Green Financing Marketing 2026: Enterprise Playbooks for Banks and NBFCs Using Personalized ESG Video and ROI Calculators

Key Takeaways

- Shift from greenwashing to green-proving with verifiable impact data embedded in customer journeys

- Use ESG portfolio personalization and sustainability score videos to boost trust and AUM

- Deploy environmental ROI calculators to quantify savings, CO2e avoided, and payback for solar, EV, and other green products

- Scale outreach with automation, multilingual localization, and real-time virtual reshoots

- Track green KPIs across acquisition, engagement, AUM growth, and portfolio-wide impact

The landscape of Indian financial services is undergoing a seismic shift as we enter 2026, moving from broad sustainability claims to granular, data-backed accountability. Green financing marketing 2026 is no longer defined by generic imagery of wind turbines; it is now a sophisticated ecosystem of personalized ESG journeys, real-time impact visualization, and automated compliance.

For Tier-1 banks and NBFCs, the mandate is clear: transition from "greenwashing" to "green-proving" by integrating environmental ROI calculators and sustainability score videos into the core customer acquisition funnel. This evolution is driven by a convergence of SEBI’s stringent BRSR Core requirements and the RBI’s formalized Green Deposits Framework, both of which demand verifiable evidence of environmental impact.

In this comprehensive enterprise playbook, we explore how financial institutions can leverage hyper-personalization and automation to scale green loans, sustainable investments, and carbon credit portfolios while maintaining the highest standards of E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness).

Section 1: Why 2026 is the Tipping Point for Climate-Positive Investment Marketing

The year 2026 marks a regulatory and cultural meridian for the Indian financial sector, where climate-positive investment marketing has shifted from a niche CSR activity to a primary growth driver. The primary catalyst is the full implementation of the SEBI Business Responsibility and Sustainability Reporting (BRSR) Core, which now mandates reasonable assurance for ESG disclosures across the value chain of the top 1,000 listed entities.

Furthermore, the Reserve Bank of India (RBI) has solidified its Green Deposits Framework, providing the necessary guardrails for banks to label products as "green" with regulatory confidence. This has eliminated the ambiguity that previously plagued the sector, allowing for standardized green labeling and reporting that raises the bar for marketing substantiation.

Consumer expectations have simultaneously matured; the 2026 investor demands transparent, personalized evidence of their contribution to the net-zero transition. They are no longer satisfied with aggregate fund performance; they require specific metrics such as CO2e avoided per lakh invested or the localized impact of their green home loan. Consequently, marketing must shift from generic claims to customer-specific impact investing visualization embedded directly into the digital journey.

Source: SEBI BRSR Core Framework

Source: RBI Green Deposits Framework

Source: RBI FAQs on Green Deposits

Section 2: The Personalization Backbone—Executing ESG Portfolio Personalization at Scale

At the heart of modern green financing lies ESG portfolio personalization, a process that goes beyond simple exclusion lists to create bespoke investment trajectories. In 2026, this involves tailoring an investor’s portfolio weights and tilts based on their specific sustainability preferences—such as clean energy, water security, or gender equality—mapped against measurable ESG metrics like emissions intensity and SDG alignment.

To execute this at an enterprise level, banks must synthesize three distinct data inputs: customer thematic preferences, BRSR Core-reported metrics from domestic issuers, and real-time risk/return constraints. The challenge is translating this complex data into a format that resonates with the retail and HNI segments.

Platforms like TrueFan AI enable financial institutions to transform these data points into dynamic sustainability score videos. These videos provide a visual comparison between a baseline portfolio and a personalized "green-tilted" portfolio, highlighting the expected directional change in financed emissions. By using impact investing visualization, banks can show animated "before and after" carbon intensity tiles, making the abstract concept of a "carbon footprint" tangible for the end investor.

This level of transparency not only fulfills the fiduciary duty of the bank but also builds a proprietary trust moat. When an investor sees their name alongside a calculated reduction in their portfolio's environmental impact, the emotional connection to the financial product strengthens, leading to higher retention and increased AUM.

