spend into personalized AI video. This scenario is designed to be EBITDA-neutral, as the increased revenue from higher conversion rates offsets the investment in the new platform.

- The Scale Scenario: For organizations that have already proven the ROI of AI video, this scenario focuses on full-scale enterprise integration. This includes multi-channel activation and the use of AI for every customer touchpoint, targeting a significant reduction in CAC and a substantial lift in CLV.

Each of these scenarios should be accompanied by a detailed financial model, including sensitivity analysis. By showing that the investment remains viable even under conservative assumptions, you build the trust necessary to secure CFO marketing budget approval.

Sources:

Implementation roadmap and risk controls

A successful AI marketing ROI justification 2026 must be backed by a realistic implementation roadmap. A 90/180/365-day plan provides the structure needed to move from pilot to enterprise scale while maintaining strict risk controls.

- 0–90 Days: Focus on use-case selection, data audits, and legal reviews. This is the period for building your budget stakeholder videos and implementing initial consent flows. Integration with CRM/CDP and WhatsApp Business API should also begin during this phase.

- 90–180 Days: Execute the pilot and measure incrementality using a test-vs-control design. Use this data to iterate on scripts via virtual reshoots and prepare a formal ROI memo for the Board. This phase also includes the first round of vendor rationalization.

- 180–365 Days: Roll out the platform across the entire enterprise. Implement multi-language programs and finalize the consolidation of the martech stack. By the end of the year, the focus should be on negotiating renewals based on the proven ROI thresholds established during the pilot.

Risk controls are the final piece of the puzzle. These include gated generation based on consent flags, mandatory watermarking, and automated moderation filters. By embedding these controls into the implementation roadmap, you demonstrate to the CFO and Legal teams that the organization is prepared for the complexities of the 2026 regulatory environment.

Sources:

Appendix: ROI calculator templates and CFO deck outline

To assist in your AI video platform ROI calculation, use the following template structure for your financial modeling:

- Inputs Tab: Funnel baseline (impressions, CTR, CVR, AOV), anticipated lift bands (conservative, base, optimistic), TCO (licenses, integration, compliance), and the discount rate for NPV calculations.

- Outputs Tab: Summary of NPV, IRR, and payback period. Include a breakdown of CAC reduction and CLV impact.

- Sensitivity Tab: A matrix showing how the ROI changes if the conversion lift or implementation costs vary by ±20%.

Your CFO deck should follow a logical progression:

- Executive Summary: The “Ask” and the headline ROI.

- Business Case: Specific use cases, industry benchmarks, and risk controls.

- Financials: Detailed NPV/IRR and payback analysis.

- Implementation: The 90/180/365-day roadmap and ownership structure.

- Compliance: A checklist covering DPDP, IT Rules, and watermarking.

By providing this level of detail, you ensure that your digital transformation investment metrics are beyond reproach, paving the way for a successful 2026 fiscal year.

Q1 2026 30–60–90 Day Action Plan

Timing is everything in Union Budget technology planning. Explore the Financial Year-End Marketing 2026 tactics guide.

Sources:

Recommended Internal Links

- Technology Spend Optimization for CFOs: ROI in 2026

- Union Budget 2026 Marketing Opportunities: Campaign Wins

- Union Budget 2026 marketing strategies to drive growth

- Union Budget 2026 marketing strategies: high-ROI playbook

- Union Budget 2026 marketing strategies: high-ROI plays

- Financial Year-End Marketing 2026: Proven Campaign Tactics

Frequently Asked Questions

How does AI video impact the overall marketing technology budget allocation?

In 2026, AI video acts as a consolidation lever. By replacing manual editing, localization, and high-cost production tools, it allows for a more efficient marketing technology budget allocation, often reducing total OPEX while increasing output.

What are the most critical digital transformation investment metrics for AI video?

CFOs prioritize Net Present Value (NPV), Internal Rate of Return (IRR), and the payback period. Additionally, tracking the delta in Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) is essential for a complete ROI picture.

How do we account for AI adoption enterprise costs beyond the license fee?

A true TCO model must include integration costs, data engineering, compliance audits (like DPDP), and the cost of change management. These are often offset by the massive savings in production and localization.

Can we use AI video to accelerate CFO marketing budget approval?

Yes. Creating personalized budget stakeholder videos that address the specific financial and risk concerns of the CFO is a highly effective way to demonstrate the technology's value and secure approval.

How does TrueFan AI ensure compliance with India's 2026 IT Rules?

TrueFan AI integrates mandatory watermarking, metadata labeling, and automated moderation tools into its platform, ensuring that all synthetic content is traceable and compliant with the latest MeitY guidelines and IT Rules.

What is the typical timeline for an AI video platform ROI calculation to show positive results?

Most enterprise pilots show a positive payback within 6 to 9 months, provided there is a clear test-vs-control design and a focus on high-intent customer segments.