Section 3: Product Playbooks for Sustainable Investment Video Campaigns

As the competition for green capital intensifies, banks must deploy specialized sustainable investment video campaigns for different asset classes, including mutual funds, green bonds, and carbon credits. Each requires a unique narrative structure and data integration strategy.

Sustainable Mutual Fund Marketing

For mutual funds, the focus is on visualizing the fund’s objective and its alignment with BRSR Core disclosures. A personalized video can dynamically pull an investor's SIP amount and project the long-term environmental impact of that specific contribution. By localizing these videos into regional languages, banks can tap into the burgeoning "Bharat" market, where interest in sustainable agriculture and renewable energy is at an all-time high.

Green Bond Marketing Automation

Green bond marketing automation represents a significant efficiency gain for debt capital markets. The journey begins with a gated explainer video that leads to an in-video FAQ, followed by auto-triggered WhatsApp updates containing second-party opinions (SPOs) and use-of-proceeds categories. This automation ensures that compliance is maintained by avoiding forward-looking impact claims and sticking strictly to the issuer’s verified frameworks.

Carbon Credit Investment Videos

Investing in carbon credits remains a complex proposition for many. Carbon credit investment videos bridge this gap by explaining project types—such as nature-based solutions or methane capture—and highlighting quality signals like additionality and permanence. Visualization tools can show the exact tonnes of CO2e expected to be offset per investment unit, while clearly stating the non-assurance disclaimers required by regulators.

Source: SEBI Circular on ESG Disclosures for Mutual Funds

Section 4: Lending Growth Engines—Green Loan Customer Acquisition for Solar and EV

The most direct path to green loan customer acquisition in 2026 is through the financing of rooftop solar and electric vehicles (EVs). These products offer immediate, calculable financial and environmental benefits to the consumer, making them ideal for personalized video marketing.

Solar Financing Video Marketing

With the Indian government’s push for 10 million rooftop solar installations, solar financing video marketing has become a high-volume play. Banks can send pre-approval videos that use a customer’s name and estimated roof size to suggest a system capacity. These videos embed the outputs of environmental ROI calculators, showing estimated monthly savings, payback periods, and subsidy eligibility under the PM Surya Ghar Muft Bijli Yojana.

EV Loan Personalization Campaigns

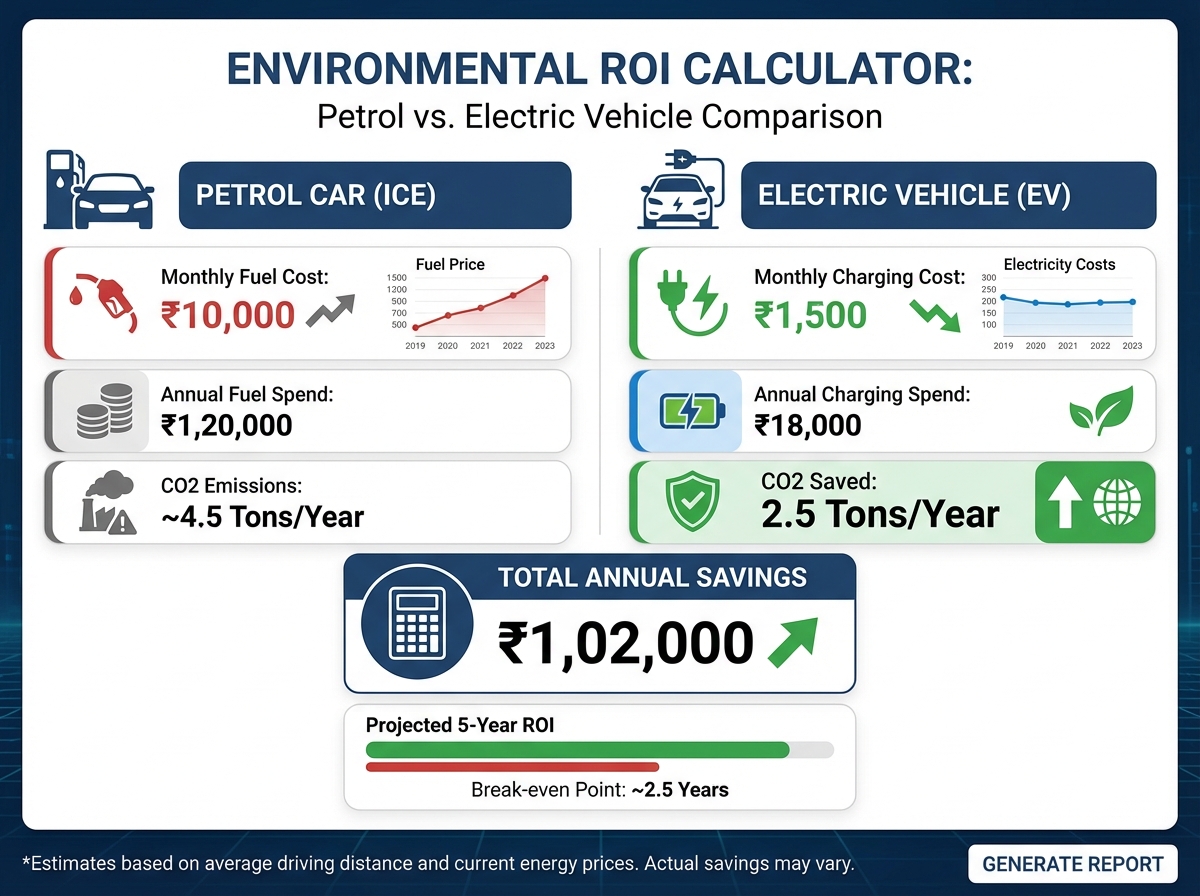

For the automotive sector, EV loan personalization campaigns are essential to overcome "range anxiety" and "price shock." By personalizing the video based on the specific EV model and the customer's state-level incentives, banks can show a visual bar chart comparing the Total Cost of Ownership (TCO) of an EV versus an Internal Combustion Engine (ICE) vehicle over five years. Dynamic overlays can include the nearest charging station map and real-time interest rate offers.

Renewable Energy Loan Campaigns

In the C&I (Commercial and Industrial) and MSME sectors, renewable energy loan campaigns focus on load profile optimization. Personalized videos can demonstrate how a shift to solar or wind can reduce operational expenses (OPEX) while improving the firm’s own ESG rating—a critical factor for MSMEs that are part of global supply chains subject to BRSR Core value-chain reporting.

Source: MNRE Rooftop Solar Calculator

Section 5: Proving Outcomes—Environmental ROI Calculators and Impact Visualization

The credibility of green financing marketing 2026 rests entirely on the accuracy of the underlying math. Environmental ROI calculators are the engines that power this credibility, computing energy savings, emissions avoided, and internal rates of return (IRR) for green products.

For a solar installation, the calculation must be robust:

- Annual Generation (kWh): System kW × Specific Yield × Performance Ratio.

- Financial Savings: kWh generated × Grid Tariff.

- CO2e Avoided: kWh generated × Grid Emission Factor (currently approx. 0.71 kg CO2/kWh in India).

- Payback Period: Net CAPEX (after subsidies) / Annual Savings.

These outputs are then piped into sustainability score videos, which translate the raw data into relatable narrative visuals. For example, instead of just stating "5,000 kg of CO2e avoided," the video can visualize the equivalent number of trees planted or cars removed from the road. This impact investing visualization must always be paired with data provenance notes to align with the transparency requirements of the BRSR Core.

By providing these calculators as self-service tools on landing pages, banks can capture high-intent leads. Once a user completes a calculation, the system can instantly generate a personalized video summarizing their results, creating a seamless transition from "curiosity" to "application."

Section 6: Enterprise Architecture—Scaling with TrueFan AI

Delivering hyper-personalized content to millions of customers requires a robust enterprise architecture. Traditional video production is too slow and expensive for the dynamic nature of 2026's green markets, where interest rates and government subsidies change frequently.

TrueFan AI's 175+ language support and Personalised Celebrity Videos provide the necessary scale and engagement for Indian banks. The architecture involves connecting the bank’s CRM or CDP (Customer Data Platform) to TrueFan’s APIs, allowing for the real-time generation of videos that include the customer’s name, city, and specific loan pre-approval details.

Key features of this enterprise-grade solution include:

- Real-Time Rendering: Generating a personalized video in under 30 seconds to power instant WhatsApp or email responses.

- Virtual Reshoots: The ability to update interest rates, regulatory disclaimers, or incentive amounts across thousands of videos without needing a new film shoot.

- Multilingual Localization: Automatically lip-syncing and dubbing content into regional languages to ensure the message is accessible to all demographics.

- Security and Compliance: Adhering to ISO 27001 and SOC 2 standards, ensuring that sensitive financial data used for personalization is protected.

This infrastructure allows marketing teams to move from static campaigns to "always-on" automated journeys. For instance, a trigger can be set so that whenever a customer visits an EV model page on a partner site, they receive a personalized video from the bank within minutes, detailing their specific loan eligibility for that vehicle.

Section 7: Risk, Compliance, and the Future of Green KPIs

As the volume of green marketing increases, so does the risk of regulatory scrutiny. To mitigate this, banks must ensure that all eco-friendly financing options are marketed with strict adherence to RBI and SEBI guidelines. This includes using only verified data sources for impact claims and providing clear, prominent disclaimers regarding financial and environmental risks.

Solutions like TrueFan AI demonstrate ROI through enhanced engagement and conversion metrics, but they also provide the audit trails necessary for compliance. Every personalized video generated can be logged and archived, ensuring that the bank can prove exactly what was communicated to a customer at any given time.

Key Performance Indicators (KPIs) for 2026:

- Green Loan Customer Acquisition: Cost Per Lead (CPL) and Cost Per Acquisition (CAC) specifically for solar and EV segments.

- AUM Growth: Inflows into sustainable mutual fund marketing campaigns and subscription rates for green bonds.

- Engagement Metrics: Video completion rates, in-video CTA clicks, and the "lift" in conversion provided by personalization versus generic content.

- Impact Metrics: Aggregated CO2e avoided across the entire loan portfolio and the average "sustainability score" uplift in personalized investor cohorts.

By tracking these metrics in a unified dashboard, marketing leaders can demonstrate the direct link between sustainability initiatives and the bank’s bottom line, securing continued investment in green marketing infrastructure.

Conclusion: The Path Forward for Enterprise Green Finance

The transition to green financing marketing 2026 represents a fundamental reimagining of the relationship between financial institutions and their customers. By moving away from abstract promises and toward personalized, data-driven storytelling, banks and NBFCs can lead the transition to a sustainable economy while driving unprecedented growth.

The integration of environmental ROI calculators, sustainability score videos, and automated green bond marketing is no longer optional—it is the baseline for competitiveness in a world where "green" is the new gold standard for value.

Final Research Citations:

Frequently Asked Questions

Section 8: FAQs on Green Financing Marketing 2026

What is ESG portfolio personalization in the context of 2026?

ESG portfolio personalization is the process of tailoring an investor's asset allocation to align with their specific environmental and social values while maintaining their risk-return profile. In 2026, this is achieved by using BRSR Core data to tilt portfolios toward high-performing ESG entities, with the results visualized through sustainability score videos that show the investor's personal impact.

How do environmental ROI calculators improve green loan conversion?

These calculators remove the "uncertainty gap" by providing precise estimates of financial savings and environmental impact. When a customer sees a personalized calculation showing that a solar loan will pay for itself in four years, the barrier to application is significantly lowered.

How can banks avoid greenwashing in their video campaigns?

Banks must tie every claim to a disclosed data source, such as a fund factsheet or a third-party ESG rating. They should also use ranges instead of absolute numbers for environmental projections and include timestamped data refresh dates. TrueFan AI's platform allows for the easy integration of these mandatory disclaimers into every personalized video.

What role does multilingual support play in green financing?

Since green products like rooftop solar and agricultural EV equipment have massive potential in rural and semi-urban India, communicating in the customer's native language is vital for trust. 175+ language support ensures that complex financial and environmental concepts are understood clearly across all regions.

What are the primary regulatory frameworks for green marketing in India?

The two pillars are SEBI’s BRSR Core (for corporate disclosures and mutual funds) and the RBI’s Green Deposits Framework (for banking products). Both emphasize the need for "use-of-proceeds" transparency and verifiable impact reporting.